Dish Network 1997 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 1997 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

7. Series B Preferred Stock – Continued

F–24

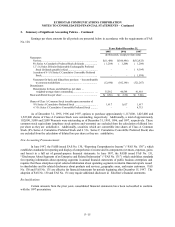

In the event that dividends on the Series B Preferred Stock are in arrears and are unpaid for four

consecutive quarterly periods or six quarterly periods (whether or not consecutive), or upon certain other events,

then, in either such case, the majority holders of the Series B Preferred Stock (“ Majority Holders”) may vote, as a

separate class, to elect two directors to the Board of Directors. In addition, the approval of the Majority Holders,

voting as a separate class, is required for any merger, consolidation or sale of substantially all of the assets of

EchoStar.

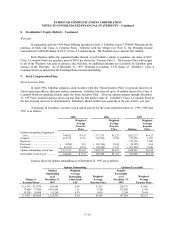

8. Stockholders’ Equity (Deficit)

Common Stock

The Class A, Class B and Class C Common Stock are equivalent in all respects except voting rights. Holders

of Class A and Class C Common Stock are entitled to one vote per share and holders of Class B Common Stock are

entitled to ten votes per share. Each share of Class B and Class C Common Stock is convertible, a t the option of the

holder, into one share of Class A Common Stock. Upon a change in control of ECC, each holder of outstanding shares

of Class C Common Stock is entitled to ten votes for each share of Class C Common Stock held. ECC’s principal

stockholder owns all outstanding Class B Common Stock and all other stockholders own Class A Common Stock.

In November 1997, EchoStar consummated an offering of 3.4 million shares of its Class A Common Stock

(the “ Common Stock Offering” ), including the exercise of a portion of the underwriters’ over-allotment option in

December 1997. The Common Stock Offering resulted in net proceeds to EchoStar of $63 million.

Preferred Stock

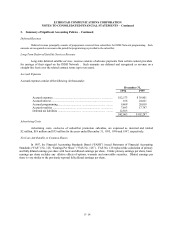

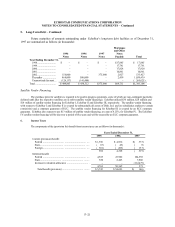

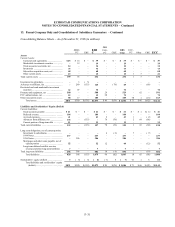

Preferred Stock consists of the following (in thousands, except share data):

December 31,

1996 1997

Preferred Stock, 20,000,000 shares authorized (inclusive of 900,000 shares

designated as Series B Preferred Stock, see Note 7):

8% Series A Cumulative Preferred Stock, 1,616,681 shares issued and

outstanding, including cumulative accrued dividends of $3,347 and

$4,551, respectively ................................ ................................ .......... $18,399 $ 19,603

6 ¾% Series C Cumulative Convertible Preferred Stock, none and

2,300,000 shares issued and outstanding, respectively ......................... –101,529

Total Preferred Stock ................................ ................................ .................. $18,399 $121,132

8% Series A Cumulative Preferred Stock

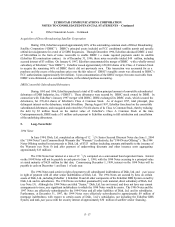

Each share of the 8% Series A Cumulative Preferred Stock (“ Series A Preferred Stock” ) is convertible, at the

option of the holder, into one share of Class A Common Stock, subject to adjustment from time to time upon the

occurrence of certain events, including, among other things ( i) dividends or distributions on Class A Common Stock

payable in Class A Common Stock or certain other capital stock; (ii) subdivisions, combinations or certain

reclassifications of Class A Common Stock; and (iii) issuance of Class A Common Stock or rights, warrants or options

to purchase Class A Common Stock at a price per share less than the liquidation preference per share. In the event of

the liquidation, dissolution or winding up of EchoStar, the holders of Series A Preferred Stock would be entitled to

receive an amount equal to approximately $12.13 per share as of December 31, 1997.

The aggregate liquidation preference for all outstanding shares of Series A Preferred Stock is limited to the

original value of the Series A Preferred Stock issued, plus accrued and unpaid dividends thereon. As of December