Dish Network 1997 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1997 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

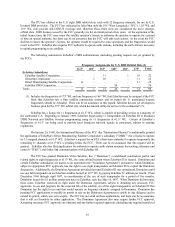

EAC and HRSI entered into a Merchandise Financing Agreement in 1989 (the “ Merchant Agreement”)

pursuant to which HRSI acted as a consumer financing source for the purchase of, among other things, satellite systems

distributed by Echosphere Corporation, a subsidiary of EchoStar, to consumers through EAC dealers. HRSI terminated

the Merchant Agreement as of December 31, 1994. During February 1995, EAC and Echosphere (the “ EAC Parties”)

filed suit against HRSI. The case is pending in U.S. District Court in Colorado (the “ HRSI Litigation”). The EAC

Parties have alleged, among other things, breach of contract, breach of fiduciary duty, fraud and wanton and willful

conduct by HRSI in connection with termination of the Merchant Agreement and related matters. The EAC parties are

seeking damages in excess of $10.0 million. HRSI’s counterclaims have been dismissed with prejudice. Summary

judgment motions have been pending on all remaining issues since May 1996. A trial date has not been set.

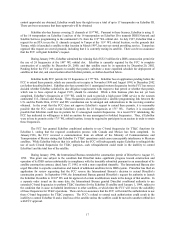

During February 1997, EchoStar and News announced an agreement (the “ News Agreement” ) pursuant to

which, among other things, News agreed to acquire approximately 50% of the outstanding capital stock of EchoStar.

News also agreed to make available for use by EchoStar the DBS permit for 28 frequencies at 110° WL purchased by

MCI for over $682 million following a 1996 FCC auction. During late April 1997, substantial disagreements arose

between the parties regarding their obligations under the News Agreement.

In May 1997, EchoStar filed a Complaint requesting that the Court confirm EchoStar’s position and declare

that News is obligated pursuant to the News Agreement to lend $200 million to EchoStar without interest and upon

such other terms as the Court orders. EchoStar also filed a First Amended Complaint significantly expanding the scope

of the litigation, to include breach of contract, failure to act in good faith, and other causes of action. EchoStar seeks

specific performance of the News Agreement and damages, including lost profits based on, among other things, a

jointly prepared ten-year business plan showing expected profits for EchoStar in excess of $10 billion based on

consummation of the transactions contemplated by the News Agreement.

In June 1997, News filed an answer and counterclaims seeking unspecified damages. News’ answer denies

all of the material allegations in the First Amended Complaint and asserts numerous defenses, including bad faith,

misconduct and failure to disclose material information on the part of EchoStar and its Chairman and Chief Executive

Officer, Charles W. Ergen. The counterclaims, in which News is joined by its subsidiary ASkyB, assert that EchoStar

and Ergen breached their agreements with News and failed to act and negotiate with News in good faith. EchoStar has

responded to News’ answer and denied the allegations in their counterclaims. EchoStar also has asserted various

affirmative defenses. EchoStar intends to vigorously defend against the counterclaims. Discovery commenced on July

3, 1997 and depositions are currently being taken. The case has been set for trial commencing November 1998, but

that date could be postponed.

While EchoStar is confident of its position and believes it will ultimately prevail, the litigation process could

continue for many years and there can be no assurance concerning the outcome of the litigation.

EchoStar is subject to various other legal proceedings and claims which arise in the ordinary course of its

business. In the opinion of management, the amount of ultimate liability with respect to those actions will not

materially affect the financial position or results of operations of EchoStar.

Item 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No items were submitted to a vote of security holders during the fourth quarter of 1997.