Dish Network 1997 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 1997 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

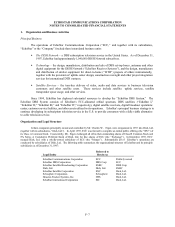

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

2. Summary of Significant Accounting Policies – Continued

F–14

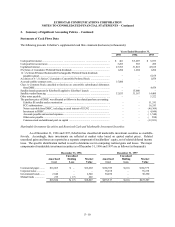

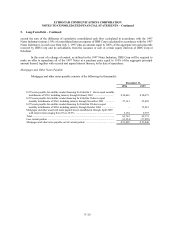

Deferred Revenue

Deferred revenue principally consists of prepayments received from subscribers for DISH Network programming. Such

amounts are recognized as revenue in the period the programming is provided to the subscriber.

Long-Term Deferred Satellite Services Revenue

Long-term deferred satellite services revenue consists of advance payments from certain content providers

for carriage of their signal on the DISH Network . Such amounts are deferred and recognized as revenue on a

straight-line basis over the related contract terms (up to ten years).

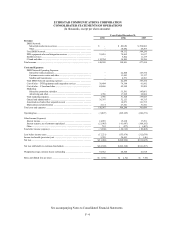

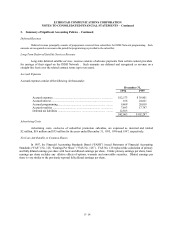

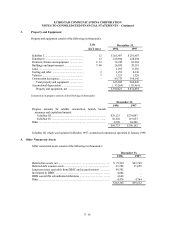

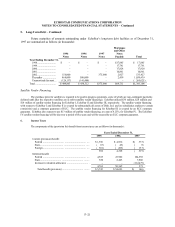

Accrued Expenses

Accrued expenses consist of the following (in thousands):

December 31,

1996 1997

Accrued expenses ................................ ................................ ............... $12,173 $ 39,901

Accrued interest ................................ ................................ .................. 166 24,621

Accrued programming ................................ ................................ ......... 9,468 20,018

Accrued royalties ................................ ................................ ................ 7,693 17,747

Deferred tax liabilities ................................ ................................ ......... 12,563 –

$42,063 $102,287

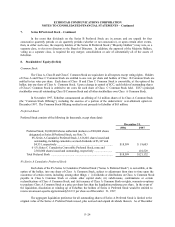

Advertising Costs

Advertising costs, exclusive of subscriber promotion subsidies, are expensed as incurred and totaled

$2 million, $18 million and $35 million for the years ended December 31, 1995, 1996 and 1997, respectively.

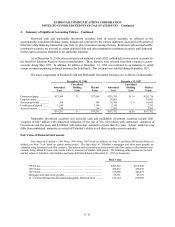

Net Loss Attributable to Common Shares

In 1997, the Financial Accounting Standards Board (“ FASB” ) issued Statement of Financial Accounting

Standards (“ FAS” ) No. 128, “ Earnings Per Share” (“ FAS No. 128”). FAS No. 128 replaced the calculation of primary

and fully diluted earnings per share with basic and diluted earnings per share. Unlike primary earnings per share, basic

earnings per share excludes any dilutive effects of options, warrants and convertible securities. Diluted earnings per

share is very similar to the previously reported fully diluted earnings per share.