Dish Network 1997 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 1997 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

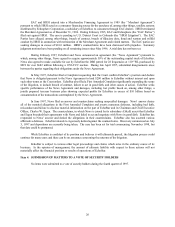

Corporation (“ ESBC”), a wholly-owned subsidiary of EchoStar, consummated an offering (the “ 1996 Notes

Offering”) of $580 million principal amount at stated maturity of 13 1/8% Senior Secured Discount Notes due 2004

(the “ 1996 Notes”), resulting in aggregate net proceeds of approximately $337 million. As of December 31, 1997,

substantially all of the proceeds of the 1994 Notes Offering, the IPO and the 1996 Notes Offering had been used to

fund the construction and development of the EchoStar DBS System.

During 1997, EchoStar consummated four additional offerings (the “ 1997 Offerings”) which, combined,

resulted in net proceeds of $715 million. The 1997 Offerings were completed in anticipation of EchoStar’s

substantial future working capital, capital expenditure and debt service requirements. EchoStar currently intends to

use the majority of the net proceeds from the 1997 Offerings for the acquisition of DISH Network subscribers, the

construction, launch and insurance of EchoStar IV, and other general corporate purposes, including working capital.

On June 25, 1997, EchoStar DBS Corporation (“ DBS Corp”), a wholly-owned subsidiary of EchoStar,

consummated an offering (the “ 1997 Notes Offering”) of 12 ½% Senior Secured Notes due 2002 (the “ 1997 Notes”).

The 1997 Notes Offering resulted in net proceeds of $363 million (after payment of underwriting discounts and other

issuance costs aggregating $12 million). Interest accrues on the 1997 Notes at a rate of 12 ½% and is payable in cash

semi-annually on January 1 and July 1 of each year, with the first interest payment due January 1, 1998. Of the net

proceeds from the 1997 Notes Offering, $109 million were placed in an escrow account (the “ Interest Escrow”) to fund

semi-annual interest payments through January 1, 2000. Additionally, $112 million of the net proceeds of the 1997

Notes Offering were placed in a separate escrow account (the “ Satellite Escrow”) to fund the construction, launch and

insurance of EchoStar IV. The 1997 Notes mature on July 1, 2002.

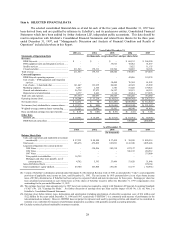

On October 2, 1997, EchoStar consummated an offering (the “ Series B Preferred Offering”) of 12 1/8% Series

B Senior Redeemable Exchangeable Preferred Stock due 2004, par value $0.01 per share (including any additional

shares of such stock issued from time to time in lieu of cash dividends, the “ Series B Preferred Stock”). The Series

B Preferred Offering resulted in net proceeds to EchoStar of $193 million. Each share of Series B Preferred Stock

has a liquidation preference of $1,000 per share. Dividends on the Series B Preferred Stock are payable quarterly in

arrears, commencing on January 1, 1998. EchoStar may, at its option, pay dividends in cash or by issuing additional

shares of Series B Preferred Stock having an aggregate liquidation preference equal to the amount of such dividends.

EchoStar currently intends to satisfy its dividend obligations on the Series B Preferred Stock by issuing additional

shares of Series B Preferred Stock. Prior to making any cash dividend payments, EchoStar would need to satisfy

certain financial ratios as defined by certain of its indentures. As of December 31, 1997, EchoStar does not meet

such financial ratios nor can there be any assurance that it will meet those financial ratios in the future. See

“−Availability of Operating Cash Flow to EchoStar.”

On November 4, 1997, EchoStar consummated an offering (the “ Series C Preferred Offering”) of 2.3 million

shares of 6 3/4% Series C Cumulative Convertible Preferred Stock (the “ Series C Preferred Stock”). The Series C

Preferred Offering, after exercise by the underwriters of their 15% over-allotment option, resulted in net proceeds to

EchoStar of $97 million. Simultaneously with the closing of the Series C Preferred Offering, the purchasers of the

Series C Preferred Stock placed $15 million into an account (the “Deposit Account”). The Deposit Account will

provide a quarterly cash payment of approximately $0.844 per share of Series C Preferred Stock (the “Quarterly Return

Amount”) commencing February 1, 1998 and continuing until November 1, 1999. After that date, dividends on the

Series C Preferred Stock will begin to accrue. EchoStar may, prior to the date on which any Quarterly Return Amount

would otherwise be payable, deliver a notice instructing the deposit agent: (i) to purchase from EchoStar, for transfer to

each holder of Series C Preferred Stock, in lieu of the Quarterly Return Amount, that number of whole shares of Class

A Common Stock determined by dividing the Quarterly Return Amount by 95% of the market value of the Class A

Common Stock as of the date of such notice; or (ii) defer delivery of the Quarterly Return Amount to holders of Series

C Preferred Stock on such quarterly payment date until the next quarterly payment date or any subsequent payment

date. However, no later than November 1, 1999 (the “ Deposit Expiration Date”), any amounts remaining in the

Deposit Account, as of such date, including amounts which have previously been deferred, will be: (i) paid to the

holders of Series C Preferred Stock; or (ii) at EchoStar’s option, used to purchase from EchoStar for delivery to each

holder of Series C Preferred Stock that number of whole shares of Class A Common Stock determined by dividing the

balance remaining in the Deposit Account by 95% of the market value of the shares of Class A Common Stock as of

the date of EchoStar’s notice. See “−Availability of Operating Cash Flow to EchoStar.”