Dish Network 1997 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1997 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

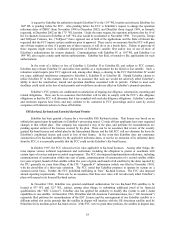

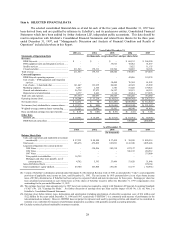

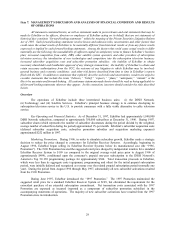

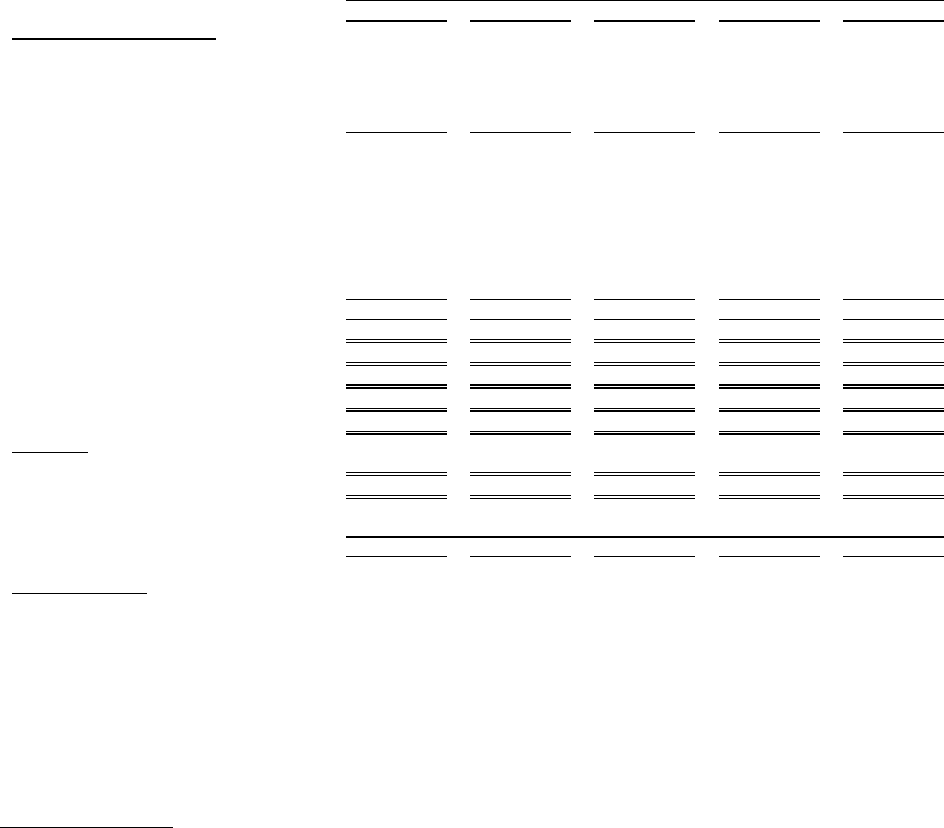

Item 6. SELECTED FINANCIAL DATA

The selected consolidated financial data as of and for each of the five years ended December 31, 1997 have

been derived from, and are qualified by reference to, EchoStar’s, and its predecessor entities, Consolidated Financial

Statements which have been audited by Arthur Andersen LLP, independent public accountants. This data should be

read in conjunction with EchoStar’s Consolidated Financial Statements and related Notes thereto for the three years

ended December 31, 1997, and “ Management’s Discussion and Analysis of Financial Condition and Results of

Operations” included elsewhere in this Report.

Years Ended December 31,

1993 (1) 1994 1995 1996 1997

Statements of Operations Data (In thousands, except subscribers and per share data)

Revenue:

DISH Network........................................................ $ – $ – $ – $ 60,132 $ 344,250

DTH equipment sales and integration services ...... – – 35,816 78,062 91,637

Satellite services...................................................... –––5,822 11,135

C-band and other..................................................... 211,563 179,313 112,704 54,885 30,396

Total revenue ............................................................. 211,563 179,313 148,520 198,901 477,418

Costs and Expenses:

DISH Network operating expenses ........................ –––42,456 193,274

Cost of sales – DTH equipment and integration

services ............................................................... – – 30,404 76,384 61,992

Cost of sales – C-band and other ............................ 161,447 133,635 84,846 42,349 23,909

Marketing expenses ................................................ 3,497 2,346 1,786 51,520 179,923

General and administrative..................................... 26,738 27,873 36,397 52,123 69,315

Depreciation and amortization................................ 1,677 2,243 3,114 43,414 173,276

Total costs and expenses............................................ 193,359 166,097 156,547 308,246 701,689

Operating income (loss)............................................. $ 18,204 $ 13,216 $( 8,027) $(109,345) $( 224,271)

Net income (loss)....................................................... $ 12,272 $ 90 $(11,486) $(100,986) $( 312,825)

Net income (loss) attributable to common shares ..... $ 12,272 $( 849) $(12,690) $(102,190) $( 321,267)

Weighted-average common shares outstanding........ 32,221 32,442 35,562 40,548 41,918

Basic and diluted earnings (loss) per share (2).......... $ 0.38 $( 0.03) $( 0.36) $( 2.52) $( 7.66)

Other Data

EBITDA (3) ............................................................ $ 19,881 $ 15,459 $( 4,913) $( 65,931) $( 50,995)

DISH Network subscribers ..................................... –––350,000 1,040,000

As of December 31,

1993 1994 1995 1996 1997

(In thousands)

Balance Sheets Data

Cash, cash equivalents and marketable investment

securities (4) ....................................................... $ 27,232 $ 48,544 $ 37,424 $ 58,038 $ 420,514

Total assets.............................................................. 106,476 472,492 623,091 1,141,380 1,805,646

Long-term obligations (less current portion):

1994 Notes ......................................................... –334,206 382,218 437,127 499,863

1996 Notes ......................................................... – – – 386,165 438,512

1997 Notes ......................................................... – – – – 375,000

Note payable to stockholder............................... 14,725 – – – –

Mortgages and other notes payable, net of

current portion ............................................... 4,702 5,393 33,444 51,428 51,846

Series B Preferred Stock......................................... – – – – 199,164

Total stockholders’ equity (deficit)......................... 49,700 103,808 156,686 61,197 ( 88,961)

(1) Certain of EchoStar’s subsidiaries operated under Subchapter S of the Internal Revenue Code of 1986, as amended (the “Code” ), and comparable

provisions of applicable state income tax laws, until December 31, 1993. The net income for 1993 presented above is net of pro forma income

taxes of $7,846, determined as if EchoStar had been subject to corporate Federal and state income taxes for those years. Earnings per share has

been calculated and presented on a pro forma basis as if the shares of EchoStar issued to reflect the December 31, 1993 reorganization were

outstanding for the year ended December 31, 1993.

(2) The earnings (loss) per share amounts prior to 1997 have been restated as required to comply with Statement of Financial Accounting Standards

(“ FAS” ) No. 128, “Earnings Per Share.” For further discussion of earnings (loss) per share and the impact of FAS No. 128, see Note 2 to

EchoStar’s Consolidated Financial Statements.

(3) Earnings (loss) before interest, taxes, depreciation and amortization (including amortization of subscriber acquisition costs of $16 million and

$122 million for the years ended December 31, 1996 and 1997, respectively) (“ EBITDA” ) is a commonly used measure of performance in the

telecommunications industry. However, EBITDA does not purport to represent cash used by operating activities and should not be considered in

isolation or as a substitute for measures of performance prepared in accordance with generally accepted accounting principles.

(4) Excludes restricted cash and marketable investment securities.