Dish Network 1997 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1997 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10

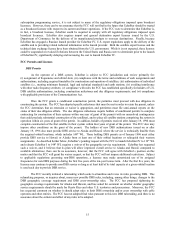

During 1998, SBC Communications Inc. (“ SBC” ) and Bell Atlantic Corporation (“ Bell Atlantic”) entered into

marketing alliances with DirecTv and USSB. As a result of these alliances, EchoStar may incur a competitive

disadvantage in marketing its DISH Network service to existing SBC and Bell Atlantic customers.

PrimeStar currently offers medium power Ku-band programming service to customers using dishes

approximately three feet in diameter. PrimeStar is owned by a group of multiple-system cable operators and provides

nationwide service. PrimeStar’s medium-power service offers approximately 150 channels of video and audio

programming. PrimeStar is expected to have access to significant DBS capacity via Tempo’s DBS satellite, which is

capable of providing full-CONUS service. PrimeStar has announced plans to use Tempo’s DBS satellite to provide a

mix of sports, multichannel movie services, pay-per-view services, and popular cable networks to traditional broadcast

television, basic cable and other analog programming customers. As of December 31, 1997, PrimeStar had

approximately 1.9 million subscribers.

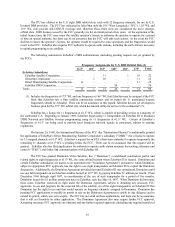

During June 1997, PrimeStar announced that a binding letter of intent had been signed providing for its

restructuring. Additionally, PrimeStar, which is currently owned by a group of multiple-system cable operators

(“ MSOs” ) including Tele-Communications, Inc. (“ TCI” ), Time Warner Inc. (“ Time Warner”) and three of the other

largest cable MSO’s, entered into an agreement to combine its assets with American Sky Broadcasting, LLC

(“ ASkyB” ), a satellite venture formed by The News Corporation Limited (“ News” ) and MCI Communications

Corporation (“ MCI” ). Each PrimeStar partner would contribute its PrimeStar customers and partnership interests into

the newly formed entity. ASkyB has agreed to contribute two satellites under construction and 28 full-CONUS

frequencies at the 110° WL orbital location. In addition, PrimeStar has agreed to acquire Tempo’s license for 11

full-CONUS frequencies at the 119° WL orbital location.

During July 1997, PrimeStar and TSAT filed an application with the FCC requesting FCC approval for the

assignment of Tempo’s authorizations to PrimeStar in connection with its restructuring. During August 1997, MCI and

PrimeStar also filed an FCC application requesting approval for the assignment of MCI’s DBS authorizations to

PrimeStar. The parties to the two transactions also initiated the antitrust clearance process with the Department of

Justice for each transaction. Public reports have suggested that PrimeStar may have obtained Department of Justice

clearance for one of the two transactions (the PrimeStar restructuring). The FCC applications have been placed on

public notice and have been opposed by EchoStar and others. There can be no assurance that any of these oppositions

will be successful. Furthermore, PrimeStar recently announced its intention to use Tempo’s 11 full-CONUS

frequencies under an arrangement that, in PrimeStar’s view, does not constitute a transfer of control and therefore

would not require FCC approval.

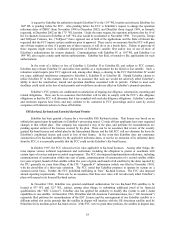

The proposed restructuring of PrimeStar and its merger with ASkyB, if approved and consummated, would

result in a stronger competitor with substantially greater financial and other resources than EchoStar. If approved in its

proposed structure, PrimeStar would have significantly more frequencies capable of serving the entire continental U.S.

than any other DBS provider. Several of the companies that would hold ownership interests in a restructured PrimeStar

entity provide programming to cable television operators, other terrestrial systems and DBS system operators, including

EchoStar. These content providers, including News, Turner Broadcasting Corporation (“ Turner”), Time Warner, TCI,

Cox Cable (“ Cox”), Comcast and US WEST, Inc. (“ US WEST” ), would likely provide programming to the new

PrimeStar entity and may decide to provide this programming to PrimeStar on better terms and at a lower cost than to

other cable or DBS operators. Additionally, among other things, those content providers could raise programming

prices to all cable, DBS and other providers (including PrimeStar), thereby increasing the Company’s cost of

programming to rates that are effectively higher than those borne by PrimeStar’s owners. Although the current

programming access provisions under the Cable Act (as defined) and applicable FCC’s rules require cable-affiliated

content providers to make programming available to multi-channel video programming distributors on

non-discriminatory terms, there are exceptions to these requirements, which in any event are currently set to expire in

2002. Any amendment to, or interpretation of, the Cable Act or the FCC’s rules that would revise or eliminate these

provisions could adversely affect EchoStar’s ability to acquire programming on a cost-effective basis.

The FCC has allocated certain additional U.S. licensed DBS frequencies to DirecTv, USSB and other parties.

These frequencies could provide additional capacity for existing DBS operators thereby enhancing their competitive

position relative to the Company. Further, such presently unused frequencies could enable new competitors to enter the

DBS market.