Dish Network 1997 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 1997 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

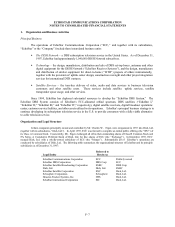

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

1. Organization and Business Activities – Continued

F–9

sufficient cash flows to pay its obligations, including its obligations on its long-term debt, or to pay cash dividends

on any of its preferred stock.

2. Summary of Significant Accounting Policies

Principles of Consolidation

The financial statements for 1995 present the consolidation of Dish, Ltd. and its subsidiaries through the date of the

Exchange and the consolidation of ECC and its subsidiaries, thereafter. The Exchange and Merger was accounted for as a

reorganization of entities under common control and the historical cost basis of assets and liabilities was not affected by the

transaction. All significant intercompany accounts and transactions have been eliminated.

EchoStar accounts for investments in 50% or less owned entities using the equity method. At December 31,

1996 and 1997, these investments were not material to EchoStar’s consolidated financial statements.

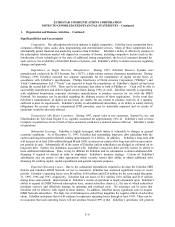

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure

of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and

expenses for each reporting period. Actual results could differ from those estimates.

Foreign Currency Transaction Gains and Losses

The functional currency of EchoStar’s foreign subsidiaries is the U.S. dollar because their sales and purchases

are predominantly denominated in that currency. Transactions denominated in currencies other than U.S. dollars are

recorded based on exchange rates at the time such transactions arise. Subsequent changes in exchange rates result in

transaction gains and losses which are reflected in income as unrealized (based on period-end translation) or realized

(upon settlement of the transaction). Net transaction gains (losses) during 1995, 1996 and 1997 were not material to

EchoStar’s results of operations.

Cash and Cash Equivalents

EchoStar considers all liquid investments purchased with an original maturity of 90 days or less to be cash

equivalents. Cash equivalents as of December 31, 1996 and 1997 consist of money market funds, corporate notes and

commercial paper; such balances are stated at cost which equates to market value.