Airtran 2002 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2002 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

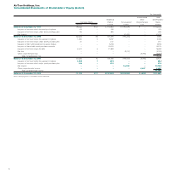

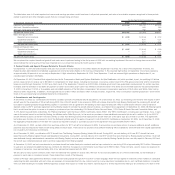

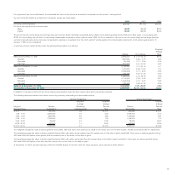

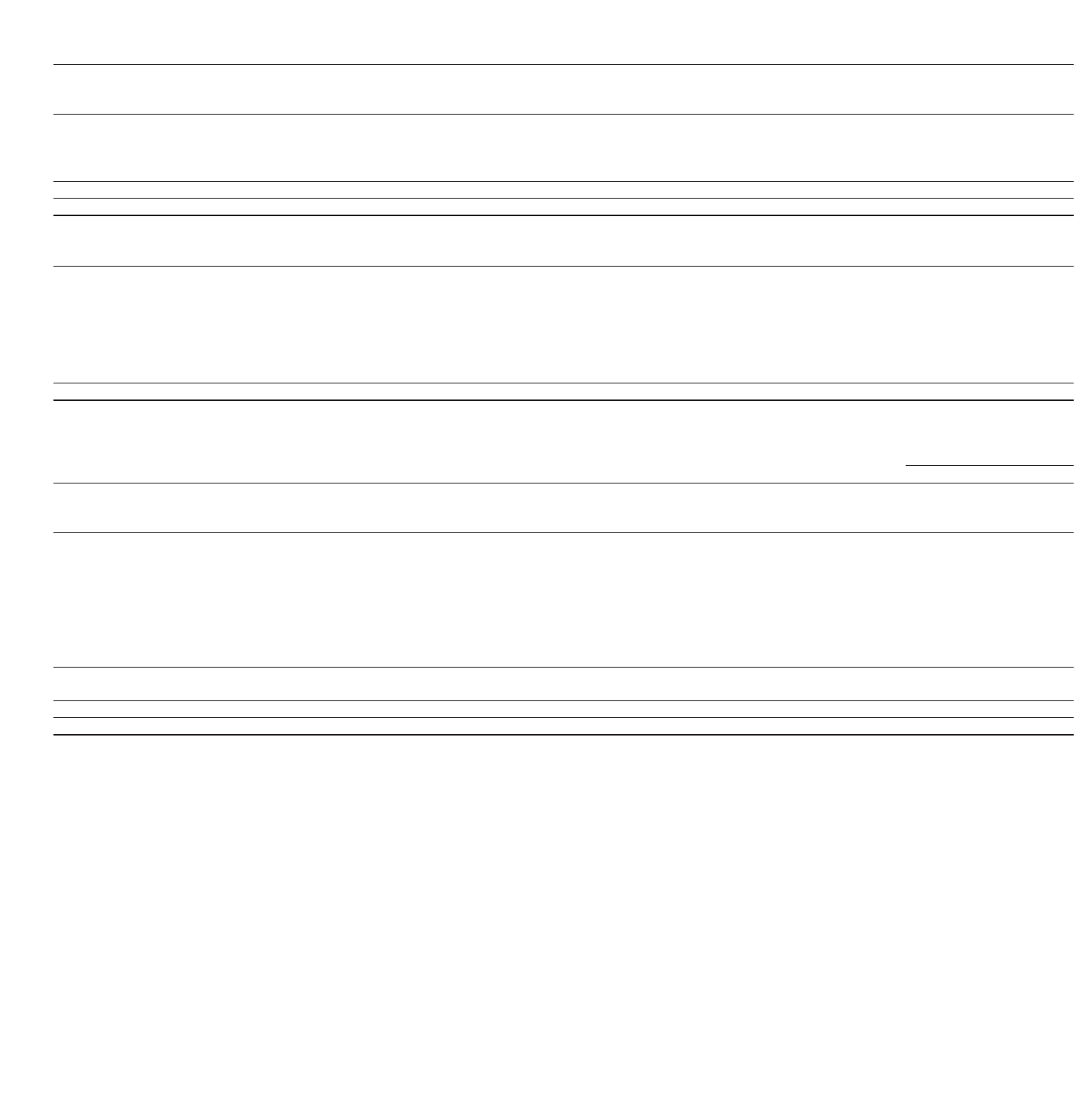

12. Income Taxes

The components of our provision for income taxes are as follows (in thousands):

2002 2001 2000

Current provision (benefit):

Federal $(786) $ 858 $–

State –130 –

Total current provision (benefit) (786) 988 –

Deferred provision:

Federal –1,896 –

State –356 –

Total deferred provision –2,252 –

Provision (Benefit) for income taxes $(786) $3,240 $–

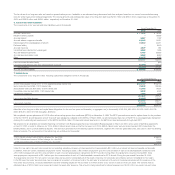

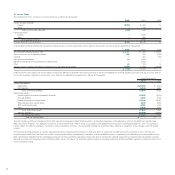

A reconciliation of taxes computed at the statutory federal tax rate on income (loss) before income taxes to the provision for income taxes is as follows (in thousands):

2002 2001 2000

Tax computed at federal statutory rate $ 3,761 $ 399 $ 16,603

State income tax, net of federal tax benefit 329 303 1,469

Goodwill –481 483

Debt discount amortization 10 1,083 –

Benefit of preacquisition net operating loss carryforwards –2,252 –

Other 65 125 54

Valuation reserve, including the effect of changes to prior year deferred tax assets (4,951) (1,403) (18,609)

$ (786) $ 3,240 $ –

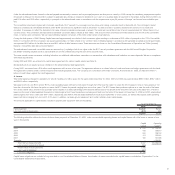

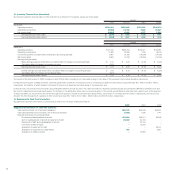

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for

income tax purposes. Significant components of our deferred tax liabilities and assets are as follows (in thousands):

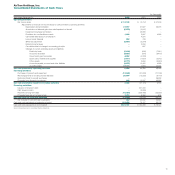

As of December 31,

2002 2001

Deferred tax liabilities:

Depreciation $ 25,663 $ 9,010

Rent expense 5,944 2,841

Gross deferred tax liabilities 31,607 11,851

Deferred tax assets:

Deferred gains from sale and leaseback of aircraft 27,992 16,749

Accrued liabilities 6,264 4,905

Federal operating loss carryforwards 40,436 36,043

State operating loss carryforwards 4,406 4,095

AMT credit carryforwards 3,292 4,078

Other 5,265 4,821

Gross deferred tax assets 87,655 70,691

Valuation allowance (56,048) (58,840)

Net deferred tax assets 31,607 11,851

Total net deferred taxes $ – $ –

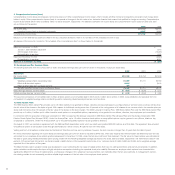

The Job Creation and Worker Assistance Act of 2002 passed by Congress in March 2002 resulted in a retroactive suspension of the alternative minimum tax (AMT) net operating loss

(NOL) 90 percent limitation. This legislation resulted in a tax benefit of $0.8 million in 2002. In accordance with Statement of Financial Accounting Standards No. 109, “Accounting for

Income Taxes,” the effect of changes in tax laws or rates is included in income in the period that includes the enactment date, resulting in recognition of the change in the first quarter

of 2002.

For financial reporting purposes, a valuation allowance has been recognized at December 31, 2002 and 2001, to reduce the net deferred income tax assets to zero. We have not

recognized any benefit from the future use of NOL carryforwards because management’s evaluation of all the available evidence in assessing the realizability of the tax benefits of such

NOL carryforwards indicates that the underlying assumptions of future profitable operations contain risks that do not provide sufficient assurance to recognize such tax benefits currently.

Although we produced operating profits in 2002 and 2001, we do not believe this and other positive evidence, including projections of future profitable operations, offset the effect of our

recent cumulative losses.

24