Airtran 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The fair values of our long-term debt are based on quoted market prices, if available, or are estimated using discounted cash flow analyses, based on our current incremental borrowing

rates for similar types of borrowing arrangements. The carrying amounts and estimated fair values of our long-term debt were $210.1 million and $210.2 million, respectively, at December 31,

2002, and $268.2 million and $258.5 million, respectively, at December 31, 2001.

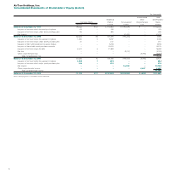

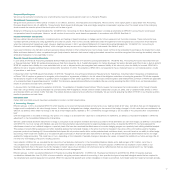

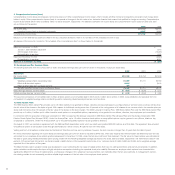

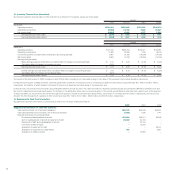

6. Accrued and Other Liabilities

The components of our accrued and other liabilities were (in thousands):

As of December 31,

2002 2001

Accrued maintenance $ 11,293 $ 18,562

Rotable inventory payable –19,658

Accrued interest 5,857 7,782

Accrued salaries, wages and benefits 18,988 14,327

Deferred gains from sale/leaseback of aircraft 73,664 44,077

Derivative liability –8,676

Accrued insurance 4,607 984

Unremitted fees collected from passengers 4,568 1,896

Accrued federal excise taxes 6,493 20,893

Accrued lease termination costs 5,068 6,663

Other 19,173 5,992

149,711 149,510

Less noncurrent derivative liability –(832)

Less noncurrent deferred gains from sale/leaseback of aircraft (69,556) (40,409)

Other liabilities (69,556) (41,241)

Accrued and other liabilities $ 80,155 $108,269

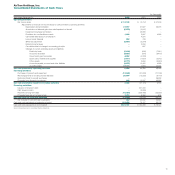

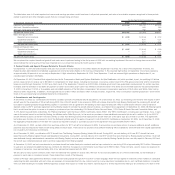

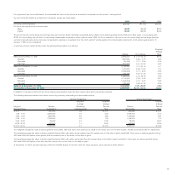

7. Indebtedness

The components of our long-term debt, including capital lease obligations were (in thousands):

As of December 31,

2002 2001

Aircraft notes payable through 2017, 10.72% weighted-average interest rate $123,737 $130,186

Senior notes due April 2008, 11.27% interest rate 76,538 129,046

Subordinated notes due April 2009, 13.00% interest rate 12,662 14,201

Convertible notes due April 2009, 7.75% interest rate 5,500 5,500

Capital lease obligations 1,783 1,594

220,220 280,527

Less unamortized debt discount (10,047) (12,316)

210,173 268,211

Less current maturities (10,460) (13,439)

$199,713 $254,772

Maturities of our long-term debt and capital lease obligations for the next five years and thereafter, in aggregate, are (in thousands): 2003 – $10,460; 2004 – $11,532; 2005 – $15,708,

2006 – $16,381; 2007–$17,709; thereafter – $148,430.

We completed a private placement of $178.9 million enhanced equipment trust certificates (EETCs) on November 3, 1999. The EETC proceeds were used to replace loans for the purchase

of the first 10 B717 aircraft delivered, and all 10 aircraft were pledged as collateral for the EETCs. In March 2000, we sold and leased back two of the B717s in a leveraged lease transaction

reducing the outstanding principal amount of the EETCs by $35.9 million. Principal and interest payments on the EETCs are due semiannually through April 2017.

We entered into an amended and restated financing commitment with Boeing Capital Services Corporation (Boeing Capital) on March 22, 2001, and a series of definitive agreements

on April 12, 2001, in order to refinance our 101⁄4% ($150.0 million) senior notes and AirTran Airways, Inc.’s 101⁄2% ($80.0 million) senior secured notes due April 2001 (collectively, the

Existing Notes), and to provide additional liquidity. The cash flow generated from the Boeing Capital transactions, together with internally generated funds, was used to retire the Existing

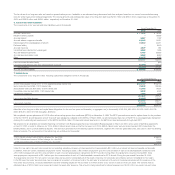

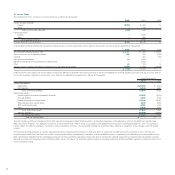

Notes at maturity. The components of the refinancing are as follows (in thousands):

11.27% Senior secured notes of AirTran Airways, Inc. due 2008 $166,400

13.00% Subordinated notes of AirTran Holdings, Inc. due 2009 17,500

7.75% Convertible notes of AirTran Holdings, Inc. due 2009 17,500

$201,400

Under the new senior secured notes issued by our operating subsidiary, Airways, principal payments of approximately $3.3 million plus interest are due and payable semiannually.

In addition, there are certain mandatory prepayment events, including for 2002, a $3.0 million prepayment upon the consummation of each of 13 sale/leaseback transactions and

a $1.0 million prepayment upon the consummation of each of seven sale/leaseback transactions for B717 aircraft. During 2002, 20 prepayments occurred. During 2001, there

were prepayment requirements of $3.1 million upon the consummation of each of 11 sale/leaseback transactions for B717 aircraft. During the year ended December 31, 2001,

11 prepayments occurred. The new senior secured notes are secured by substantially all of the assets of Airways not previously encumbered, and are noncallable for four years.

In the fifth year, the senior secured notes may be prepaid at a premium of 4 percent and in the sixth year at a premium of 2 percent. Contemporaneously with the issuance of the

new senior secured notes, we issued detachable warrants to Boeing Capital for the purchase of 3 million shares of our common stock at $4.51 per share. The warrants had an

estimated value of $12.3 million when issued and expire five years after issuance. This amount is being amortized to interest expense over the life of the new senior secured notes.

20