Airtran 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

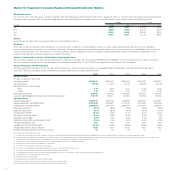

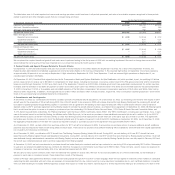

Impairment loss/lease termination expenses represent $38.8 million of charges related to decreases in the fair market values of our DC-9 and B737 aircraft fleets. These charges were

calculated in accordance with SFAS 121. In addition, we recorded a $7.3 million charge related to the termination of a B737 lease (see Note 13 to the Consolidated Financial Statements).

Special charges primarily represent operating costs incurred during the FAA’s ground stop order following the September 11 Events.

Government grant represents the entire amount of compensation we expect to receive from the U.S. government pursuant to the Stabilization Act (see Note 3 to the Consolidated

Financial Statements).

Nonoperating Expenses

Other expense, net, included interest income and interest expense, a special item and an adjustment related to our fuel hedges in accordance with SFAS 133. Interest income decreased

11.5 percent primarily due to lower rates of return on invested cash, partially offset by higher amounts of invested cash. Interest expense decreased 4.8 percent primarily due to overall

lower debt obligations, partially offset by higher interest rates associated with our refinanced debt (see Note 7 to the Consolidated Financial Statements). The special item represents addi-

tional debt discount amortization resulting from the exercise of conversion rights on approximately two-thirds of our 7.75% Convertible Notes. Upon conversion, we expensed $3.8 million of

the debt discount and $0.5 million of debt issuance costs associated with our 7.75% Convertible Notes. These amounts are shown on the Consolidated Statements of Operations as

Convertible Debt Discount Amortization. In accordance with SFAS 133 (see Note 5 to the Consolidated Financial Statements) we also recognized fuel-hedging gains of $2.2 million.

Income Tax Expense (Benefit)

Our income tax expense was $3.2 million compared to $0 in the prior year. The 2001 tax expense resulted from the utilization of a portion of our $141.0 million of NOL carryforwards

existing at December 31, 1998, offset in part by AMT and the application to goodwill of the tax benefit related to the realization of a portion of the Airways Corporation, Inc. NOL carry -

forwards. We have not recognized any benefit from the future use of NOL carryforwards. We have not recognized any such benefit because our evaluation of available evidence indicates

an unacceptable degree of risk underlying any current assumption of sufficient future profitable operations to realize such benefit.

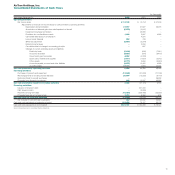

Liquidity and Capital Resources

Our cash and cash equivalents, including restricted cash, totaled $138.3 million at December 31, 2002 compared to $130.0 million at December 31, 2001. The deferral of $16.5 million

in excise tax payments until January 2002 in accordance with the Stabilization Act is reflected in our 2001 year-end cash balance.

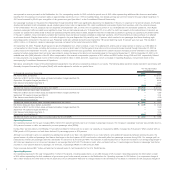

Operating activities provided cash flows of $6.4 million in 2002 compared to $95.4 million in 2001. The primary components of our 2002 operating cash flows were net income

improvements, air traffic liability growth and reduced depreciation and amortization. Our net income improved by $13.5 million primarily due to the growth of our business, as measured

by passenger revenues. As our business has grown, so has the level of our customers’ advance payments for future travel, commonly referred to as air traffic liability. The primary rea-

son for our depreciation and amortization-related operating cash flows adjustments is attributable to the reduction of the original cost bases of our DC-9 aircraft, as recognized in 2001

in accordance with SFAS 121 (see Note 13 to the Consolidated Financial Statements). Partially offsetting these primary components were: (i) the growth of our interline receivables for our

efforts to accommodate other airlines’ involuntarily displaced passengers on our flights; (ii) deferred gains recognized commensurate with the sale/leaseback of every B717 delivered to

us during 2002; (iii) the deferral of excise tax payments until January 2002 in accordance with the Stabilization Act; (iv) payments of prepaid aircraft rent associated with the majority

of our B717s and (v) increases to the amount of cash temporarily withheld by our credit card processors related to our customers’ advance payments for future travel.

Investing activities provided cash flows of $7.6 million in 2002 compared to cash flows used of $31.2 million in 2001. Our property and equipment purchases in both years primarily

consisted of spare parts and equipment provisioning for the B717 aircraft. To a lesser extent our property and equipment purchases consisted of capital expenditures on leasehold improve-

ments and computer equipment to support our operations growth particularly for the cities added to our route network during those years. Cash flows for aircraft purchase deposits relate

to our agreement to acquire B717 aircraft. During 2002, we amended our B717 purchase agreement with the airframe manufacturer (see “Commitments” below). Pursuant to the amended

B717 purchase agreement we were refunded deposits of approximately $21.0 million in 2002. During 2001, we paid approximately $13.3 million as deposits toward the construction of

our future B717 aircraft deliveries. Our proceeds from the disposal of equipment were $0.6 million and $13.3 million in 2002 and 2001, respectively. The 2001 disposals primarily consisted

of certain B717 aircraft that we acquired during 2000 and then sold and leased back under a lease financing commitment with Boeing Capital Services Corporation (Boeing Capital).

Financing activities used $13.3 million of cash in 2002 compared to $38.8 million in 2001. Financing activities for 2002 consisted primarily of scheduled payments of debt obligations.

Financing activities for 2001 related to the refinancing of certain debt obligations associated with the Boeing Capital transactions (see “Other Information” below).

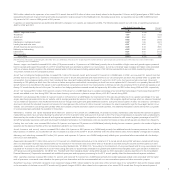

Commitments

Our contractual purchase commitments consist primarily of scheduled acquisitions of new Boeing 717 aircraft. As of December 31, 2002, our remaining commitments with respect to

B717 aircraft were for the acquisition of 23 aircraft during 2003. All of the 2003 deliveries will be lease-financed through Boeing Capital. In connection with an agreement with The

Boeing Company (Boeing) to return approximately $21 million in 2002 and $5 million in 2003 of advance deposits under our B717 purchase agreement and by Boeing Capital to provide

lease financing to us for up to 22 previously-owned and one new B717 aircraft to be added to our fleet during 2003, we entered into an agreement on September 30, 2002 whereby

Boeing Capital would have the option to cause us to prepay or purchase at par the outstanding 13% Series A Senior Secured Notes, 7. 75% Series B Senior Secured Convertible Notes,

and 11.27% Senior Secured Notes (collectively, the “Refinancing Notes”) and the Class C EETC Certificates, Series 1999-1 (the “EETC Certificates”), including accrued interest, if any,

in each case to the extent issued to and held by Boeing, its affiliates and/or Rolls Royce plc, in the event we purchase or lease additional commercial jet aircraft in addition to (i) the

23 B717 aircraft being financed by Boeing Capital, (ii) the B717 aircraft currently on order from Boeing and (iii) certain replacement aircraft which are of the same type as currently in our

fleet. This agreement terminates upon the later of (i) payment in full of the Refinancing Notes and (ii) the earlier of payment in full of the EETC Certificates or September 30, 2009. As of

December 31, 2002, the aggregate principal balance of the debt we could be so required to prepay or purchase pursuant to this agreement was approximately $124.6 million.

As of December 31, 2002, we had a total of six purchase options for B717 aircraft to be delivered in 2005. If we exercise our purchase options to acquire additional aircraft, additional

payments could be required for these aircraft during 2003 and future years. There can be no assurance that sufficient financing will be available for all aircraft and other capital expendi-

tures not covered by firm financing commitments.

As of December 31, 2002, our deliveries of B717 aircraft from Boeing totaled 50 aircraft. During 2002, we took delivery of 20 new B717 aircraft that were lease-financed by Boeing

Capital through sale/leaseback transactions. During 2001, we took delivery of 14 new B717 aircraft that were financed by Boeing Capital as follows: 13 aircraft were delivered through

sale/leaseback transactions with Boeing Capital, and one was purchased with a loan provided by Boeing Capital (the loan was fully repaid in February 2001 and the aircraft was

contemporaneously sold to and then leased back from Boeing Capital).

As of December 31, 2002, our debt obligations totaled $210.2 million, with respect to which substantially all our assets are pledged as security. Our debt obligations are composed of

$123.7 million of 10.72% EETCs, of which a portion of interest and principal is payable semiannually through April 2017, and certain debt obligations due to Boeing Capital, as described

in Other Information below. The EETC proceeds were used to finance the purchase of the first 10 B717 aircraft delivered (all 10 aircraft were pledged as collateral for the EETCs). Eight

8