Airtran 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

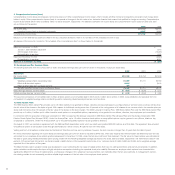

Under the subordinated notes, interest is due and payable semiannually in arrears, and no principal payments are due prior to maturity in 2009, except for mandatory prepayments equal to

25 percent of Airways’ net income (which, subject to applicable law, Airways is required to dividend to us in cash on a quarterly basis for payment to the lender). During 2002 and 2001, we

paid $1.5 million and $3.3 million, respectively, in principal on the subordinated notes in accordance with the requirements to pay 25 percent of Airways’ net income from profitable quar-

ters.

The convertible notes bear a higher rate of interest, specifically 12.27 percent if our average common stock price during a calendar month is below $6.42. This contingent interest

feature is considered an embedded derivative under SFAS 133 and had no significant value at December 31, 2002 and 2001. Quarterly valuations will continue to be made and

recorded, if necessary, to reflect the derivative’s fair value. Interest is payable semiannually in arrears. The notes are convertible at any time into approximately 3.2 million shares of our

common stock. This conversion rate represents a beneficial conversion feature valued at $5.6 million. This amount will be amortized to interest expense over the life of the convertible

notes, or sooner upon conversion. We can require Boeing Capital’s conversion of the notes under certain circumstances.

During the third quarter of 2001, Boeing Capital exercised approximately two-thirds of their conversion rights resulting in a decrease of $12 million of principal on the 7. 75% Convertible

Notes. In connection with the conversion, we issued approximately 2.2 million shares of our common stock to Boeing Capital. In accordance with generally accepted accounting principles,

we expensed $3.8 million of the debt discount and $0.5 million of debt issuance costs. These amounts are shown on the Consolidated Statements of Operations as “Other (Income)

Expense – Convertible debt discount amortization.”

The subordinated notes and convertible notes are secured by: (i) a pledge of all of our rights under the B717 aircraft purchase agreement with the McDonnell Douglas Corporation

(an affiliate of Boeing Capital) and (ii) a subordinated lien on the collateral securing the new senior secured notes.

The notes contain certain covenants, including limitations on additional indebtedness, restrictions on transactions with subsidiaries and limitations on asset disposals. We are in compliance

with these requirements.

During 2002 and 2000, we entered into capital lease agreements for various capital assets (see Note 8).

Substantially all of our assets serve as collateral on the aforementioned debt agreements.

During 2002, we entered into a $15 million credit agreement with a term of one year. The agreement allows us to obtain letters of credit and enter into hedge agreements with the bank.

The agreement contains certain covenant requirements including liquidity tests. The company is in compliance with these covenants. At December 31, 2002, we had $7.8 million in

letters of credit drawn against the credit agreement.

8. Leases

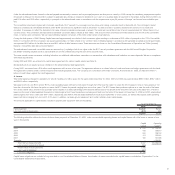

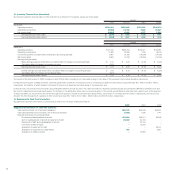

Total rental expense charged to operations for aircraft, facilities and office space for the years ended December 31, 2002, 2001 and 2000 was approximately $96.6 million, $56.7 million

and $30.9 million, respectively.

We lease six DC-9s, one B737 and 42 B717s under operating leases with terms that expire through 2021. We have the option to renew the DC-9 leases for one or more periods of not

less than six months. We have the option to renew the B717 leases for periods ranging from one to four years. The B717 leases have purchase options at or near the end of the lease

term at fair market value, and two have purchase options based on a stated percentage of the lessor’s defined cost of the aircraft at the end of the 13th year of the lease term. The B717

leases are the result of sale/leaseback transactions. Deferred gains from these transactions are being amortized over the terms of the leases. At December 31, 2002 and 2001, unamortized

deferred gains were $73.7 million and $44.1 million, respectively. See Note 6. We also lease facilities from local airport authorities or other carriers, as well as office space under operating

leases with terms ranging from one month to 12 years. In addition, we lease ground equipment and certain rotables under capital leases.

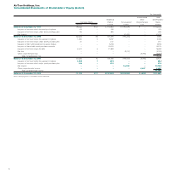

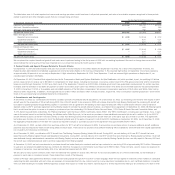

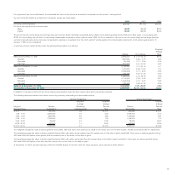

The amounts applicable to capital leases included in property and equipment were (in thousands):

As of December 31,

2002 2001

Flight equipment $3,330 $2,627

Less: Accumulated depreciation (576) (285)

$2,754 $2,342

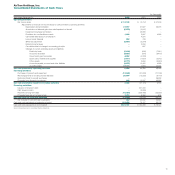

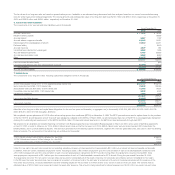

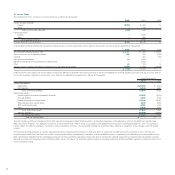

The following schedule outlines the future minimum lease payments at December 31, 2002, under noncancelable operating leases and capital leases with initial terms in excess of one

year (in thousands):

Capital Operating

Leases Leases

2003 $ 760 $ 133,187

2004 709 128,210

2005 244 126,153

2006 174 123,912

2007 160 121,336

Thereafter – 1,160,381

Total minimum lease payments 2,047 $1,793,179

Less: amount representing interest (264)

Present value of future payments 1,783

Less: current obligations (627)

Long-term obligations $1,156

Capital lease obligations are included in long-term debt in our Consolidated Balance Sheets. Amortization of assets recorded under capital leases is included as “Depreciation” in the

Consolidated Statements of Operations.

21