Airtran 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$28.0 million related to the impairment of our owned DC-9 aircraft fleet and $2.5 million of other costs directly related to the September 11 Events; and (iii) special gains of $29.0 million

representing the amount of government grant funds we expected to receive pursuant to the Stabilization Act. Excluding special items, our operating cost per ASM (CASM) improved

8.8 percent to 8.51 cents on ASM growth of 26.3 percent.

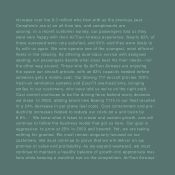

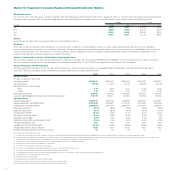

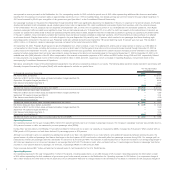

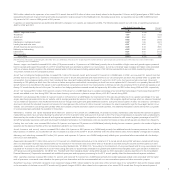

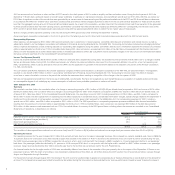

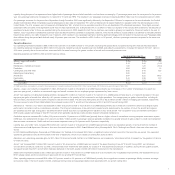

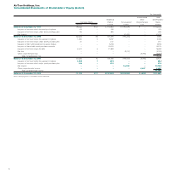

In general, our operating expenses are significantly affected by changes in our capacity, as measured by ASMs. The following table presents our unit costs, or operating expenses per

ASM, for 2002 and 2001:

Year Ended December 31, Percent

2002 2001 Change

Salaries, wages and benefits 2.46¢ 2.43¢ 1.2

Aircraft fuel 1.87 2.13 (12.2)

Aircraft rent 0.88 0.54 63.0

Distribution 0.52 0.69 (24.6)

Maintenance, materials and repairs 0.57 1.05 (45.7)

Landing fees and other rents 0.51 0.55 (7.3)

Aircraft insurance and security services 0.36 0.19 89.5

Marketing and advertising 0.25 0.28 (10.7)

Depreciation 0.21 0.43 (51.2)

Other operating 0.88 1.04 (15.4)

Total CASM 8.51¢ 9.33¢ (8.8)

Note: Amounts for 2002 exclude a government grant of $0.6 million (0.01¢ on a CASM basis). Amounts for 2001 exclude impairment loss/lease termination, special charges and a government grant of $46.1 million, $2.5 million and $29.0 million,

respectively (0.30¢ on a CASM basis).

Salaries, wages and benefits increased $44.4 million (27.9 percent overall or 1.2 percent on a CASM basis) primarily due to the addition of flight crews and ground support personnel

hired to operate and support the growth of our B717 aircraft fleet and new destinations added to our route system, as well as contractual wage increases and higher costs associated

with our employee benefit programs. We employed approximately 5,000 employees (including approximately 4,700 full-time equivalents) at year-end 2002 representing roughly a

17.6 percent increase over the comparative period.

Aircraft fuel, including fuel-hedging activities, increased $15.1 million (10.8 percent overall, and improved 12.2 percent on a CASM basis). In 2002, we consumed 15.1 percent more fuel

primarily due to the growth of our operations. Decreases in the price of aircraft fuel purchases and improvements to our fuel consumption per block hour partially offset our greater fuel

consumption. Our average per gallon cost of fuel, including all fees, taxes and hedging activities decreased 3.7 percent to 90.37 cents. Our fuel consumption improved 7.0 percent,

decreasing to 722 gallons per block hour. We continue to realize savings from reduced fuel consumption per block hour as we replace the DC-9 aircraft in our operating fleet with B717

aircraft that are more fuel-efficient. We expect to derive additional fuel consumption per block hour improvements in 2003 as we retire the remaining 15 DC-9 aircraft and operate an all-

Boeing 717 aircraft fleet by the end of the year. The results of our hedging activities increased aircraft fuel expense by $6.0 million and $2.5 million during 2002 and 2001, respectively.

Aircraft rent increased $37.3 million (105.6 percent overall or 63.0 percent on a CASM basis) due to a greater percentage of our aircraft fleet being leased. Twenty lease-financed B717

aircraft were added to our fleet during 2002. We have lease financing commitments in place to accept delivery of 23 B717 aircraft during 2003.

Distribution costs decreased $2.3 million (5.0 percent overall or 24.6 percent on a CASM basis). Our improvement in this area was primarily due to: (i) a greater percentage of our pas-

senger sales being generated online via our website; and (ii) savings generated by revisions to our commission structure. We recognize significant savings when our sales are transacted

via our website as opposed to more traditional methods such as through travel agents and global distribution systems. During the second quarter of 2002, we revised our commission

structure to eliminate the standard 5 percent commission for travel agencies. We continue to offer a 5 percent commission for sales transacted through the travel agent section of our

website. Our commission cost savings were partially offset by increased computer reservation system and credit card fees. The additional transaction volume derived from our growth

in revenue passengers generated the escalation in these fees.

Maintenance, materials and repairs decreased $21.4 million (31.1 percent or 45.7 percent on a CASM basis). On a block hour basis, maintenance costs declined 40.0 percent to approxi-

mately $200 per block hour, primarily reflecting the retirement of 14 DC-9 aircraft in 2002 and seven DC-9 aircraft in 2001. The timing of maintenance to be performed is predominantly

determined by the number of hours the aircraft and engines are operated, and their age. The composition of our aircraft fleet continued to shift toward a greater percentage of new B717

aircraft that generally require less costly and less frequent scheduled maintenance. Our maintenance costs are expected to increase as these aircraft age and are utilized more frequently.

Landing fees and other rents increased $6.6 million (18.6 percent, and improved 7.3 percent on a CASM basis) reflecting landing fee rate increases, growth in the number of flights we

operated and the leasing of facilities at the new destinations added to our route network.

Aircraft insurance and security services increased $16.8 million (134.4 percent or 89.5 percent on a CASM basis) primarily from additional aircraft insurance premiums for war risk lia-

bility insurance. In addition, our insured fleet hull value increased as a result of the new B717 aircraft deliveries while the overall rates for basic hull and liability coverage also increased.

Marketing and advertising increased $2.5 million (13.5 percent, and improved 10.7 percent on a CASM basis) primarily reflecting our promotional efforts associated with the develop-

ment of our new destinations.

Depreciation decreased $11.1 million (39.4 percent or 51.2 percent on a CASM basis) primarily due to the retirement of 14 owned aircraft during 2002 and seven owned aircraft during

2001. Our depreciation expense was reduced further by the reduction in the net book value of our B737 and DC-9 aircraft as recorded during the second and third quarters of 2001,

respectively, in accordance with Statement of Financial Accounting Standards No. 121 (SFAS 121), “Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to be

Disposed Of.” A revision to the useful life of our B717 fleet during 2001 and our discontinued amortization of goodwill and indefinite-lived intangible assets upon adoption of Statement

of Financial Accounting Standards No. 142 (SFAS 142), “Goodwill and Other Intangible Assets” during 2002 reduced our 2002 depreciation expense (see Note 2 to the Consolidated

Financial Statements). Depreciation associated with additional spare parts and equipment provisioning for the B717 aircraft partially offset the aforementioned expense reductions.

Other operating expenses increased $5.0 million (7.4 percent, and improved 15.4 percent on a CASM basis) primarily from added passenger-related costs associated with the higher

level of operations, contractual costs related to the opening of new destinations and the costs associated with our new reservations system and other automation projects.

Impairment loss/lease termination represents: (i) an impairment charge of $18.1 million related to the write-down of the net book value of our owned B737 fleet and for charges related

to the termination of the lease on one B737 aircraft; and (ii) special charges of $28.0 million related to the impairment of our owned DC-9 aircraft fleet. During the second quarter of

5