Airtran 2000 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10. Impairment Loss

In the fourth quarter of 1998, we decided to accelerate the retirement of our four owned B737 aircraft as a result of the elimination of their original route system

and continued operating losses upon their redeployment to other routes. The B737s, which were acquired in the Airways merger, will be replaced with B717

aircraft. In the fourth quarter of 1999, we decided to accelerate the retirement of our 42 DC-9 aircraft to accommodate the introduction of our B717 fleet. It

was our original intent to use the B717s to increase overall capacity while continuing to use the DC-9s into 2005. However, during 1999, the new management

team (including our Chief Executive Officer and President, who joined AirTran in 1999) reevaluated our near- and long-term fleet strategy and the components

underlying such strategy. By October 1999, we determined that it would be cost-beneficial to begin to retire the DC-9s. As a result, we developed a fleet plan

which provided for the retirement of the DC-9s between December 31, 1999, and October 2003, generally coinciding with the delivery of the B717s. The

Board approved the plan in October 1999.

In connection with each of the decisions to accelerate the retirement of these aircraft, we performed evaluations to determine, in accordance with SFAS No. 121,

whether future cash flows (undiscounted and without interest charges) expected to result from the use and eventual disposition of these aircraft would be less

than the aggregate carrying amount of these aircraft and related assets and, for the B737s, an allocation of cost in excess of net assets acquired resulting

from the Airways merger. SFAS No. 121 requires that, when a group of assets being tested for impairment was acquired as part of a business combination

that was accounted for using the purchase method of accounting, any cost in excess of net assets acquired that arose as part of the transaction must be

included as part of the asset grouping. As a result of the evaluations, management determined that the estimated future cash flows expected to be generated

by these aircraft would be less than their carrying amounts and, for the B737s, allocated cost in excess of net assets acquired, and therefore these aircraft

are impaired as defined by SFAS No. 121. Consequently, the original cost bases of these assets were reduced to reflect the fair market value at the date

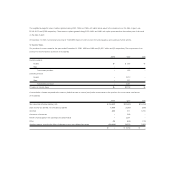

the decisions were made, resulting in a $27.5 million impairment loss on the B737s in 1998 and a $147.7 million impairment loss on the DC-9s in 1999. We

considered recent transactions and market trends involving similar aircraft in determining the fair market value.

11. Financial Instruments

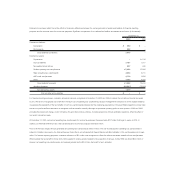

Financial instruments that potentially subject us to significant concentrations of credit risk consist principally of cash and cash equivalents and accounts

receivable. We maintain cash and cash equivalents with various high credit-quality financial institutions or in short-duration high-quality debt securities. We

periodically evaluate the relative credit standing of those financial institutions that are considered in our investment strategy. Concentration of credit risk with

respect to accounts receivable is limited, due to the large number of customers comprising our customer base.

The fair values of our long-term debt are based on quoted market prices, if available, or are estimated using discounted cash flow analyses, based on our

current incremental borrowing rates for similar types of borrowing arrangements. The carrying amounts and estimated fair values of our long-term debt were

$427.9 million and $439.0 million, respectively, at December 31, 2000, and $415.7 million and $392.3 million, respectively, at December 31, 1999.

12. Employee Benefit Plans

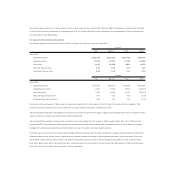

Effective January 1, 1998, we consolidated our 401(k) plans (the Plan). All employees are eligible to participate in the consolidated Plan, a defined contribution

benefit plan which qualifies under Section 401(k) of the Internal Revenue Code. Participants may contribute up to 15 percent of their base salary to the Plan.

Contributions to the Plan by AirTran are discretionary. The amount of our contributions to the Plan expensed in 2000, 1999, and 1998 were approximately

$0.5 million, $0.3 million and $0.3 million, respectively.

Under the 1995 Employee Stock Purchase Plan, employees who complete twelve months of service are eligible to make quarterly purchases of our common

stock at up to a 15 percent discount from the market value on the offering date. The Board of Directors determines the discount rate before each offering date.