Airtran 2000 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

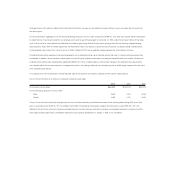

The subordinated notes will bear interest at the higher of: (a) 13 percent, or (b) the rate on the new senior secured notes plus 1 percent. Interest is payable

quarterly in arrears, and no principal payments are due prior to maturity in 2009 except for mandatory quarterly prepayments equal to 25 percent of

AirTran Airways’ net income.

The stated interest rate on the convertible notes will be 7.75 percent, except that they will bear a higher rate of interest if our average common stock price

during a calendar month is below $6.42, or if we have not registered under the Securities Act of 1933 the common stock to be issued upon conversion of the

notes. Interest will be payable semiannually in arrears. The notes are convertible at any time into approximately 3.2 million shares of our common stock. This

conversion rate represents a beneficial conversion feature valued at approximately $12.2 million. This amount will be amortized to interest expense over the life

of the convertible notes. We will be able to require Boeing Capital’s conversion of the notes under certain circumstances.

The subordinated notes and convertible notes will be secured by: (1) a pledge of all of our rights under the B717 aircraft purchase agreement with the

McDonnell Douglas Corporation (an affiliate of Boeing Capital), and (2) a subordinated lien on the collateral securing the new senior secured notes.

During 2000, we obtained a lease financing commitment from Boeing Capital which provided for the purchase and sale-leaseback of up to 20 B717 aircraft

(three of the 20 leases were completed in 2000). In connection with the Boeing Capital transactions, the lease financing commitment was amended to:

(a) increase the term of the leases for the remaining 17 aircraft from 18 years to 18.5 years, and (b) increase Boeing Capital’s purchase price by $3.1 million per

aircraft or $52.7 million in the aggregate. To date, five of the sale-leaseback transactions have closed in 2001. Upon closing of each sale-leaseback transaction

occurring on or after funding of the new senior secured notes, we must make a principal payment of $3.1 million on the new senior secured notes.

In addition, in partial consideration of the refinancing transactions, we have granted Boeing an option to cause us to purchase or lease up to four additional

B717 aircraft per year during 2001, 2002, and 2003. If we elect to lease, Boeing Capital will provide financing substantially equivalent to the lease financing

commitment. These aircraft, and Boeing Capital’s commitment to provide financing thereof, are supplemental to the 50 firm aircraft which are the subject of

our existing purchase agreement with Boeing.

During the last quarter of 2000, we financed the acquisition of three B717 aircraft with promissory notes from Boeing. Subsequent to December 31, 2000,

these notes were repaid through the sale and lease back of the three B717s. Accordingly, these notes are classified as long-term debt.

During 2000, we entered into capital lease agreements for various capital assets (see Note 6).

Certain aircraft and engines with a book value totaling approximately $260.3 million serve as collateral on the senior secured notes, EETCs and promissory notes.

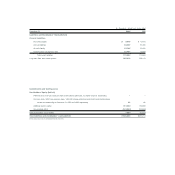

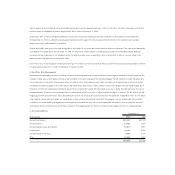

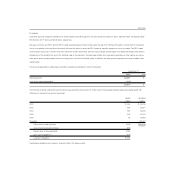

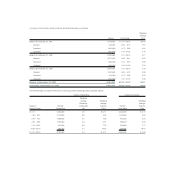

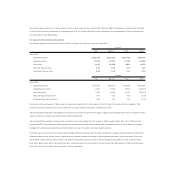

The following table shows our maturities of long-term debt and capital lease obligations for the next five years, based on the maturities of the refinanced debt

discussed above (in thousands):

2001 $ 62,491

2002 19,881

2003 10,270

2004 11,479

2005 15,115

Thereafter 245,523

Promissory notes repaid in 2001 through the sale of equipment 63,144