Airtran 2000 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

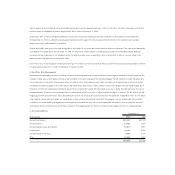

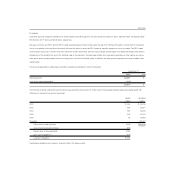

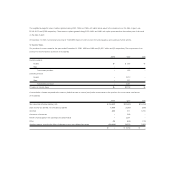

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting

purposes and the amounts used for income tax purposes. Significant components of our deferred tax liabilities and assets are as follows (in thousands):

December 31,

2000 1999

Deferred tax liabilities:

Depreciation $ 590 $ –

Rent expense 988 –

Gross deferred tax liabilities 1,578 –

Deferred tax assets:

Depreciation –21,740

Accrued liabilities 1,181 1,011

Nonqualified stock options 931 930

Federal operating loss carryforwards 47,959 37,938

State operating loss carryforwards 4,606 6,741

AMT credit carryforwards 3,770 3,526

Other 3,358 4,024

Gross deferred tax assets 61,805 75,910

Valuation allowance (60,227) (75,910)

Net deferred tax assets 1,578 –

Total net deferred tax liabilities $ – $ –

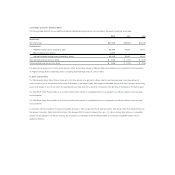

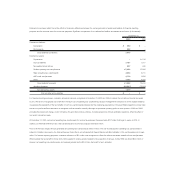

For financial reporting purposes, a valuation allowance has been recognized at December 31, 2000 and 1999, to reduce the net deferred income tax assets

to zero. We have not recognized any benefit from the future use of operating loss carryforwards, because management’s evaluation of all the available evidence

in assessing the realizability of the tax benefits of such loss carryforwards indicates that the underlying assumptions of future profitable operations contain risks

that do not provide sufficient assurance to recognize such tax benefits currently. Although we produced operating profits in each quarter in 2000 and 1999,

excluding the impairment charge, we do not believe this and other positive evidence, including projections of future profitable operations, offset the effect of

our recent cumulative losses.

At December 31, 2000, we had net operating loss carryforwards for income tax purposes of approximately $137 million that begin to expire in 2012. In

addition, our Alternative Minimum Tax credit carryforwards for income tax purposes were $3.8 million.

Prior to the Airways merger, Airways generated net operating loss carryforwards of $23.1 million. The use of preacquisition operating loss carryforwards is

subject to limitations imposed by the Internal Revenue Code. We do not anticipate that these limitations will affect utilization of the carryforwards prior to expi-

ration. For financial reporting purposes, a valuation allowance of $8.1 million was recognized to offset the deferred tax assets related to those carryforwards.

When realized, the tax benefit for those items will be applied to reduce goodwill related to the acquisition of Airways. During 1999, we utilized $6.3 million of

Airways’ net operating loss carryforwards, and reduced goodwill by the $2.4 million tax benefit of such utilization.