Airtran 2000 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

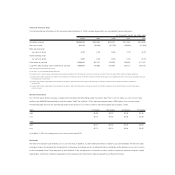

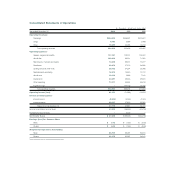

Selected Financial Data

The following financial information for the five years ended December 31, 2000, has been derived from our consolidated financial statements:

(In thousands, except per share data)

2000 1999 1998(a) 1997 1996

Operating revenues $624,094 $523,468 $439,307 $211,456 $219,636

Net income (loss) 47,436 (99,394)(b) (40,738)(c) (96,663)(d) (41,469)(e)

Basic earnings (loss)

per common share 0.72 (1.53) (0.63) (1.72) (0.76)

Diluted earnings (loss)

per common share 0.69 (1.53) (0.63) (1.72) (0.76)

Total assets at year-end 546,255 467,014 376,406 433,864 417,187

Long-term debt including current maturities at year-end 427,903 415,688 245,994 250,712 244,706

Note: All special items listed below are pre-tax.

(a) See Note 1 to the consolidated financial statements.

(b) Includes a $147.7 million impairment loss related to the accelerated retirement of the DC-9 fleet as a result of the introduction of the B717 fleet and a gain of $19.6 million for a litigation settlement.

(c) Includes a $27.5 million impairment loss related to the acceleration of the retirement of four owned B737 aircraft as a result of the elimination of their original route system and continued operating losses upon

their redeployment to other routes.

(d) Includes a $24.8 million charge related to the shutdown of the airline in 1996 and a $5.2 million charge for the renaming of the airline in connection with the merger with Airways Corporation in

November 1997.

(e) Includes a $68.0 million charge related to the shutdown of the airline in 1996, a $3.9 million gain on the sale of property, a $13.0 million arrangement fee for aircraft transfer and a $2.8 million gain on

insurance recovery.

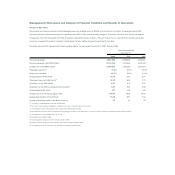

Market Information

Our common stock, $0.001 par value, is traded on the American Stock Exchange under the symbol “AAI.” Prior to July 14, 2000, our common stock was

traded on the NASDAQ National Market under the symbol “AAIR.” As of March 1, 2001, there were approximately 4,989 holders of our common stock.

The following table sets forth the reported high and low sale prices for our common stock for each fiscal quarter since January 1, 1999.

2000 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

High $5.09 $5.00 $4.94 $7.38

Low $3.72 $3.88 $3.94 $3.88

1999

High $5.13 $6.00 $7.25 $6.06

Low $2.75 $4.13 $4.94 $3.50

As of March 1, 2001, the closing price of our common stock was $8.70.

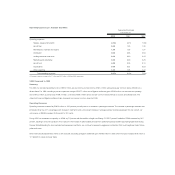

Dividends

We have never declared cash dividends on our common stock. In addition, our debt indentures restrict our ability to pay cash dividends. We intend to retain

earnings to finance the development and growth of our business. Accordingly, we do not anticipate that any dividends will be declared on our common stock

for the foreseeable future. Future payments of cash dividends, if any, will depend on our financial condition, results of operations, business conditions, capital

requirements, restrictions contained in agreements, future prospects and other factors deemed relevant by our Board of Directors.