Airtran 2000 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Revenue Recognition

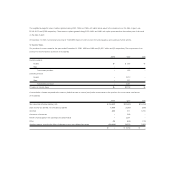

Passenger and cargo revenue is recognized when transportation is provided. Transportation purchased but not yet used is included in air traffic liability.

Stock-Based Compensation

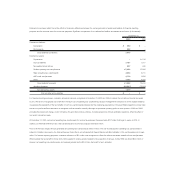

We grant stock options for a fixed number of shares to our officers, directors, key employees and consultants, with an exercise price equal to or below the

fair value of the shares at the date of grant. We account for stock option grants in accordance with APB Opinion No. 25, Accounting for Stock Issued to

Employees, and accordingly recognize compensation expense only if the market price of the underlying stock exceeds the exercise price of the stock option

on the date of grant.

SFAS No. 123, Accounting for Stock-Based Compensation, provides an alternative to APB Opinion No. 25 in accounting for stock-based compensation

issued to employees. However, we will continue to account for stock-based compensation in accordance with APB Opinion No. 25. See Note 8.

Recently Issued Accounting Standards

In June 1998, the FASB issued SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, as amended in June 2000 by SFAS No. 138,

Accounting for Certain Derivative Instruments and Certain Hedging Activities, which requires companies to recognize all derivatives as either assets or lia-

bilities in the balance sheet and measure such instruments at fair value. As amended by SFAS No. 137, Accounting for Derivative Instruments and Hedging

Activities – Deferral of the Effective Date of FASB Statement No. 133, we will adopt SFAS No. 133 effective January 1, 2001. Adoption of these new

accounting standards will result in a cumulative after-tax reduction to net income of approximately $0.3 million and an increase to other comprehensive

income of approximately $0.8 million in the first quarter of 2001. The adoption will also impact assets and liabilities recorded on the balance sheet. The ongo-

ing effects will depend upon future market conditions and our hedging activities. See Note 3.

Reclassification

Certain 1999 and 1998 amounts have been reclassified to conform with 2000 classifications.

2. Commitments and Contingencies

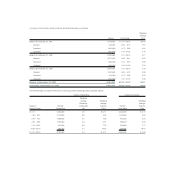

At December 31, 2000, our contractual commitments consisted primarily of scheduled aircraft acquisitions. Initially, we contracted with an affiliate of Boeing to

purchase 50 B717 aircraft for delivery between 1999 and 2002, with options to purchase an additional 50 B717s. During the second quarter of 2000, we revised

our contracts with Boeing relating to the purchase and financing of our future B717 aircraft deliveries. The revised contract provides for a delivery schedule as

follows: 1999 (eight aircraft – all delivered), 2000 (eight aircraft – all delivered), 2001 (12 aircraft), 2002 (12 aircraft), and 2003 (10 aircraft). In connection with

our agreement with Boeing, we also recharacterized the 50 option aircraft to provide for 25 options, 20 purchase rights, and five rolling options. The options

and purchase rights, to the extent exercised, would provide for delivery to us of all of our B717s on or before September 30, 2005. Prior to this revision, we

had committed to purchase 50 B717 aircraft during the following years: 1999 (eight aircraft), 2000 (eight aircraft), 2001 (16 aircraft), and 2002 (18 aircraft).

Also prior to the revision, the 50 option aircraft, if exercised, would have been available for delivery between January 2003 and January 2005.

Aggregate funding needed for these and all other aircraft commitments was approximately $669 million at December 31, 2000. Of this amount, approximately

$6.9 million and $12.5 million are required to be paid in progress payments in 2001 and 2002, respectively. After progress payments, the balance of the total

purchase price must be paid or financed upon delivery of each aircraft. While the major airframe manufacturer is required to provide credit support for a limited

portion of third-party financing, we will be required to obtain financing from other sources relating to these deliveries. If we exercise our options and purchase