Airtran 2000 Annual Report Download - page 26

Download and view the complete annual report

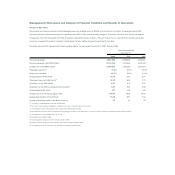

Please find page 26 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Aircraft rent decreased $2.4 million in 1999 from 1998 due to the return to the lessor of five leased B737 aircraft throughout the year.

Other operating expenses decreased by $7.3 million, or 11.0 percent, primarily due to the decline of credit card chargebacks and communications costs.

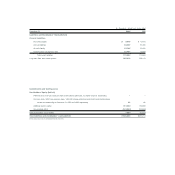

In the fourth quarter of 1999, we decided to accelerate the retirement of our owned DC-9 fleet to accommodate the introduction of the B717 fleet. It was origi-

nally our intent to use the B717s to increase overall capacity while continuing to use the DC-9s into 2005. However, during 1999, the new management team

(including our Chief Executive Officer and President, who joined us in 1999) reevaluated our near- and long-term fleet strategy and the components underlying

such strategy. By October 1999, we determined that it would be cost-beneficial to begin to retire the DC-9s. As a result, we developed a fleet plan which

provided for the retirement of the DC-9s between December 31, 1999, and October 2003, generally coinciding with the delivery of the B717s. Our board

of directors approved the plan in October 1999. In connection with our decision to accelerate the retirement of these aircraft, we performed an evaluation to

determine, in accordance with Statement of Financial Accounting Standards (SFAS) No. 121, whether future cash flows (undiscounted and without interest

charges) expected to result from the use and eventual disposition of these aircraft would be less than the aggregate carrying amount of these aircraft and

related assets. As a result of the evaluation, we determined that the estimated future cash flows expected to be generated by these aircraft would be less

than their carrying amount, and therefore these aircraft are impaired as defined by SFAS No. 121. Consequently, the original cost bases of these assets were

reduced to reflect the fair market value at the date the decision was made, resulting in a $147.7 million impairment charge. We considered recent transactions

and market trends involving similar aircraft in determining the fair market value. See Note 10 to the consolidated financial statements.

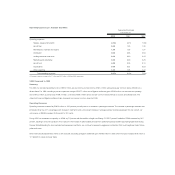

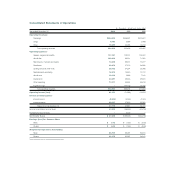

Non-operating Expenses

Interest expense, net of interest income, increased 11.2 percent due to the November 3, 1999, issuance of $178.9 million of EETCs for financing ten B717 air-

craft. See Note 5 to the consolidated financial statements.

Income tax expense was $2.7 million and $0 in 1999 and 1998, respectively. The 1999 tax expense resulted from the utilization of a portion of our $141 million

of net NOL carryforwards, existing at December 31, 1998, offset in part by alternative minimum tax and the application to goodwill of the tax benefit related to

the realization of a portion of the Airways Corporation NOL carryforwards. As of December 31, 1999, we had not recognized any benefit from the use beyond

1999 of NOL carryforwards, because our evaluation of all the available evidence in assessing the realizability of tax benefits of such loss carryforwards indi-

cates that the underlying assumptions of future profitable operations contain risks that do not provide sufficient assurance to recognize such tax benefits cur-

rently. Although we produced operating profits in each quarter in 1999, excluding the impairment charge, we do not believe this and other positive evidence,

including our projection of future profitable operations, offsets the effect of our recent cumulative losses.

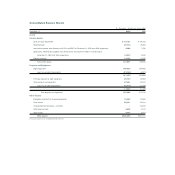

Liquidity and Capital Resources

We rely primarily on operating cash flows to provide working capital. We presently have no lines of credit or short-term borrowing facilities. As of December 31,

2000, our cash and cash equivalents including restricted cash were $103.8 million compared to $76.2 million at December 31, 1999, and our working capital

deficit was $35.1 million compared to $7.3 million at December 31, 1999. We generally must satisfy all of our working capital expenditure requirements from

cash provided by operating activities, from external capital sources or from the sale of assets. Substantial portions of our assets have been pledged to secure

various issues of our outstanding indebtedness. To the extent that the pledged assets are sold, the applicable financing agreements generally require the sales

proceeds to be applied to repay the corresponding indebtedness. To the extent that our access to capital is constrained, we may not be able to make certain

capital expenditures or to continue to implement certain other aspects of our strategic plan, and would potentially be unable to achieve the full benefits

expected therefrom. We expect to continue generating positive working capital through our operations; however, we cannot predict whether current trends

and conditions will continue, or the effects of competition or other factors, such as increased fuel prices, that are beyond our control.