Airtran 2000 Annual Report Download - page 25

Download and view the complete annual report

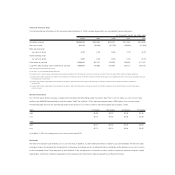

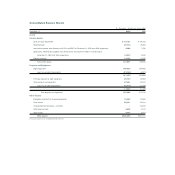

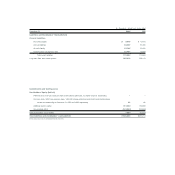

Please find page 25 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.cumulative losses. As a result, income tax expense was $0 and $2.7 million in 2000 and 1999, respectively. The 1999 tax expense resulted from the utilization

of a portion of our $141.0 million of net operating loss (NOL) carryforwards, existing at December 31, 1998, offset in part by alternative minimum tax and the

application to goodwill of the tax benefit related to the realization of a portion of the Airways Corporation NOL carryforwards.

1999 Compared to 1998

Summary

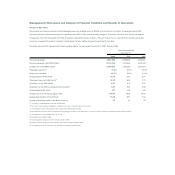

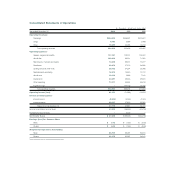

For 1999, including a pre-tax impairment charge of $147.7 million and a litigation settlement gain of $19.6 million, we recorded an operating loss of $72.0 mil-

lion, a pre-tax loss of $96.7 million, a net loss after taxes of $99.4 million and a loss per common share of $1.53 on a basic and diluted basis. The impairment

loss and litigation settlement gain increased our loss per common share by $1.98. For 1998, including a pre-tax impairment charge of $27.5 million, we

recorded an operating loss of $18.6 million, a pre-tax loss and a net loss after taxes of $40.7 million and a loss per common share of $0.63 on a basic

and diluted basis. The impairment loss increased our loss per common share by $0.43.

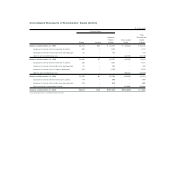

Operating Revenues

Passenger revenues increased by 15.6 percent, or $65.6 million in 1999 compared to 1998. The growth in our passenger revenue stems from increasing traffic

demand in both the business and leisure market segments. Business class loads were up significantly in 1999 compared to 1998. Adjustments in pricing and

inventory strategies also led to gains in leisure traffic. Yield increased by 8.0 percent, from 13.0 cents to 14.0 cents. Unit revenue increased 15.1 percent, from

7.7 cents to 8.9 cents – better improvements than any major airline in the industry.

Traffic, or RPMs, increased 7.1 percent or 229.0 million RPMs on a 0.5 percent increase in capacity, or ASMs. For the year ended December 31, 1999, load

factor increased 3.9 points to 63.5 percent versus 59.6 percent for the year ended December 31, 1998.

Other revenue increased 121.8 percent, or $18.2 million, in 1999 compared to 1998, due to the $19.6 million gain from a litigation settlement.

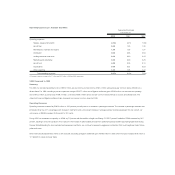

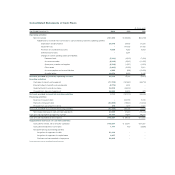

Operating Expenses

Excluding the impairment charges in 1999 and 1998, operating expenses increased $17.4 million or 4.0 percent year-over-year. Our operating cost per ASM,

excluding impairment charges, increased 3.5 percent to 8.19 cents in 1999 from 7.91 cents in 1998.

Salaries, wages and benefits increased 11.3 percent, or $12.3 million, due to a 6.1 percent increase in overall headcount and contractual wage increases for

our union-represented labor groups.

Aircraft fuel expense decreased year-over-year by $3.6 million, or 5.0 percent, due to a 9.0 percent decrease in the average fuel cost per gallon offset by a

4.4 percent increase in fuel consumption.

Maintenance increased 15.8 percent or $11.8 million, due to a volume increase of five check lines as a result of completing our structural life improvement pro-

gram and six additional engine overhauls. The timing of maintenance to be performed is determined by the number of hours an aircraft and engine are flown.

Commissions paid to travel agents increased $2.4 million or 6.9 percent, due to an increase in commissionable sales, offset by a rate reduction from 10.0 per-

cent to 8.0 percent during the second quarter of 1998 and a further reduction to 5.0 percent during the fourth quarter of 1999.

Landing fees and other rents increased $3.6 million compared to the year ended 1998, due to increased departures. We operated 5.1 percent more depar-

tures in 1999 than 1998, at 96,858 and 92,141, respectively.