Airtran 2000 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

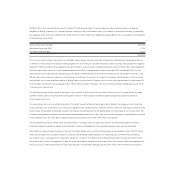

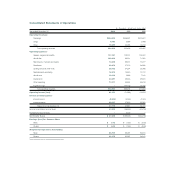

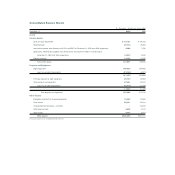

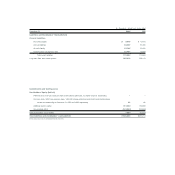

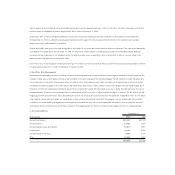

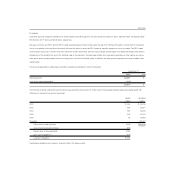

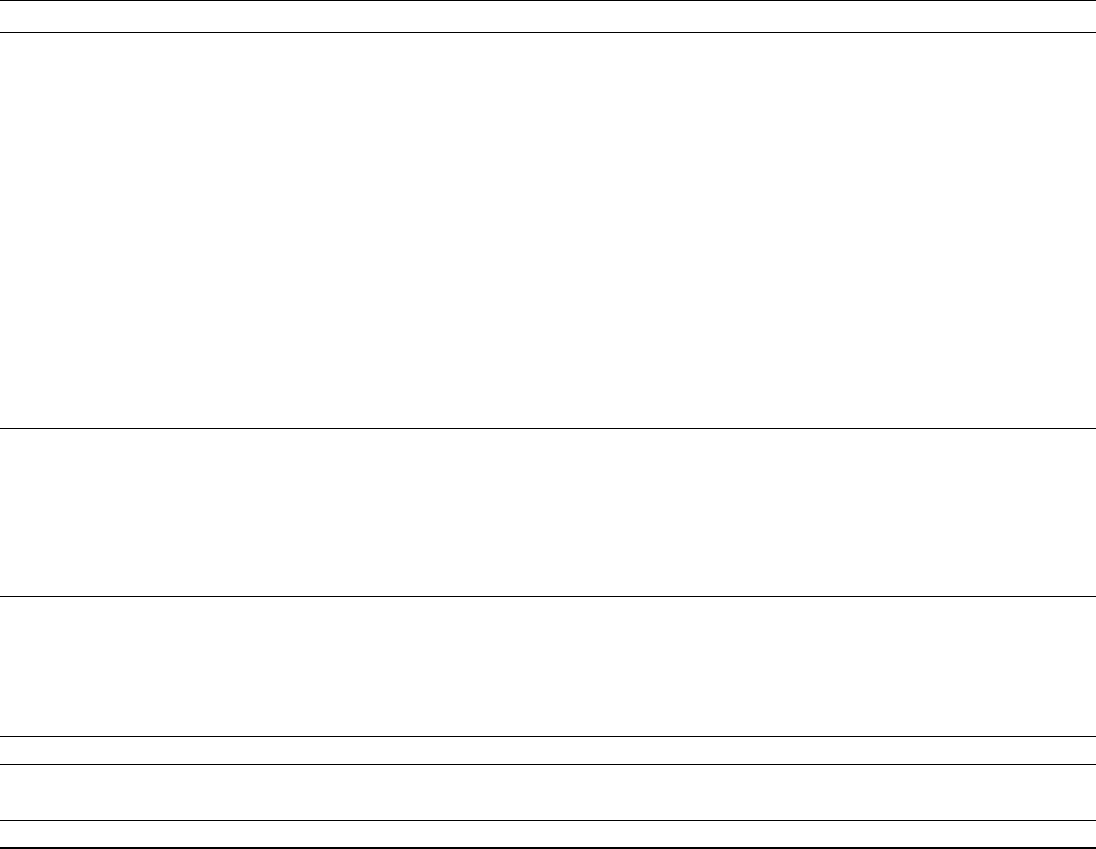

(In thousands)

Year Ended December 31, 2000 1999 1998

Operating activities:

Net income (loss) $ 47,436 $ (99,394) $(40,738)

Adjustments to reconcile net income (loss) to cash provided by (used for) operating activities:

Depreciation and amortization 26,078 30,432 31,525

Impairment loss –147,735 27,492

Provisions for uncollectible accounts 4,626 4,022 8,003

Deferred income taxes –2,387 –

Changes in current operating assets and liabilities:

Restricted cash (7,641) (4,610) (7,494)

Accounts receivable (6,415) (3,837) (11,425)

Spare parts, material and supplies (5,312) (1,657) (1,878)

Other assets (3,943) (5,169) 5,911

Accounts payable and accrued liabilities 4,289 (636) (19,476)

Air traffic liability 10,274 6,469 2,106

Net cash provided by (used for) operating activities 69,392 75,742 (5,974)

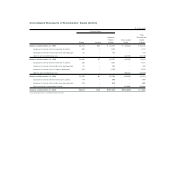

Investing activities:

Purchases of property and equipment (77,709) (187,667) (66,716)

(Payment) refund of aircraft purchase deposits (6,770) 4,374 –

Restricted funds for aircraft purchases 39,232 (39,232) –

Proceeds from disposal of equipment 48,980 24,815 370

Net cash provided by (used for) investing activities 3,733 (197,710) (66,346)

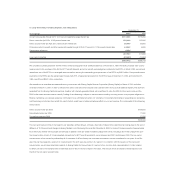

Financing activities:

Issuance of long-term debt –244,756 6,100

Payments of long-term debt (53,555) (76,801) (10,844)

Proceeds from sale of common stock 455 1,233 1,921

Net cash provided by (used for) financing activities (53,100) 169,188 (2,823)

Net increase (decrease) in cash and cash equivalents 20,025 47,220 (75,143)

Cash and cash equivalents at beginning of period 58,102 10,882 86,025

Cash and cash equivalents at end of period $ 78,127 $ 58,102 $ 10,882

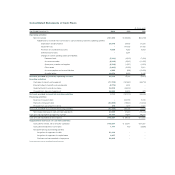

Supplemental disclosure of cash flow activities:

Cash paid for interest, net of amounts capitalized $ 35,607 $ 23,911 $ 21,557

Cash paid (refunded) for income taxes 1,141 420 (9,686)

Noncash financing and investing activities:

Acquisition of equipment for debt 63,144 ––

Acquisition of equipment for capital leases 2,627 ––

Purchase and sale-leaseback of equipment 62,608 ––

See accompanying notes to consolidated financial statements.

Consolidated Statements of Cash Flows