Airtran 2000 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vesting and term of all options is determined by the Board of Directors and may vary by optionee; however, the term may be no longer than ten years from

the date of grant.

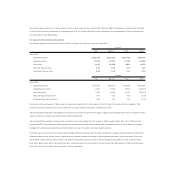

Pro forma information regarding net income (loss) and earnings (loss) per common share is required by SFAS No. 123, which also requires that the information

be determined as if we had accounted for our employee stock options granted subsequent to December 31, 1994, under the fair value method of that state-

ment. The fair value for these options was estimated at the date of grant using a Black-Scholes option pricing model with the following weighted-average

assumptions for 2000, 1999 and 1998, respectively: risk-free interest rates of 6.2 percent, 5.0 percent and 5.4 percent; no dividend yields; volatility factors

of the expected market price of our common stock of 0.596, 0.648 and 0.710; and a weighted average expected life of the options of 5 years.

The Black-Scholes option valuation model was developed for use in estimating the fair value of traded options that have no vesting restrictions and are fully

transferable. In addition, option valuation models require the input of highly subjective assumptions including the expected stock price volatility. Because our

employee stock options have characteristics significantly different from those of traded options, and because changes in the subjective input assumptions

can materially affect the fair value estimate, in management’s opinion, the existing models do not necessarily provide a reliable single measure of the fair value

of its employee stock options.

For purposes of pro forma disclosures, the estimated fair value of the options is amortized to expense over the options’ vesting period.

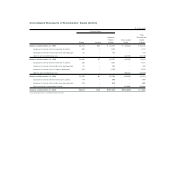

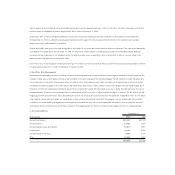

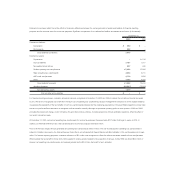

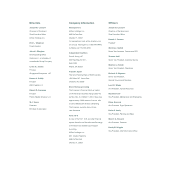

Our pro forma information is as follows (in thousands, except per share data):

2000 1999 1998

Pro forma net income (loss) $45,059 $(102,173) $(42,279)

Pro forma earnings (loss) per common share:

Basic 0.69 (1.57) (0.65)

Diluted 0.65 (1.57) (0.65)

The pro forma net income (loss) and earnings (loss) per common share information presented above reflect stock options granted during 1995 and in later

years, in accordance with SFAS No. 123. Accordingly, the full effect of calculating compensation expense for stock options under SFAS No. 123 is not

reflected in the pro forma net income (loss) and earnings (loss) per common share amounts above, because compensation expense is recognized over the

stock option’s vesting period and compensation expense for stock options granted prior to January 1, 1995, is not considered.