Airtran 1999 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 1999 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

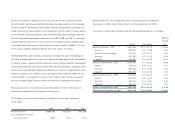

The results of the third quarter of 1999 include net proceeds of $19,640,000 from

the settlement of a lawsuit against a third party maintenance provider.

Year-end adjustments resulted in increasing the loss before income taxes during the

fourth quarter of 1999 by approximately $5,250,000. Of this amount, approximately

$3,160,000 relates to the correction of revenue recorded in earlier quarters during

1999 and approximately $2,090,000 relates to changes in management’s estimates

and assumptions primarily related to accruals for vacation and group health insurance.

At December 31, 1997, the Company had accrued the estimated costs to reactivate

certain aircraft. During the quarter ended June 30, 1998, the reactivation of these

aircraft was completed and the associated costs were finalized. The remaining

maintenance accrual was therefore revised based on this additional information

and $3 million was reversed into income, increasing income for the quarter ended

June 30, 1998, by approximately $0.05 per share on a diluted basis.

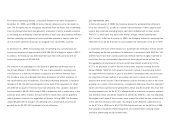

15. Supplemental Guarantor Financial Information

The Company’s $150,000,000 of 10.25% Senior Notes issued during 1996 are

fully and unconditionally guaranteed on a joint and several basis by AirTran Airways,

a wholly-owned subsidiary of the Company, and by AirTran Airways’ subsidiary

(“Guarantors”). The $80,000,000 of 10.50% Senior Secured Notes issued by AirTran

Airlines, now AirTran Airways, during 1997 are fully and unconditionally guaranteed

on a joint and several basis by AirTran Holdings, Inc., and AirTran Airways’ subsidiary.

AirTran Airways and its subsidiary conduct all of the operations of the Company.

All of the subsidiary Guarantors are wholly-owned or indirect subsidiaries of the

Company, and there are no direct or indirect subsidiaries of the Company that

are not Guarantors. Separate financial statements of the subsidiary Guarantors

are not presented because AirTran Holdings, Inc. and all of its subsidiaries guarantee

the Senior Notes and the Senior Secured Notes on a full, unconditional and joint and

several basis.

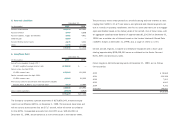

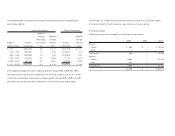

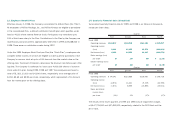

Summarized consolidated financial information as of and for the year ended

December 31, 1999, is as follows (in thousands):

AirTran AirTran

Airways AirTran Holdings, Inc.

and Holdings, and

Subsidiary Inc. Eliminations Subsidiaries

Current assets $103,644 $ — $ — $103,644

Non-current assets 362,355 113,172 (112,157) 363,370

Current liabilities 107,723 3,203 — 110,926

Non-current liabilities 399,322 150,000 (153,203) 396,119

Operating revenues 523,468 — — 523,468

Operating loss (71,988) — — (71,988)

Loss before income

taxes (96,655) — — (96,655)

Net loss (99,394) — — (99,394)

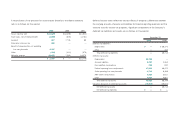

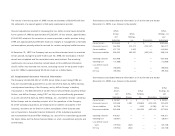

Summarized consolidated financial information as of and for the year ended

December 31, 1998, is as follows (in thousands):

AirTran AirTran

Airlines AirTran Holdings, Inc.

and AirTran Holdings, and

Subsidiary Airways Inc. Eliminations Subsidiaries

Current assets $ 52,957 $ — $ — $ — $ 52,957

Non-current assets 321,646 3,290 208,835 (210,322) 323,449

Current liabilities 83,798 — 3,203 (3,290) 83,711

Non-current liabilities 240,268 — 150,000 (153,203) 237,065

Operating revenues 439,307 — — — 439,307

Operating loss (18,557) — — — (18,557)

Loss before income

taxes (39,922) (816) — — (40,738)

Net loss (39,922) (816) — — (40,738)