Airtran 1999 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 1999 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

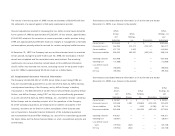

7. Leases

The Company leases seven DC-9s and one B737 under operating leases with terms

that expire in 2003. The Company has the option to renew the DC-9 lease for one

or more periods of not less than six months, with the renewal term to commence

upon the expiration of the original term. The Company also leases facilities from

local airport authorities or other carriers, as well as office space. These leases are

operating leases and have terms from one month to thirteen years.

Total rental expense charged to operations for aircraft, facilities and office space

for the years ended December 31, 1999, 1998 and 1997 was approximately

$21,705,000, $23,851,000 and $13,655,000, respectively.

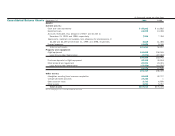

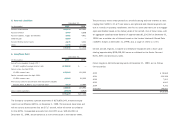

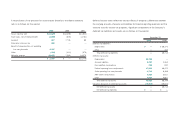

The following schedule outlines the future minimum lease payments at December 31,

1999, under non-cancelable operating leases with initial terms in excess of one

year (in thousands):

2000 $ 18,059

2001 17,208

2002 15,609

2003 15,233

2004 8,700

Thereafter 45,623

$120,432

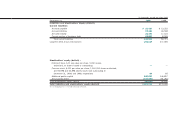

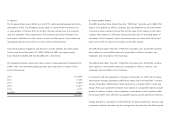

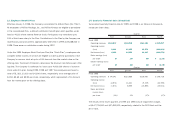

8. Stock Option Plans

The 1993 Incentive Stock Option Plan (the “1993 Plan”) provides up to 4,800,000

options to be granted to officers, directors and key employees to purchase shares

of common stock at prices not less than the fair value of the shares on the dates

of grant. With respect to individuals owning more than 10% of the voting power of

all classes of the Company’s stock, the exercise price per share shall not be less

than 110% of the fair value of the shares on the date of grant.

The 1994 Stock Option Plan (the “1994 Plan”) provides up to 4,000,000 incentive

stock options or non-qualified options to be granted to officers, directors, key

employees and consultants of the Company.

The 1996 Stock Option Plan (the “1996 Plan”) provides up to 5,000,000 incentive

stock options or non-qualified options to be granted to officers, directors, key

employees and consultants of the Company.

In connection with the acquisition of Airways on November 17, 1997, the Company

assumed the Airways Corporation 1995 Stock Option Plan (“Airways Plan”) and the

Airways Corporation 1995 Director Stock Option Plan (“Airways DSOP”). Under the

Airways Plan up to 1,150,000 incentive stock options or non-qualified options may be

granted to officers, directors, key employees or consultants of the Company. Under

the Airways DSOP, up to 150,000 non-qualified options may be granted to Directors.

Vesting and term of all options is determined by the Board of Directors and may vary

by optionee; however, the term may be no longer than ten years from the date of grant.