Airtran 1999 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1999 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business Strategy

Even though we currently have no plans to do so, we may change our business strategy

in the future and may not pursue some of the goals and initiatives stated herein.

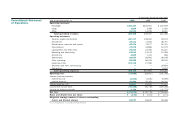

Quantitative and Qualitative Disclosures about Market Risk

Market Risk Sensitive Instruments and Positions

We are subject to certain market risks including interest rates and commodity prices

(i.e., aircraft fuel). The adverse effects of changes in these markets pose a potential

loss as discussed below. The sensitivity analyses do not consider the effects that

such adverse changes may have on overall economic activity nor do they consider

additional actions we may take to mitigate our exposure to such changes. Actual

results may differ. See the notes to the consolidated financial statements for a

description of our Company’s financial policies and additional information.

Interest Rates

As of December 31, 1999, and 1998, the fair value of our long-term debt was

estimated to be $392.3 million, and $175.3 million, respectively, based upon

discounted future cash flows using current incremental borrowing rates for similar

types of instruments or market prices. Market risk, estimated as the potential

increase in fair value resulting from a hypothetical one percent decrease in interest

rates, was approximately $8.0 million as of December 31, 1999, and approximately

$4.2 million as of December 31, 1998.

Aircraft Fuel

Our results of operations are impacted by changes in the price of aircraft fuel.

Excluding the impairment charge, aircraft fuel accounted for 15.3% and 16.7% of

our operating expenses in 1999, and 1998, respectively. Based on our 2000 pro-

jected fuel consumption, a 10% increase in the average price per gallon of aircraft

fuel as of December 31, 1999, would increase the fuel expense for the next twelve

months by approximately $10.8 million, net of hedging instruments outstanding at

December 31, 1999. Comparatively, based on 1999 fuel usage, a 10% increase

in fuel prices would have resulted in an increase in fuel expense of approximately

$2.8 million, net of hedging instruments utilized during 1999. The increase in

market risk is primarily due to our fuel hedging contracts covering significantly more

fuel requirements in 1999 than in 2000. In 1999, we entered into fixed rate swap

contracts and jet fuel purchase commitments in order to manage the price risk and

utilization of fuel cost. At December 31, 1999, we had hedged approximately 11%

of our projected fuel requirements for the first six months of 2000.