Airtran 1999 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 1999 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

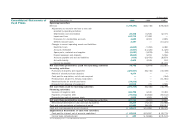

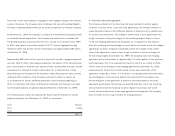

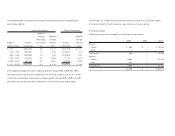

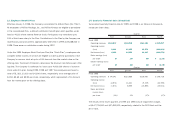

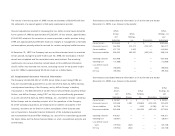

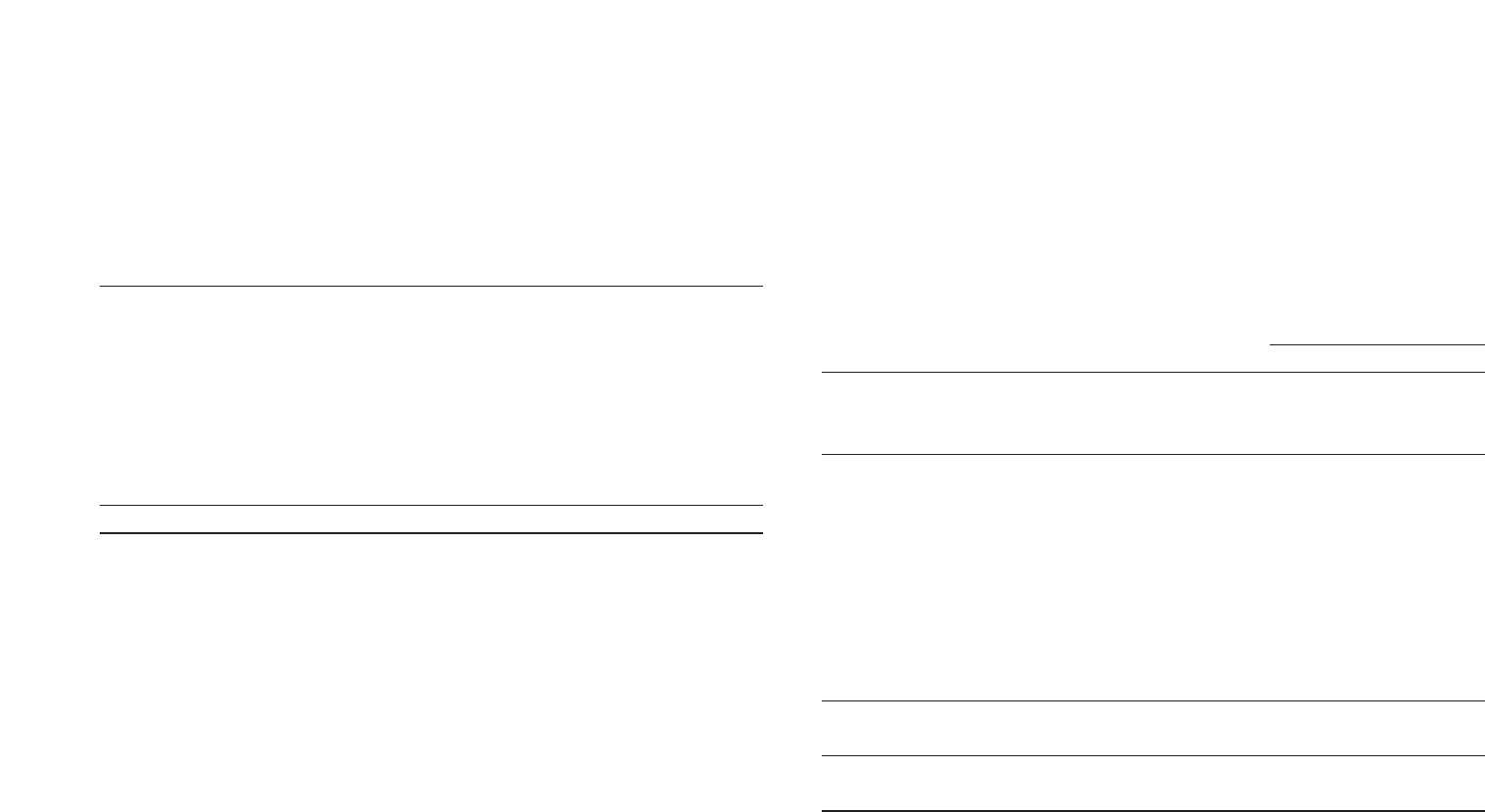

A reconciliation of the provision for income taxes (benefit) to the federal statutory

rate is as follows (in thousands):

1999 1998 1997

Tax at statutory rate $(33,829) $(14,258) $(41,803)

State taxes, net of federal benefit (3,089) (606) (4,761)

Goodwill 517 7,705 89

Alternative minimum tax 909 ——

Benefit of preacquisition net operating

loss carryforwards 2,387 ——

Other (434) (110) (570)

Valuation reserve 36,278 7,269 24,270

$ 2,739 $ — $(22,775)

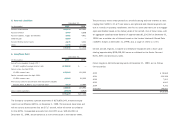

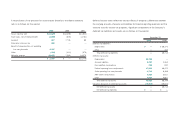

Deferred income taxes reflect the net tax effects of temporary differences between

the carrying amounts of assets and liabilities for financial reporting purposes and the

amounts used for income tax purposes. Significant components of the Company’s

deferred tax liabilities and assets are as follows (in thousands):

December 31,

1999 1998

Deferred tax liabilities:

Depreciation $— $ 28,370

Other —342

Total deferred tax liabilities —28,712

Deferred tax assets:

Depreciation 21,740 —

Accrued liabilities 1,011 2,362

Non qualified stock options 930 930

Federal operating loss carryforwards 37,938 49,470

State operating loss carryforwards 6,741 8,158

AMT credit carryforwards 3,526 2,617

Other 4,024 4,807

Total deferred tax assets 75,910 68,344

Valuation allowance for deferred tax assets (75,910) (39,632)

Net deferred tax assets —28,712

Net deferred tax liabilities $— $—