Airtran 1999 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 1999 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

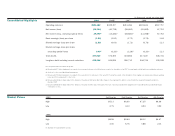

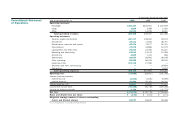

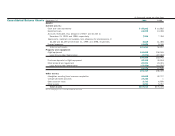

Non-operating Expenses

Interest expense, net of interest income, increased 11.2% due to the November 3,

1999, issuance of the $178.9 million in debt for financing ten B717 aircraft. See

Note 5 to the consolidated financial statements.

Income tax expense was $2.7 million and $0 in 1999, and 1998, respectively.

The 1999 tax expense results from the utilization of a portion of our $141 million

of net operating loss (“NOL”) carryforwards, existing at December 31, 1998, offset

in part by alternative minimum tax and the application to goodwill of the tax benefit

related to the realization of a portion of the Airways Corporation NOL carryforwards.

We have not recognized any benefit from the use beyond 1999 of NOL carryforwards

because our evaluation of all the available evidence in assessing the realizability of

tax benefits of such loss carryforwards indicates that the underlying assumptions of

future profitable operations contain risks that do not provide sufficient assurance

to recognize such tax benefits currently.

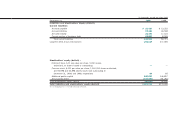

1998 Compared to 1997

Summary

Our results of operations for 1997 are not reflective of results to be expected

in future periods. This comes as a result of reduced service levels during the year

of 1997, incremental costs incurred to reinitiate service to certain markets and

to reactivate aircraft taken out of service, and the merger of Airways Corporation

into our Company in November 1997. Our financial results include the operations of

Airways Corporation only from and after November 17, 1997, the date of the Merger.

We recorded a net loss of $40.7 million and $96.7 million for the years ended

December 31, 1998, and 1997, respectively. Excluding the impairment charge of

$27.5 million, we recorded a net loss of $13.2 million, or 20 cents per share in

1998 versus a net loss of $66.6 million, excluding a charge of $30.1 million related

to rebranding and shutdown costs, or $1.19 per share, in 1997.

Excluding the special items previously mentioned, our operating income increased

$80.6 million, from an operating loss of $71.7 million in 1997 to operating income

of $8.9 million in 1998. Our operating margin in 1998 was 2.0% versus an operating

margin deficit of 33.9% in 1997.

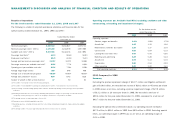

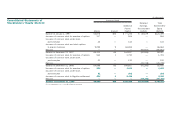

Operating Revenues

Passenger revenues in 1998 were $420.9 million as compared to $200.9 million

for the year ending December 31, 1997. The 109.5% increase is principally due

to the 81.8% increase in revenue passengers enplaned and a 103.1% increase

in revenue passenger miles. Our yield (the average amount that a passenger pays

to fly one mile) increased 3.2%, year over year, from 12.6 cents to 13.0 cents.

Our RPMs increased 103.1%, or 1.6 billion, on an 80.3% increase in ASMs.

For the year ended December 31, 1998, load factor increased 6.7 points to 59.6%

versus 52.9% for the twelve months ended December 31, 1997.

Cargo revenue increased 55.0%, from $2.3 million in 1997 to $3.5 million in 1998

due to the 80.3% increase in capacity.

Other revenues increased 80.5%, or $6.7 million, in 1998 compared to 1997 due to

the 81.8% increase in revenue passengers enplaned.

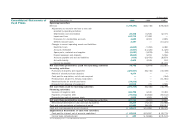

Operating Expenses

Excluding the impairment charge in 1998 and rebranding and shutdown and other

nonrecurring charges in 1997, operating expenses increased $147.2 million or 52.0%.

Our operating cost per ASM decreased 15.7% to 7.91 cents from 9.38 cents in

1997. Labor costs increased from $54.1 million in 1997 to $108.5 million in 1998

primarily due to contractual wage increases for our union-represented labor groups

and the acquisition of Airways Corporation on November 17, 1997. Aircraft

fuel increased 47.4% primarily due to the increase in consumption related to