Airtran 1999 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 1999 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

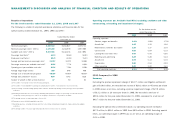

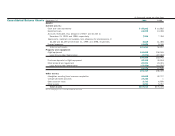

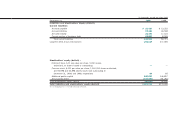

Non-operating Expenses

Interest expense, net, increased $4.5 million primarily due to the decrease in interest

income earned from excess cash as a result of cash and cash equivalents decreasing

from $86.0 million at December 31, 1997, to $10.9 million at December 31, 1998.

We have not recognized any benefit from the future use of operating loss

carryforwards because our evaluation of all the available evidence in assessing

the realizability of the tax benefits of such loss carryforwards indicates that the

underlying assumptions of future profitable operations contain risks that do not

provide sufficient assurance to recognize such tax benefits currently. Our income

tax benefit was $0 and $22.8 million in 1998 and 1997, respectively. The benefit

recorded in 1997 was the result of operating loss carryback claims.

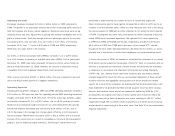

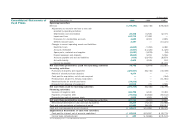

Outlook for 2000

During 1999, we celebrated many accomplishments on our return to profitability. The

accomplishments include, but are not limited to:

• Four quarters of profitability (exclusive of impairment loss in fourth quarter and

litigation settlement gain)

• Significant improvement in cash balance

• Introduction and delivery of eight B717 aircraft

• Awarded 75% of Department of Defense contract awards on which we bid —

estimated to be worth nearly $9.0 million per year

• Significant Revenue per ASM growth compared to the industry

We expect 2000 to be another good year for our airline. We will benefit from the

travel agent commission reduction from 8% to 5%, reduced maintenance costs per

block hour and reduced depreciation expense as a result of the impairment charge.

We are exposed to high jet fuel prices without the benefit of a significant hedge.

Higher interest expense is also a risk we will face in 2000. We are incurring higher

interest expense due to aircraft financing. In addition, there can be no assurance

that attractive financing will be available when we seek to refinance our $230.0 mil-

lion of debt due in April 2001.

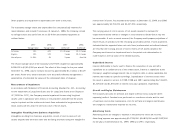

Year 2000

In prior years, we discussed the nature and progress of our plans to become Year

2000 ready. In late 1999, we completed our remediation and testing of systems. As

a result of those planning and implementation efforts, we experienced no significant

disruptions in mission critical information technology and non-information technology

systems and believe those systems successfully responded to the Year 2000 date

change. We expensed approximately $800,000 during 1999 in connection with

remediating our systems. We are not aware of any material problems resulting from

Year 2000 issues, either with our internal systems or the products and services of

third parties. We will continue to monitor our mission critical computer applications

and those of our suppliers and vendors throughout the year 2000 to ensure that

any latent Year 2000 matters that may arise are addressed promptly.

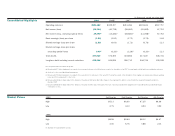

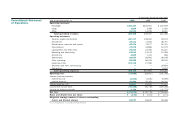

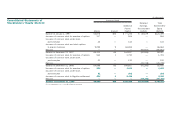

Liquidity and Capital Resources

We rely primarily on operating cash flows to provide working capital. We have

no lines of credit or other facilities. As of December 31, 1999, we had cash and

cash equivalents of $58.1 million compared to $10.9 million at December 31, 1998,

and working capital deficit of $7.3 million compared to a working capital deficit of

$30.8 million at December 31, 1999, and 1998, respectively. We generally must

satisfy all of our working capital expenditure requirements from cash provided

by operating activities, from external capital sources or from the sale of assets.

Substantial portions of our assets have been pledged to secure various issues

of our outstanding indebtedness. To the extent that the pledged assets are sold,

the applicable financing agreements generally require the sales proceeds to be

applied to repay the corresponding indebtedness. To the extent that our access to