Airtran 1999 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 1999 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

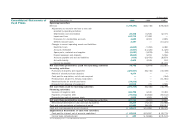

excess of cost over the fair value of the net assets acquired has been recorded

as goodwill and is being amortized on a straight-line basis over 30 years.

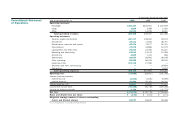

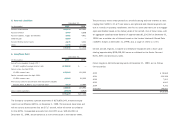

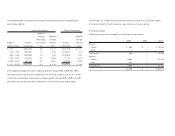

The non-cash investing activity for the acquisition is as follows:

Fair value of assets acquired $ 45,709

Intangibles resulting from business acquisitions 58,029

Liabilities assumed (36,710)

Fair value of common stock and options issued (66,664)

Net cash paid for acquisition $ 364

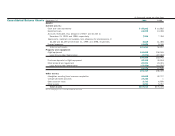

The following data represents the combined unaudited operating results of the

Company on a pro forma basis as if the acquisition of Airways had occurred at the

beginning of the period presented. The pro forma information does not necessarily

reflect the results of operations as they would have been had the acquisition actually

taken place at that time, nor are they indicative of the results of future combined

operations. Adjustments include amounts of depreciation to reflect the fair market

value and economic lives of property and equipment and amortization of intangible

assets. In addition, adjustments were made to reflect the additional shares issued.

Unaudited Pro Forma

Year Ended December 31,

(In thousands, except per share data) 1997

Total operating revenues $ 303,669

Net loss (107,017)

Net loss per share:

basic and diluted (1.67)

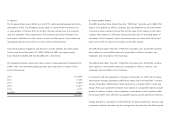

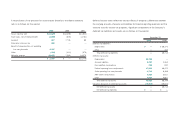

3. Commitments and Contingencies

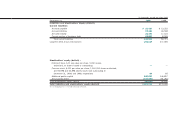

Of the numerous lawsuits that were filed against the Company seeking damages

attributable to those on Flight 592, there are two remaining cases proceeding in

state courts in Florida and Texas. As all claims are handled independently by the

Company’s insurance carrier, the Company cannot reasonably estimate the amount

of liability that may finally exist. As a result, no accruals for losses and the related

claim for recovery from the Company’s insurance carrier have been reflected in

the Company’s financial statements. The Company believes that the $750 million

coverage available with respect to these claims will be sufficient to cover all claims

arising from the accident. However, there can be no assurance that the total amount

of judgments and settlements will not exceed the amount of insurance available

therefor or that all damages awarded will be covered by insurance.

In November 1997, the Company filed a suit against SabreTech and its parent

corporation seeking to hold them responsible for the accident involving Flight 592.

On September 23, 1999, the Company settled its lawsuit against SabreTech and its

parent. The net proceeds of $19,640,000 from the settlement are included in other

revenue in the 1999 statement of operations.

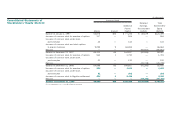

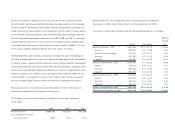

Several stockholder class action suits were filed against the Company and certain of

its current and former executive officers and Directors. The suits were subsequently

consolidated into a single action. On December 31, 1998, the Company entered into

a Memorandum of Understanding to settle the consolidated lawsuit. Although the

Company denied that it violated any of its obligations under the federal securities

laws, it paid $2.5 million in cash and $2.5 million in common stock in the settlement

which was approved on October 28, 1999.