Airtran 1999 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 1999 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

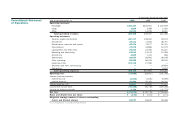

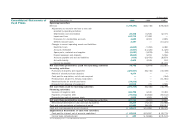

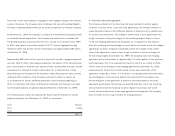

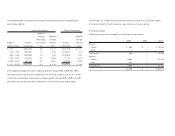

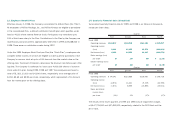

5. Accrued Liabilities

December 31,

(In thousands) 1999 1998

Accrued maintenance $24,278 $15,541

Accrued interest 9,447 5,508

Accrued salaries, wages and benefits 8,961 4,931

Deferred gain 6,300 —

Accrued federal excise taxes 2,176 3,042

Other 6,294 15,486

$57,456 $44,508

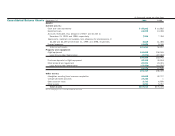

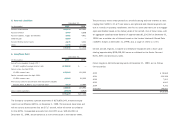

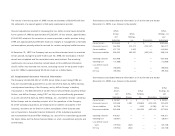

6. Long-Term Debt

December 31,

(In thousands) 1999 1998

Aircraft notes payable through 2017,

10.63% weighted average interest rate $178,850 $—

Senior notes due April 2001,

10.25% interest rate 150,000 150,000

Senior secured notes due April 2001,

10.50% interest rate 80,000 80,000

Promissory notes for aircraft and other equipment payable

through 2002, 5.85% to 11.7% interest rates 6,838 15,994

415,688 245,994

Less current maturities (19,569) (8,929)

$396,119 $237,065

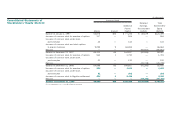

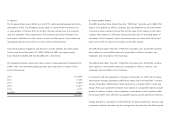

The Company completed a private placement of $178,850,000, enhanced equip-

ment trust certificates (EETCs) on November 3, 1999. The proceeds have been and

will be used to purchase the first ten B717 aircraft, which will serve as collateral

for the EETCs. Unexpended proceeds from the EETC issue, $39,232,000 at

December 31, 1999, are presented as a non-current asset in the balance sheet.

The promissory notes relate primarily to aircraft financing and bear interest at rates

ranging from 5.85% to 11.67% per annum, and principal and interest payments are

due in monthly or quarterly installments over four to seven year terms on a mortgage-

style amortization based on the delivery date of the aircraft. One of these notes, with

an aggregate unpaid principal balance of approximately $1,200,000 at December 31,

1999, has a variable rate of interest based on the London Interbank Offered Rate

(“LIBOR”) (5.82% at December 31, 1999), plus a range of 1.50% to 3.73%.

Certain aircraft, engines, computer and telephone equipment with a book value

totaling approximately $218,028,000 serve as collateral on the Senior Secured

Notes, EETC and promissory notes.

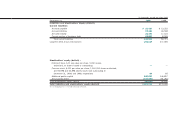

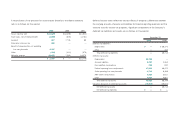

Future long-term debt principal payments at December 31, 1999, are as follows

(in thousands):

2000 $ 19,569

2001 232,158

2002 7,523

2003 4,643

2004 6,142

Thereafter 145,653

$415,688