Airtran 1999 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 1999 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

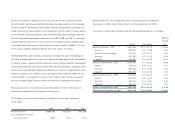

From time to time, the Company is engaged in other litigation arising in the ordinary

course of business. The Company does not believe that any such pending litigation

will have a materially adverse effect on its results of operations or financial condition.

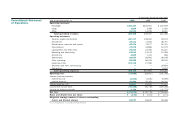

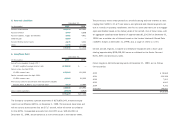

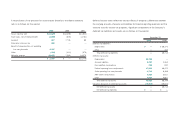

At December 31, 1999, the Company’s contractual commitments consisted primarily

of scheduled aircraft acquisitions. The Company has entered into a contract with

The Boeing Company to purchase 50 new B717 aircraft, to be delivered from 1999

to 2002, with options to purchase another 50 B717 aircraft. Aggregate funding

needed for these and all other aircraft commitments was approximately $780 million

at December 31, 1999.

Approximately $86 million of this amount is required to be paid in progress payments

due from 2000 to 2001. After progress payments, the balance of the total purchase

price must be paid or financed upon delivery of each aircraft. While the major aircraft

manufacturer is required to provide credit support for a limited portion of third

party financing, the Company will be required to obtain financing from other sources

relating to these deliveries. If the Company exercises its option to acquire up

to an additional 50 aircraft, additional payments could be required beginning in

2001. In conjunction with these contractual commitments, the Company has made

non-refundable deposits of approximately $22,562,000 at December 31, 1999.

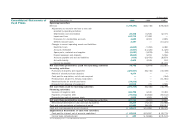

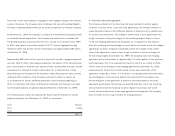

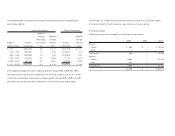

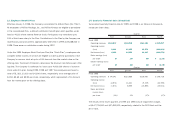

The following chart outlines the approximate future required deposits for aircraft

progress payments as of December 31, 1999, (in thousands):

2000 $56,211

2001 29,565

2002 —

$85,776

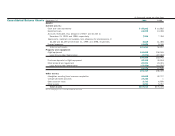

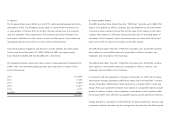

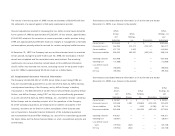

4. Fuel Price Risk Management

The Company entered into two fixed rate fuel swap contracts to protect against

increases in jet fuel prices. Under the swap agreements, the Company receives or

makes payments based on the difference between a fixed price and a variable price

for certain fuel commodities. The change in market value of such agreements has

a high correlation to the price changes of the fuel being hedged. Gains or losses

on the fuel hedging agreements are recognized as a component of fuel expense

when the underlying fuel being hedged is used. Gains and losses on the fuel hedging

agreements would be recognized immediately should the changes in the market

value of the agreements cease to have a high correlation to the price changes of

the fuel being hedged. At December 31, 1999, the Company had a fuel hedging

agreement with a broker-dealer on approximately 7.2 million gallons of fuel products,

which represents 11% of its expected fuel needs for the first six months of 2000.

The fair value of the Company’s fuel hedging agreement at December 31, 1999,

representing the amount the Company would receive upon termination of the

agreement, totaled $1.1 million. If in the future, a swap agreement were terminated,

any resulting gain or loss would be deferred and amortized to fuel expense over

the remaining life of the agreement. A default by the broker-dealer to the swap

agreement would expose the Company to potential fuel price risk on the remaining

fuel purchases in that the Company would be required to purchase fuel at the

current fuel price rather than at the swap agreement exchange rate. The Company

does not enter into fuel swap contracts for trading purposes.