Airtran 1999 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1999 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

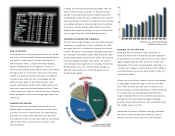

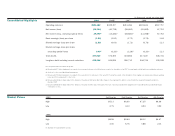

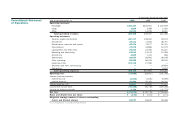

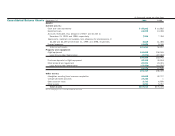

(In thousands, except per share data)

1999 1998(b) 1997 1996 1995

Operating revenues $523,468 $439,307 $211,456 $219,636 $367,757

Net income (loss) (99,394) (40,738) (96,663) (41,469) 67,763

Net income (loss), excluding special items 29,094(a) (13,246)(c) (66,581)(d) (11,098)(e) 67,763

Basic earnings (loss) per share (1.53) (0.63) (1.72) (0.76) 1.24

Diluted earnings (loss) per share (1.53) (0.63) (1.72) (0.76) 1.13

Diluted earnings (loss) per share,

excluding special items 0.45(a) (0.20)(c) (1.19)(d) (0.20)(e) 1.13

Total assets 467,014 376,406 433,864 417,187 346,741

Long-term debt including current maturities 415,688 245,994 250,712 244,706 109,038

Note: All special items listed below are pre-tax.

(a) Excludes a $147.7 million impairment loss related to the accelerated retirement of the DC-9 fleet as a result of the introduction of the B717 fleet and a gain of $19.6 million from a litigation settlement.

(b) See Note 1 to the consolidated financial statements.

(c) Excludes a $27.5 million impairment loss related to the acceleration of the retirement of four owned B737 aircraft as a result of the elimination of their original route system and continued operating

losses upon their redeployment to other routes.

(d) Excludes a $24.8 million charge related to the shutdown of the airline in 1996 and a $5.2 million charge for the renaming of the airline in connection with the merger with Airways Corporation in

November 1997.

(e) Excludes a $68.0 million charge related to the shutdown of the airline in 1996, a $3.9 million gain on the sale of proper ty, a $13.0 million arrangement fee for aircraft transfer and a $2.8 million gain

on insurance recovery.

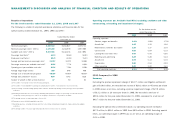

1999 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

High $5.13 $6.00 $7.25 $6.06

Low 2.75 4.13 4.94 3.50

1998

High $8.06 $9.44 $8.12 $4.47

Low 3.00 6.75 3.88 2.13

No dividends were paid during the periods.

Consolidated Highlights

Market Prices