Aflac 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

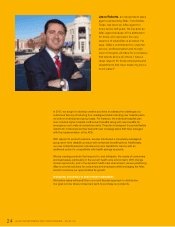

Jay Wink, a health care consultant with a

specialty in voluntary benefits at Trion Group, a

Marsh & McLennan Agency LLC in Greensboro,

North Carolina, works closely with Aflac to help

tailor products help fill the gaps in their clients’

core benefit packages. About his firm’s choice

to oer Aflac insurance, he says, “Aflac’s brand

provides credibility with the employees, which

improves interest and acceptance. What has

been most valuable to us is on site enrollment

support. Aflac has worked with our clients

to create a coordinated enrollment eort,

communicating Aflac products, the client’s core

benefits package and electronic enrollment

tools. This additional communication support is

what our clients have valued the most. I can’t

leave out the written marketing material and

the microsite, the material is clever, built upon

the Aflac Duck!”

We are creating products

that respond to, and

anticipate, the needs

of consumers and

businesses, particularly

in the current health

care environment.

In this endeavor, we are continually working to enhance our sales

capabilities, both through our traditional sales force and brokers who

operate in local, regional and national markets. At the end of 2013, our

extensive distribution network was made up of more than 76,300 licensed

sales associates and brokers who sell our products.

In 2013, we initiated a pilot for a proprietary exchange in three states as a

means to help solidify our leading position with small businesses that are our

core market and provide them with access to richer medical benefit options.

Following our assessment of the pilot program, which runs through early

2014, we will determine the best course of action for rolling out our exchange

through the rest of the United States. We believe this proprietary exchange will

prove beneficial to our career sales agents and small business owners alike.

Additionally, we are continuing to work with brokers on a local, regional and

national basis to give us better access to the larger-case market. And as

we work at enhancing relationships with larger brokers, we will also pursue

opportunities to have our products on their private exchanges.

As consumers’ preferences change with respect to how and where they

want to buy insurance, we will enhance our distribution opportunities to

maintain our leadership position and provide more solutions to help protect

consumers from the financial strain of medical health events.

AFLAC INCORPORATED 2013 YEAR IN REVIEW – AFLAC U.S. 25