Xcel Energy 2008 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

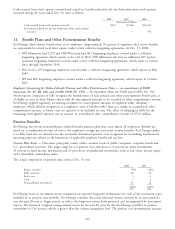

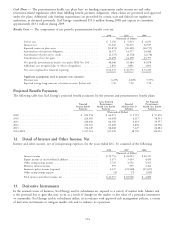

The following table presents the changes in Level 3 recurring fair value measurements for the year ended Dec. 31,

2008:

Commodity Nuclear

Derivatives, Decommissioning

Net Fund

(Thousands of Dollars)

Balance Jan. 1, 2008 ........................................ $19,466 $108,656

Purchases, issuances, and settlements, net .......................... (5,981) 12,198

Transfers out of Level 3 ..................................... (3,962) —

Gains recognized in earnings .................................. 2,129 —

Gains (losses) recognized as regulatory assets and liabilities ............... 11,569 (11,431)

Balance Dec. 31, 2008 ....................................... $23,221 $109,423

Gains on Level 3 commodity derivatives recognized in earnings for the year ended Dec. 31, 2008, include $3.7 million

of net unrealized gains relating to commodity derivatives held at Dec. 31, 2008. Realized and unrealized gains and

losses on commodity trading activities are included in electric revenues. Realized and unrealized gains and losses on

short-term wholesale activities reflect the impact of regulatory recovery and are deferred as regulatory assets and

liabilities. Realized and unrealized gains and losses on nuclear decommissioning fund investments are deferred as a

component of a nuclear decommissioning regulatory asset.

16. Rate Matters

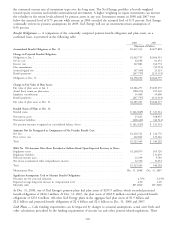

NSP-Minnesota

Pending and Recently Concluded Regulatory Proceedings — MPUC

Base Rate

NSP-Minnesota Electric Rate Case — On Nov. 3, 2008, NSP-Minnesota filed a request with the MPUC to increase

Minnesota electric rates by $156 million annually, or 6.05 percent. The request is based on a 2009 forecast test year, an

electric rate base of $4.1 billion, a requested ROE of 11.0 percent and an equity ratio of 52.5 percent.

In December 2008, the MPUC approved an interim rate increase of $132 million, or 5.12 percent, effective Jan. 2,

2009. The primary difference between interim rate levels approved and NSP-Minnesota’s request of $156 million is due

to a previously authorized ROE of 10.54 percent and NSP-Minnesota’s requested ROE of 11.0 percent.

A final decision from the MPUC is expected in the third quarter of 2009. The following procedural schedule has been

established:

• Staff and intervenor direct testimony on April 7, 2009;

• NSP-Minnesota rebuttal testimony on May 5, 2009;

• Staff and intervenor surrebuttal testimony on May 26, 2009; and

• Evidentiary hearings are scheduled for June 2-9, 2009.

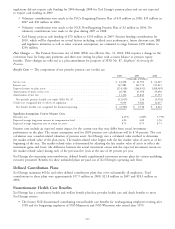

Electric, Purchased Gas and Resource Adjustment Clauses

TCR Rider — In November 2006, the MPUC approved a TCR rider pursuant to legislation, which allows annual

adjustments to retail electric rates to provide recovery of incremental transmission investments between rate cases. In

December 2007, NSP-Minnesota filed adjustments to the TCR rate factors and implemented a rider to recover

$18.5 million beginning Jan. 1, 2008. In March 2008, the MPUC approved the 2008 rider, but required certain

procedural changes for future TCR filings if costs are disputed. On Oct. 30, 2008, NSP-Minnesota submitted its

proposed TCR rate factors for proposed recovery in 2009, seeking to recover $14 million beginning Jan. 1, 2009. A

portion of amounts previously collected through the TCR rider prior to 2009 has been included for recovery in the

electric rate case described above. MPUC approval is pending.

RES Rider — In March 2008, the MPUC approved an RES rider to recover the costs for utility-owned projects

implemented in compliance with the RES, and the RES rider was implemented on April 1, 2008. Under the rider,

NSP-Minnesota could recover up to approximately $14.5 million in 2008 attributable to the Grand Meadow wind

farm, a 100 MW wind project, subject to true-up. In 2008, NSP-Minnesota submitted the RES rider for recovery of

approximately $22 million in 2009 attributable to the Grand Meadow wind farm. On Feb. 12, 2009, the MPUC

119