Xcel Energy 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

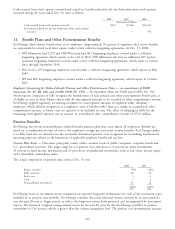

(d) Failure of Xcel Energy or one of its subsidiaries to perform under the agreement that is the subject of the relevant bond. In addition, per the indemnity agreement between

Xcel Energy and the various surety companies, the surety companies have the discretion to demand that collateral be posted.

(e) The debtor becomes the subject of bankruptcy or other insolvency proceedings.

(f) Xcel Energy agreed to indemnify an insurance company in connection with surety bonds they may issue or have issued for Utility Engineering up to $80 million. The Xcel

Energy indemnification will be triggered only in the event that Utility Engineering has failed to meet its obligations to the surety company.

(g) See Note 17 to the consolidated financial statements for further discussion of Fru-Con Construction Corporation vs. Utility Engineering et al.

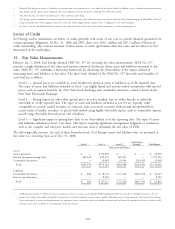

Letters of Credit

Xcel Energy and its subsidiaries use letters of credit, generally with terms of one year, to provide financial guarantees for

certain operating obligations. At Dec. 31, 2008 and 2007, there were $24.1 million and $20.1 million of letters of

credit outstanding. The contract amounts of these letters of credit approximate their fair value and are subject to fees

determined in the marketplace.

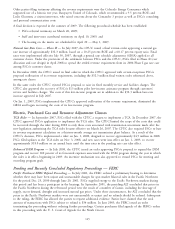

15. Fair Value Measurements

Effective Jan. 1, 2008, Xcel Energy adopted SFAS No. 157 for recurring fair value measurements. SFAS No. 157

provides a single definition of fair value and requires enhanced disclosures about assets and liabilities measured at fair

value. SFAS No. 157 establishes a hierarchal framework for disclosing the observability of the inputs utilized in

measuring assets and liabilities at fair value. The three levels defined by the SFAS No. 157 hierarchy and examples of

each level are as follows:

Level 1 — Quoted prices are available in active markets for identical assets or liabilities as of the reported date.

The types of assets and liabilities included in Level 1 are highly liquid and actively traded instruments with quoted

prices, such as equities listed by the New York Stock Exchange and commodity derivative contracts listed on the

New York Mercantile Exchange.

Level 2 — Pricing inputs are other than quoted prices in active markets, but are either directly or indirectly

observable as of the reported date. The types of assets and liabilities included in Level 2 are typically either

comparable to actively traded securities or contracts, such as treasury securities with pricing interpolated from

recent trades of similar securities, or priced with models using highly observable inputs, such as commodity options

priced using observable forward prices and volatilities.

Level 3 — Significant inputs to pricing have little or no observability as of the reporting date. The types of assets

and liabilities included in Level 3 are those with inputs requiring significant management judgment or estimation,

such as the complex and subjective models and forecasts used to determine the fair value of FTRs.

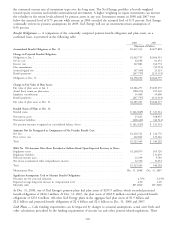

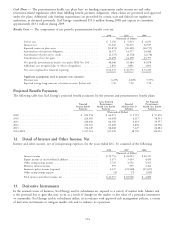

The following table presents, for each of these hierarchy levels, Xcel Energy’s assets and liabilities that are measured at

fair value on a recurring basis as of Dec. 31, 2008:

Counterparty

Level 1 Level 2 Level 3 Netting(a) Net Balance

(Thousands of Dollars)

Assets:

Cash equivalents ......................... $ — $ 50,000 $ — $ — $ 50,000

Nuclear decommissioning fund ................ 465,936 499,935 109,423 — 1,075,294

Commodity derivatives ..................... — 29,648 39,565 (16,245) 52,968

Total ............................... $465,936 $579,583 $148,988 $(16,245) $1,178,262

Liabilities:

Commodity derivatives ..................... $ 600 $78,714 $ 16,344 $(41,351) $ 54,307

Interest rate derivatives ..................... — 8,503 — — 8,503

Total ............................... $ 600 $ 87,217 $ 16,344 $(41,351) $ 62,810

(a) FASB Interpretation No. 39 Offsetting of Amounts Relating to Certain Contracts, as amended by FASB Staff Position FIN 39-1 Amendment of FASB Interpretation No. 39,

permits the netting of receivables and payables for derivatives and related collateral amounts when a legally enforceable master netting agreement exists between Xcel Energy

and a counterparty. A master netting agreement is an agreement between two parties who have multiple contracts with each other that provides for the net settlement of all

contracts in the event of default on or termination of any one contract.

118