Xcel Energy 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

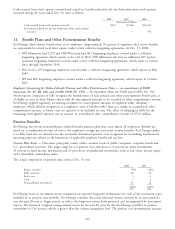

In January 2004, Xcel Energy granted 323,548 performance share awards under the Xcel Energy Omnibus Incentive

Plan. The grant-date market price used to calculate the TSR for this grant was $17.03. The 2004 performance share

awards met the TSR requirements as of Dec. 31, 2006 and were settled in cash and shares of common stock in

February 2007.

In January 2005, Xcel Energy granted 323,889 performance share awards under the Xcel Energy Omnibus Incentive

Plan, which had a grant date fair value of $18.10. These performance share awards met the TSR requirements as of

Dec. 31, 2007 and were settled in cash and shares of common stock in February 2008.

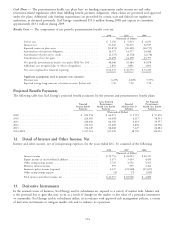

The PSP awards granted for the years ended Dec. 31 were as follows:

2008 2007 2006

(Awards in thousands)

Share awards granted ............................... 216 231 262

Vesting period (in years) ............................333

The 2006, 2007 and 2008 awards were granted under the Xcel Energy 2005 Omnibus Incentive Plan.

The total settlement amounts of performance awards settled during the years ended Dec. 31 were as follows:

2008 2007 2006

(In Thousands)

Share awards settled ............................... 328 395 1,139

Settlement amount (cash and common stock) ............... $6,826 $9,613 $21,756

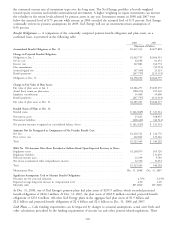

Share-Based Compensation Plan Expense — The vesting of the restricted stock units is predicated on the achievement

of a performance condition, which is the achievement of an earnings per share or environmental measures target.

Restricted stock unit awards are considered to be equity awards, since the plan settlement determination (shares or cash)

resides with Xcel Energy and not the participants. In addition, these awards have not been previously settled in cash

and Xcel Energy plans to continue electing share settlement. Restricted stock as granted under the Xcel Energy

Executive Annual Incentive Award Plan is also considered to be an equity award. The grant date fair value of restricted

stock units and restricted stock is expensed as employees vest in their rights to those awards.

The PSP awards have been historically settled partially in cash, and therefore, do not qualify as an equity award, but are

accounted for as a liability award. As liability awards, the fair value on which ratable expense is based, as employees vest

in their rights to those awards, is remeasured each period based on the current stock price, and final expense is based

on the market value of the shares on the date the award is settled.

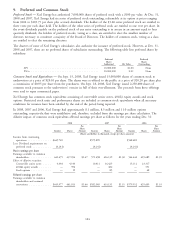

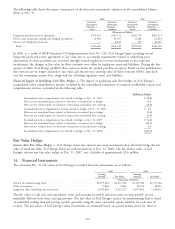

The compensation costs related to share-based awards for the years ended Dec. 31 were as follows:

2008 2007 2006

(Thousands of Dollars)

Compensation cost for share-based awards(a)(b) ............... $23,912 $24,900 $43,253

Tax benefit recognized in income ....................... 9,241 9,661 16,777

Total compensation cost capitalized ...................... 3,666 3,697 3,680

(a) Compensation costs for share-based payment arrangements is included in other operating and maintenance expense in the consolidated statements of income

(b) Included in compensation cost for share-based awards are matching contributions related to the Xcel Energy 401(k) plan, which totaled $18.6 million, $15.2 million and

$15.0 million for the years ended 2008, 2007 and 2006, respectively.

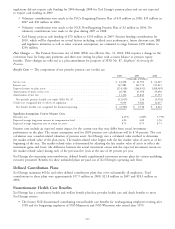

The maximum aggregate number of shares of common stock available for issuance under the Xcel Energy Omnibus

Incentive Plan, approved in 2000, is 14.5 million and 8.3 million was approved under the Xcel Energy 2005 Omnibus

Incentive Plan. Under the Executive Annual Incentive Plan approved in 2000, the total number of share approved for

issuance is 1.5 million and 1.2 million shares were approved under the Executive Annual Incentive Plan in 2005.

As of Dec. 31, 2008 and 2007, there was approximately $14.9 million and $6.5 million of total unrecognized

compensation cost related to non-vested share-based compensation awards. Xcel Energy expects to recognize that cost

over a weighted-average period of 2.4 years. Total unrecognized compensation expense will be adjusted for future

changes in estimated forfeitures.

The amount of cash used to settle Xcel Energy’s share-based compensation awards was $3.1 million and $7.8 million in

2008 and 2007, respectively.

108