Westjet 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 54 WESTJET ANNUAL REPORT 2007

WestJet Airlines Ltd.

Years ended December 31, 2007 and 2006

(Tabular amounts are stated in thousands of dollars, except share and per share data)

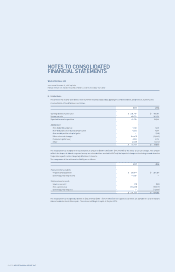

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

9. Share capital (continued):

(c) Per share amounts:

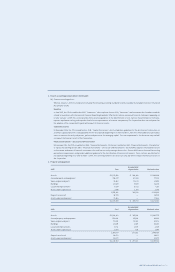

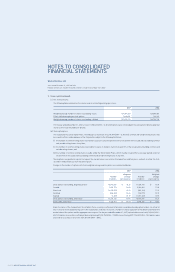

The following table summarizes the shares used in calculating earnings per share:

For the year ended December 31, 2007, a total of 1,584,520 (2006 – 12,823,662) options were not included in the calculation of dilutive potential

shares as the result would be anti-dilutive.

(d) Stock option plans:

The Corporation has Stock Option Plans, whereby up to a maximum of 12,016,887 (2006 – 12,957,831) common and variable voting shares may

be issued to offi cers and employees of the Corporation subject to the following limitations:

(i) the number of common voting shares reserved for issuance to any one optionee will not exceed 5% of the issued and outstanding common

and variable voting shares at any time;

(ii) the number of common voting shares reserved for issuance to insiders shall not exceed 10% of the issued and outstanding common and

variable voting shares; and

(iii) the number of common voting shares issuable under the Stock Option Plans, which may be issued within a one-year period, shall not

exceed 10% of the issued and outstanding common and variable voting shares at any time.

Stock options are granted at a price that equals the market value, have a term of between four and fi ve years, and vest on either the fi rst,

second or third anniversary from the date of grant.

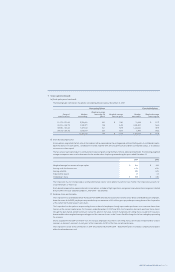

Changes in the number of options, with their weighted average exercise prices, are summarized below:

Under the terms of the Corporation’s Stock Option Plans, a cashless settlement alternative is available whereby option holders can either (a)

elect to receive shares by delivering cash to the Corporation, or (b) elect to receive a number of shares equivalent to the difference between the

market value of the options and the aggregate exercise price. For the year ended December 31, 2007, option holders exercised 4,139,944 (2006 –

433,129) options on a cashless settlement basis and received 1,049,752 (2006 – 73,589) shares. During 2007, 136,630 (2006 – NIL) options were

exercised on a cash basis for a total of $1,551,000 (2006 – $NIL).

2007 2006

Weighted average number of shares outstanding – basic 129,709,329 129,585,403

Effect of dilutive employee stock options 1,900,850 124,321

Weighted average number of shares outstanding – diluted 131,610,179 129,709,724

2007 2006

Number

of options

Weighted

average

exercise price

Number

of options

Weighted

average

exercise price

Stock options outstanding, beginning of year 15,046,201 $ 13.21 11,428,718 $ 13.94

Granted 1,689,773 16.45 5,980,660 11.82

Exercised (4,276,574) 13.19 (433,129) 11.21

Forfeited (226,909) 13.24 (332,711) 13.19

Expired (6,259) 15.97 (1,597,337) 13.78

Stock options outstanding, end of year 12,226,232 13.66 15,046,201 13.21

Exercisable, end of year 4,425,763 $ 14.93 4,846,236 $ 13.63