Westjet 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 16 WESTJET ANNUAL REPORT 2007

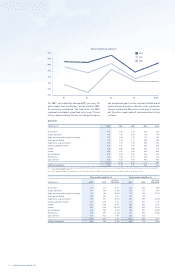

For 2007, our load factor averaged 80.7 per cent, 2.5

points higher than the 78.2 per cent recorded for 2006.

As previously mentioned, the load factor for 2007

represents our highest annual load factor in our 12-year

history, demonstrating that our on-time performance

and exceptional guest service continue to build brand

loyalty and repeat business. Results of our satisfaction

surveys indicate that 90 per cent of our guests say they

will fl y with us again and will recommend our airline

to others.

Expenses

CASM (cents) 2007 2006 2005 2004 2003

Aircraft fuel 3.46 3.40 3.32 2.69 2.27

Airport operations 1.99 1.96 2.04 1.94 1.78

Flight operations and navigational charges 1.78 1.83 1.72 1.66 1.53

Sales and marketing 1.30 1.30 1.16 0.95 0.84

Depreciation and amortization 0.87 0.89 1.00 0.88 0.92

General and administration 0.72 0.66 0.67 0.70 0.70

Infl ight 0.59 0.54 0.50 0.49 0.47

Interest 0.52 0.56 0.52 0.49 0.36

Aircraft leasing 0.52 0.57 0.62 0.46 0.64

Maintenance 0.51 0.54 0.67 0.85 1.06

Guest services 0.25 0.25 0.26 0.26 0.32

12.51 12.50 12.48 11.37 10.89

CASM, excluding fuel 9.05 9.10 9.16 8.68 8.62

Note 1: For comparative purposes, the impairment loss of $47,577,000 related to the retirement of 200-series aircraft included in depreciation and amortization expense has been excluded from

unit cost calculations for 2004.

Note 2: For comparative purposes, the impairment loss of $31,881,000 related to the aiRES reservation system has been excluded from unit cost calculations for 2007.

Three months ended Dec. 31 Twelve months ended Dec. 31

CASM (cents) 2007 2006

increase /

(decrease) 2007 2006

increase /

(decrease)

Aircraft fuel 3.73 3.21 16.2% 3.46 3.40 1.8%

Airport operations 1.81 1.87 (3.2%) 1.99 1.96 1.5%

Flight operations and navigational charges 1.73 1.88 (8.0%) 1.78 1.83 (2.7%)

Sales and marketing 1.38 1.30 6.2% 1.30 1.30 —

Depreciation and amortization 0.86 0.91 (5.5%) 0.87 0.89 (2.2%)

General and administration 0.70 0.68 2.9% 0.72 0.66 9.1%

Infl ight 0.62 0.56 10.7% 0.59 0.54 9.3%

Interest 0.51 0.58 (12.1%) 0.52 0.56 (7.1%)

Aircraft leasing 0.48 0.53 (9.4%) 0.52 0.57 (8.8%)

Maintenance 0.48 0.51 (5.9%) 0.51 0.54 (5.6%)

Guest services 0.27 0.26 3.8% 0.25 0.25 —

12.57 12.29 2.3% 12.51 12.50 0.1%

CASM, excluding fuel 8.84 9.08 (2.6%) 9.05 9.10 (0.5%)

Annual and quarterly load factors