Westjet 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 38 WESTJET ANNUAL REPORT 2007

We have identifi ed the following areas that contain

critical accounting estimates utilized in the preparation

of our fi nancial statements:

Property and equipment

We make estimates about the expected useful lives,

projected residual values, lease-return conditions,

and the potential for impairment of our property and

equipment. In estimating the lives and expected residual

values of our fl eet, we rely upon annual independent

appraisals, recommendations from Boeing and actual

experience with the same aircraft types. Revisions to

the estimates for our fl eet can be caused by changes in

the utilization of the aircraft or changing market prices

of used aircraft of the same type. We evaluate our

estimates and potential impairment on all property and

equipment annually and when events and circumstances

indicate that the assets may be impaired.

Non-refundable guest credits

We also make estimates in accounting for our liability

related to certain types of non-refundable guest

credits. We issue future travel credits to guests for

fl ight changes and cancellations, as well as for gift

certifi cates. Where appropriate, future travel credits

are also issued for fl ight delays, missing baggage and

other inconveniences. All credits are non-refundable

and expiry dates vary depending on the nature of the

credit. We record a liability in the period the credit is

issued. The utilization of guest credits is recorded as

revenue when the guest has fl own or upon expiry.

Deferred sales and marketing costs

We defer sales and marketing costs related to advanced

ticket sales. We estimate the amount to defer based on

the proportion of advanced ticket sales to total bookings

on an annualized basis. This amount is included on our

balance sheet in prepaid expenses.

Future income taxes

We use the liability method of accounting for future

income taxes, which requires a signifi cant amount

of judgment regarding assumptions and the use of

estimates. This can create signifi cant variances between

actual results and estimates, including the scheduling

of our effective tax rate and the potential realization of

future tax assets and liabilities.

Stock-based compensation expense

We use the fair value method for valuing stock options.

Under this method, as new options are granted, the fair

value of these options will be expensed on a straight-

line basis over the applicable vesting period, with an

offsetting entry to contributed surplus. The fair value

of each option grant is estimated on the date of grant

using the Black-Scholes option pricing model. The

Black-Scholes option pricing model was developed for

use in estimating the fair value of short-term traded

options that have no vesting restrictions and are fully

transferable. In addition, option valuation models

require the input of somewhat subjective assumptions

including expected stock price volatility.

Financial derivative instruments

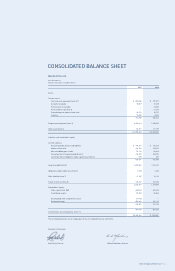

The carrying amounts of fi nancial instruments included

in the balance sheet, other than long-term debt,

approximate their fair value due to their short term

to maturity.

Changes in accounting policies

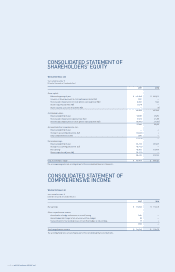

On January 1, 2007, we adopted the new Canadian

accounting standards for financial instruments:

Section 3861, “Financial Instruments – Disclosure and

Presentation,” Section 3855, “Financial Instruments

– Recognition and Measurement,” Section 3865,

“Hedges” and Section 1530, “Comprehensive Income”.

Prior periods have not been restated. Under adoption

of these new standards, we designated our cash and

cash equivalents, including US-dollar deposits, as held-

for-trading, which is measured at fair value. Accounts

receivable are classifi ed as loans and receivables, which

are measured at amortized cost. Accounts payable and

accrued liabilities and long-term debt are classifi ed

as other fi nancial liabilities, which are measured at

amortized cost.

Effective January 1, 2007, and as provided for on

transition, we selected a policy of immediately expensing

transaction costs incurred related to the acquisition of

fi nancial assets and liabilities. Previously, transaction

costs had been deferred and included on the balance

sheet as other assets or liabilities and amortized over

the term of the related asset or liability. Under the

transitional provisions, we retrospectively adopted this

change in accounting policy without the restatement of

prior-period fi nancial statements and incurred a charge

to retained earnings of $36.6 million (net of future tax

of $16.3 million) related to legal and fi nancing fees on

long-term debt.

Effective January 1, 2007, we transferred $13.4 million

of unamortized hedging losses related to certain leased

aircraft to accumulated other comprehensive income.

We will continue to amortize the hedging losses to net

earnings over the remaining term of the previously

related hedged item.

Future accounting policy changes

Effective January 1, 2008, we will adopt the following

accounting standards recently issued by the Canadian

Institute of Chartered Accountants (CICA):

Inventory

In June 2007, the CICA issued Section 3031, “Inventories,”

which replaces Section 3030, “Inventories,” and

harmonizes the Canadian standards related to

inventories with International Financial Reporting

Standards (IFRS). Effective for interim and annual

fi nancial statements beginning on or after January 1,

2008, this section provides changes to the measurement

and more extensive guidance on the determination of

cost, narrows the permitted cost formulas, requires

impairment testing, and expands the disclosure

requirements to increase transparency. Entities can

choose to apply the standard either to opening inventory

for the period, adjusting opening retained earnings by

the difference in the measurement of opening inventory,

or retrospectively, by restating prior periods. We do

not anticipate that the adoption of this standard will

signifi cantly impact our fi nancial results.