Westjet 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 48 WESTJET ANNUAL REPORT 2007

WestJet Airlines Ltd.

Years ended December 31, 2007 and 2006

(Tabular amounts are stated in thousands of dollars, except share and per share data)

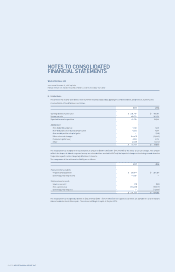

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

1. Signifi cant accounting policies (continued):

(m) Financial instruments (continued):

The Corporation formally documents all relationships between hedging instruments and hedged items, as well as its risk management

objective and strategy for undertaking various hedge transactions. This process includes linking all derivatives to specifi c assets and liabilities

on the balance sheet or to specifi c fi rm commitments or anticipated transactions. The Corporation also formally assesses, both at the hedge’s

inception and on an ongoing basis, whether the derivatives that are used in hedging transactions are highly effective in offsetting changes in

fair value or cash fl ow of hedged items. All derivative instruments, including embedded derivatives, are recorded on the balance sheet and

in the statement of earnings at fair value unless exempted from derivative treatment as a normal purchase and sale. All changes in their

fair value are recorded in earnings. If cash fl ow hedge accounting is used, the fair value of derivative instruments is included in accumulated

other comprehensive income with any ineffectiveness recorded in earnings. Any changes in the fair value to the extent effective are recorded

through other comprehensive income. See note 12 – Financial instruments and risk management for additional details.

(n) Per share amounts:

Basic per share amounts are calculated using the weighted average number of shares outstanding during the year. Diluted per share amounts

are calculated based on the treasury stock method, which assumes that the total proceeds obtained on the exercise of options and the

unamortized portion of stock-based compensation would be used to purchase shares at the average price during the period. The weighted

average number of shares outstanding is then adjusted by the net change.

(o) Comparative fi gures:

Certain prior-period balances have been reclassifi ed to conform to current period’s presentation.

2. Recent accounting pronouncements:

(a) Change in accounting policies:

On January 1, 2007, the Corporation adopted the following new Canadian accounting standards: Section 3855, “Financial Instruments –

Recognition and Measurement,” Section 3865, “Hedging” and Section 1530, “Comprehensive Income.” Prior periods have not

been restated.

Comprehensive income consists of changes in gains and losses on hedge settlements. Other comprehensive income refers to items recognized

in comprehensive income that are excluded from net earnings.

The new standard on Financial Instruments prescribes when a fi nancial asset, fi nancial liability or non-fi nancial derivative is to be recognized

on the balance sheet and at what amount, requiring fair value or cost-based measures under different circumstances. Financial instruments

must be classifi ed into one of these fi ve categories: held-for-trading, held-to-maturity, loans and receivables, available-for-sale fi nancial

assets or other fi nancial liabilities. All fi nancial instruments, including derivatives, are measured on the balance sheet at fair value except

for loans and receivables, held-to-maturity investments and other fi nancial liabilities, which are measured at amortized cost. Subsequent

measurement and changes in fair value will depend on initial classifi cation, as follows: held-for-trading fi nancial assets are measured at

fair value and changes in fair value are recognized in net earnings; available-for-sale fi nancial instruments are measured at fair value with

changes in fair value recorded in other comprehensive income until the investment is derecognized or impaired, at which time the amounts

would be recorded in net earnings. There were no changes to the measurement or presentation of the Corporation’s fi nancial assets or

liabilities at the date of adoption.

The Corporation selected January 1, 2003, as its transition date for embedded derivatives; as such only contracts or fi nancial instruments

entered into or substantively modifi ed after the transition date were examined for embedded derivatives.

Effective January 1, 2007, and as provided for on transition, the Corporation selected a policy of immediately expensing transaction costs

incurred related to the acquisition of fi nancial assets and liabilities. Under the transitional provisions, the Corporation retrospectively adopted

this change in accounting policy without the restatement of prior-period fi nancial statements and incurred a charge to retained earnings of

$36,612,000 (net of future tax of $16,321,000) related to legal and fi nancing fees on long-term debt.

Effective January 1, 2007, the Corporation transferred $13,420,000 of unamortized hedging losses related to certain leased aircraft to

accumulated other comprehensive income. The Corporation will continue to amortize the hedging losses to net earnings over the remaining

term of the previously related hedged item.