Westjet 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTJET ANNUAL REPORT 2007 PAGE 23

For 2007, we estimated that every one-cent change in

the value of the Canadian dollar versus the US dollar

will have an approximate $6 million impact on our

annual costs (approximately $4 million for fuel and $2

million for remaining costs). During 2007, we entered

into foreign currency forward contracts to offset our

US-dollar denominated aircraft lease payments. As at

December 31, 2007, we entered into forward contracts

to purchase US $5.9 million per month for fi ve months

for a total US $29.5 million at an average forward rate

of 0.9871 per US dollar. Maturity dates for all contracts

are within 2008. For the year ended December 31, 2007,

we realized a loss on the contracts of $18,000 included

in aircraft leasing costs. As at December 31, 2007, the

estimated fair market value of the remaining contracts

recorded in prepaid expenses, deposits and other, and

accumulated other comprehensive income was a gain

of $106,000.

Income taxes

Our operations span several tax jurisdictions, which

subjects our income to various rates of taxation. As

such, the computation of the provision for income taxes

involves judgments based on the analysis of several

different pieces of legislation and regulation.

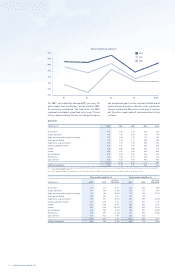

Our effective consolidated income tax rate for 2007

was approximately 19.3 per cent, as compared to 30.2

per cent in 2006. The 2007 rate was signifi cantly lower

primarily due to corporate income tax rate reductions

enacted by the federal government. In addition, we

realized a benefi cial impact to our future effective tax

rate for the year based on revised expectations of when

certain temporary differences are anticipated to reverse.

These changes resulted in a $33.7 million favourable

adjustment of future income tax expense recognized in

the fourth quarter of 2007, which was in addition to a

$2.3 million recovery recorded in the second quarter. The

2007 income tax expense was $3.7 million lower than

2006’s due to the changes in future income tax rates

partially offset by higher earnings before income tax.

LIQUIDITY AND CAPITAL RESOURCES

Our record fi nancial performance in 2007 resulted from

our ongoing efforts to build infrastructure, manage risk,

prepare for opportunities, and secure our competitive

advantage and reputation in our industry’s rapidly

changing environment.

In an industry highly sensitive to unpredictable

circumstances, such as increasing energy prices,

maintaining a strong fi nancial position is imperative to

our long-term success. Through our cautious fi nancial

management, we have maintained one of the most

favourable balance sheets in the airline industry.

We realized a signifi cant growth in our cash position by

the end of 2007, completing the year with total cash and

cash equivalents of $653.6 million compared to $377.5

million at December 31, 2006. Part of this cash balance

relates to cash collected with respect to advance ticket

sales, for which the balance at December 31, 2007,

was $194.9 million. Our fi nancial position remained

strong as we were able to achieve an increase in our

working capital ratio to 1.2, from 1.0 at December 31,

2006. As at December 31, 2007, WestJet did not have any

investments in asset-backed commercial paper.

Our debt-to-equity ratio at December 31, 2007, was 1.94

to 1.0, including $410.8 million which represented the

present value of our aircraft operating lease obligations.

This compared favourably to our debt-to-equity ratio

at December 31, 2006, of 2.3 to 1. Our debt-to-equity

ratio was impacted negatively by an adjustment to

our opening retained earnings during the period as a

result of the adoption of the new accounting policies

for Financial Instruments. Effective January 1, 2007, we

adjusted our opening retained earnings balance by $36.6

million (net of future income tax of $16.3 million) related

to transaction costs on long-term debt we previously

included in other assets. Without this adjustment, our

debt-to-equity ratio at December 31, 2007, would have

been 1.87 to 1.0.

Operating cash fl ow

Cash from operations in 2007 increased 59.9 per cent to

$541.1 million from $338.3 million for the same period

in 2006 due to growth in earnings from operations and

improved working capital.

Financing cash fl ow

In 2007, our total cash fl ow used in fi nancing activities

was $59.3 million, consisting mainly of $141.2 million

in long-term debt issued related to the fi nancing of four

new purchased aircraft, offset by $156.5 million in long-

term debt repayments. During 2007, we repurchased

1,263,500 shares under the normal course issuer bid

for a total of $21.3 million and made deposits on future

leased aircraft of $18.3 million. In 2006, cash fl ow from

fi nancing activities was $256.6 million, which was made

up of an increase of $418.6 million in long-term debt to

fi nance 12 aircraft, offset by $132.6 million in long-term

debt repayments, $16.0 million in transaction costs and

$10.9 million in deposits on future leased aircraft.

One of the major challenges that airlines face is the

high cost of capital. Having suffi cient access to capital

is critical in order to facilitate our planned growth. At

the same time, we require the fl exibility and resources

to take advantage of unforeseen opportunities as they

arise. In addition to having strong cash liquidity, we have

been successful in fi nancing our growth through aircraft

acquisitions fi nanced by low interest rate debt supported

by the Export-Import Bank of the United States (Ex-

Im Bank) commitments. During 2007, we converted

a preliminary commitment into a fi nal commitment

from Ex-Im Bank for a total of US $249.1 million. As at

December 31, 2007, we have taken delivery of the fi rst

four aircraft under this facility and have drawn a total of

$141.2 million (US $136.9 million). As at December 31,

2007, the unutilized and uncancelled balance of the fi nal

commitment from Ex-Im Bank was US $108.0 million

for three aircraft to be delivered between January and

July of 2008.