Westjet 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 26 WESTJET ANNUAL REPORT 2007

To accommodate our current and future growth and to

ensure our people have an effi cient work environment,

we are building new offi ces adjacent to our existing

hangar near the Calgary airport. The “Campus” will

centralize our corporate office departments and

will have the ability to accommodate at least 1,250

WestJetters in addition to the 450 currently at the

Calgary hangar. The Campus is expected to cost $96.5

million and will be fi nanced from operating cash fl ow.

During 2007, we incurred a total of $11.8 million relating

to the Campus.

Contractual obligations, off-balance-sheet

arrangements and commitments

Our contractual obligations for each of the next fi ve

years, which do not include commitments for goods and

services required in the ordinary course of business, are

indicated in the table below:

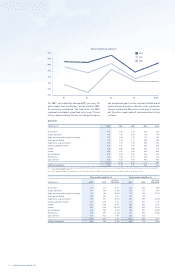

At December 31, 2007

Series

600s 700s 800s Total Fleet

Leased Owned Total Leased Owned Total Leased Owned Total Leased Owned Total

Fleet at December 31, 2006 — 13 13 13 32 45 5 — 5 18 45 63

Fleet at December 31, 2007 — 13 13 16 35 51 5 1 6 21 49 70

Commitments:

2008 — — — 2 3 5 2 — 2 4 3 7

2009 — — — 7 — 7 3 — 3 10 — 10

2010 — — — 4 — 4 1 — 1 5 — 5

2011 — — — 4 — 4 — — — 4 — 4

2012 — — — — 14*14 — — — — 14 14

2013 — — — — 6*6———— 6 6

Total commitments — — — 17 23 40 6 — 6 23 23 46

Committed fl eet as of 2013 — 13 13 33 58 91 11 1 12 44 72 116

*We have an option to convert any of these future aircraft to 737-800s.

These loan guarantees from the U.S. government

represent approximately 85 per cent of the purchase

price of these aircraft. This fi nancing activity brings

the cumulative number of aircraft fi nanced with loan

guarantees to 49, with an outstanding debt balance of

$1.4 billion associated with those aircraft. All of this

debt has been fi nanced in Canadian dollars at fi xed

rates ranging from 4.6 per cent to 6.0 per cent, thus

eliminating all future foreign exchange and interest rate

exposure on these US-dollar aircraft purchases.

To facilitate the fi nancing of our Ex-Im Bank supported

aircraft, we utilize fi ve special-purpose entities. We

have no equity ownership in the special-purpose

entities, however, we are the benefi ciary of the special-

purpose entities’ operations. The accounts of the

special-purpose entities have been consolidated in the

fi nancial statements.

Investing cash fl ow

Cash used in investing activities for 2007 totalled $200.3

million compared to $477.1 million in the previous year.

In the current year, our investing activities included the

addition of four new aircraft totalling $191.4 million, as

well as $26.8 million in Boeing deposits on 23 future-

owned aircraft deliveries partially offset by $13.7 million

received in the fi rst quarter related to the sale of two

engines. In 2006, cash used in investing activities

related to 12 new aircraft acquisitions of $438.9 million,

as well as $43.6 million of additions to property and

equipment primarily related to the development of the

aiRES project.

Capital resources

WestJet increased its aircraft commitment by 31

aircraft, bringing the total committed fl eet to 116 by

2013. On July 12, 2007, we signed a Letter of Intent

to lease three aircraft in 2010 with options to lease

three more aircraft in 2011, which were exercised on

October 26, 2007. On July 31, 2007, we announced an

agreement to purchase 20 Boeing 737-700 aircraft with

14 scheduled for delivery in 2012 and six in 2013. On

August 7, 2007, we signed another Letter of Intent to

lease three aircraft with two scheduled for delivery in

2010 and one in 2011, and on November 6, 2007, we

signed a Letter of Intent for two more 737-800 aircraft

to be delivered in November 2008 and January 2009. As

at December 31, 2007, total aircraft commitment was

$947.5 million, or US $968.9 million.

At December 31, 2007, we had existing commitments

to take delivery of an additional 46 aircraft as

summarized below:

Contractual obligations (thousands) Total 2008 2009 2010 2011 2012 Thereafter

Long-term debt repayments $ 1,429,518 $ 172,992 $ 157,173 $ 156,504 $ 169,228 $ 154,797 $ 618,824

Capital lease obligations(1) 1,624 444 444 698 38 — —

Operating leases(2) 1,487, 676 107,143 130,315 154,692 169,906 176,691 748,929

Purchase obligations(3) 947,513 101,157 7,446 36,367 79,027 509,650 213,866

$ 3,866,331 $ 381,736 $ 295,378 $ 348,261 $ 418,199 $ 841,138 $ 1,581,619

(1) Includes weighted average imputed interest at 5.29% totalling $141.

(2) Included in operating leases are US-dollar operating leases primarily related to aircraft. The obligations of these operating leases in US dollars are: 2008 – $94,885; 2009 – $125,394; 2010 –

$152,720; 2011 – $171,180; 2012 – $178,151; 2013 and thereafter – $743,404.

(3) Relates to purchases of aircraft, live satellite television systems, and winglets. These purchase obligations in US dollars are: 2008 – $103,443; 2009 – $7,614; 2010 – $37,189; 2011 – $80,813;

2012 – $521,168; 2013 and thereafter – $218,699.