Visa 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 Visa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

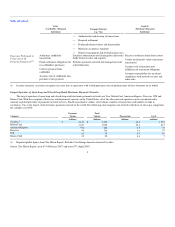

Table of Contents

Other Value-Added Processing Services

The size of our network and our processing capabilities allow us to offer a range of other value-added services in certain countries. These services

include risk management, debit issuer processing, loyalty services, dispute management and value-added information services.

Risk Management Services. Our centralized and integrated network architecture allows us to monitor, on a real-time basis, all transactions that we

process for authorization. As a result, we provide customers in certain countries with a number of value-added risk-management services, which complement

our core authorization services. Our risk management services provide preventive, monitoring, investigative and predictive tools, which are intended to

mitigate and help eliminate fraud at the cardholder and merchant level. For example, Visa Advanced Authorization, which we introduced in 2005, enables us

to monitor and evaluate VisaNet authorization requests in real-time and deliver enhanced transaction risk scores to issuers as part of the authorization

message. It is the first system of its kind to deliver risk indicators in real-time by assessing transaction data on both an account level and a transaction level.

Debit Issuer Processing Services. Visa Debit Processing Services provides comprehensive processing services for participating United States issuers of

Visa debit, prepaid and ATM payment products. In addition to core issuer authorization processing, Visa Debit Processing Services offers card management

services, exception processing, PIN and ATM network gateways, call center services, fraud detection services and ATM terminal driving. Visa Debit

Processing Services processes more Visa transactions than any other issuer processor in the world.

Loyalty Services. We offer loyalty services that allow our customers to enhance the attractiveness of their Visa payment programs and to strengthen

their relationships with cardholders and merchants. These services are designed to allow our customers to differentiate their Visa program offerings, to

support increased card usage and to increase the importance of Visa payments to merchants.

Visa Extras is a service that participating issuers may offer to their cardholders to increase card usage, enhance the value of their Visa programs and

create stronger cardholder relationships. Visa Extras is a points-based program that rewards cardholders for using their enrolled Visa cards to make qualifying

purchases. Cardholders can redeem points for rewards in the Visa Extras rewards catalog for everyday items such as movie tickets, retail gift certificates,

merchandise, travel certificates, dining and other rewards.

The Visa Incentive Network enables merchants and financial institution customers to deliver tailored merchant offers to targeted groups of cardholders.

Visa Incentive Network offers benefits traditionally associated with a closed-loop system. Visa Incentive Network was launched in April 2005 and allows us

to deliver merchant promotions to affluent and high-spending Visa cardholders on behalf of participating issuers. Based on merchant-specific cardholder

spending and location criteria for each promotion, we can analyze the spending patterns of Visa credit card holders in the United States about which

information is provided to us by participating card issuers. We then deliver the promotion to the appropriate cardholders on behalf of these issuers. In order to

protect cardholder privacy, the merchant does not gain access to cardholder information or underlying transaction data. The Visa Incentive Network database

contains more than 80 million accounts. Visa Incentive Network is enabled through account level processing, which allows transactions to be processed and

afforded customized treatment at the account level—i.e., by identifying each transaction by the entire 16-digit account number—rather than by the six-digit

bank identification number, or BIN, as is the more typical industry practice. We are able to implement account level processing as a result of our reengineered

Visa Integrated Payment platform, as described below.

Dispute Management Services. We manage Visa Resolve Online, an automated web-based service that allows our customers' back-office analysts and

customer service representatives to manage and resolve Visa transaction disputes more efficiently than with previous paper-based processes. Transaction

disputes between issuers and acquirers sometimes arise from suspected fraud, merchant non-fulfillment of transaction requirements

15