Visa 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Visa annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

-

183

-

184

-

185

-

186

-

187

-

188

-

189

-

190

-

191

-

192

-

193

-

194

-

195

-

196

-

197

-

198

-

199

-

200

-

201

-

202

-

203

-

204

-

205

-

206

-

207

-

208

-

209

-

210

-

211

-

212

-

213

-

214

-

215

-

216

-

217

-

218

-

219

-

220

-

221

-

222

-

223

-

224

-

225

-

226

-

227

-

228

-

229

-

230

-

231

-

232

-

233

-

234

-

235

-

236

Visa Inc. (V)

10-K

Annual report pursuant to section 13 and 15(d)

Filed on 12/21/2007

Filed Period 09/30/2007

Table of contents

-

Page 1

Visa Inc.

(V)

10-K

Annual report pursuant to section 13 and 15(d) Filed on 12/21/2007 Filed Period 09/30/2007

-

Page 2

...UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2007 OR

¨

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE...

-

Page 3

... Officers and Corporate Governance Item 11 Executive Compensation Item 12 Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Item 13 Certain Relationships and Related Transactions, and Director Independence Item 14 Principal Accountant Fees and Services...

-

Page 4

... our relationships with customers and expectations as to the future development of these relationships; statements regarding the capabilities and advantages of our processing platform, VisaNet; statements as to the market opportunities for certain product segments and in certain geographies, as well...

-

Page 5

...range of product platforms, transaction processing and related value-added services. Based on the size of our network, the strength of the Visa brand and the breadth and depth of our products and services, we believe we are the leading electronic payments company in the world. Our business primarily...

-

Page 6

..., balance transfers and convenience check transactions associated with our products. Total volume, which we consider to be an important measure of the scale of our business, is the sum of payments volume and cash volume. An increasing portion of our revenues come from outside the United States...

-

Page 7

..., money orders, government checks, travelers cheques, official checks and other paper-based means of transferring value; card-based payments: credit cards, charge cards, debit cards, deferred debit cards, ATM cards, prepaid cards, private label cards and other types of general-purpose and limited...

-

Page 8

...the United States and other major international markets, Visa and others have over time broadened their offerings to include debit, ATM, prepaid and commercial cards. In addition to general purpose cards, a number of retailers and other entities issue limited-purpose credit, charge and prepaid cards...

-

Page 9

... product platforms (e.g., credit, debit) to financial institutions credit, debit) Operates data processing network that Establishes and maintains accounts with transfers transaction data and manages cardholders (either consumers or payment flow between issuers and acquirers businesses)

Merchants...

-

Page 10

... Connection with Payment Transaction(1)

Authorization and clearing of transactions Financial settlement Product platform features and functionality Merchant acceptance standards

- Dispute management and arbitration processes Transfers authorization and clearing data and settles Receives settlement...

-

Page 11

...real-time, value-added information to our customers. In addition, our centralized processing platform provides us the flexibility to develop, modify and enhance our products and services efficiently. VisaNet is highly reliable and processed more than 78 billion authorization, clearing and settlement...

-

Page 12

...expanding the number of merchants and cardholders in our network, we increase the value we provide to our financial institution customers.

•

Expand into New and High Growth Geographies and Market Segments We will continue to globalize our product and service offerings and to expand acceptance of...

-

Page 13

... that issue Visa cards to cardholders, and acquirers, which are the financial institutions that offer Visa network connectivity and payments acceptance services to merchants. In addition, we offer a range of value-added processing services to support our customers' Visa programs and to promote the...

-

Page 14

... a later point in time containing additional data required for clearing and settlement.

Authorization A typical Visa transaction begins when the cardholder presents his or her Visa card to a merchant as payment for goods or services. The transaction information is then transmitted electronically to...

-

Page 15

...located in Visa Europe's region and an acquirer that is located in the rest of the world, or vice versa. In addition, we currently provide clearing and settlement services for Visa transactions occurring entirely within Visa Europe's region and will continue to provide such services until completion...

-

Page 16

... processing services for participating United States issuers of Visa debit, prepaid and ATM payment products. In addition to core issuer authorization processing, Visa Debit Processing Services offers card management services, exception processing, PIN and ATM network gateways, call center services...

-

Page 17

... customers, provides real-time access to Visa transaction data, electronic transfer of substantiating documents and automated management of communications between issuers and acquirers. Value-Added Information Services. We provide our customers with a range of additional information-based business...

-

Page 18

... the United States and certain countries in the AP region. Interlink is a single-message point-of-sale debit network. It generally requires a cardholder to enter a personal identification number, or PIN, for authentication. Interlink allows our issuers to provide a full range of debit card offerings...

-

Page 19

...institution processing of checks by taking advantage of Visa's efficient electronic payments processing. Cash Access Our customers can provide global cash access to their cardholders by issuing products accepted at Visa and PLUS branded ATMs. Most Visa and Visa Electron branded cards offer customers...

-

Page 20

...requirements and risk controls that increase their ability to offer Visa cards to high-risk consumer segments. These standards include codes on the magnetic stripe that instruct point-of-sale terminals to request real-time transaction authorizations from the card issuer, providing an increased level...

-

Page 21

... relations to create programs that build active preference for products carrying our brand, promote product usage, increase product acceptance and support cardholder acquisition and retention. For merchants, we work to ensure that the Visa brand represents timely and guaranteed payment, as well...

-

Page 22

...and locations and increase cardholder spending and merchant sales revenue through special offers and promotions. Merchant Acceptance Initiatives Merchants play a vital role in our payments network, and we work continuously to build our merchant acceptance and enhance our relationships with merchants...

-

Page 23

... use of our brands and trademarks, the standards, design and features of payment cards and programs, merchant acquiring activities, including acceptance standards applicable to merchants, use of agents, disputes between members, risk management, guaranteed settlement, customer financial failures and...

-

Page 24

... better assist customers in their identification and monitoring of high-risk relationships. Interchange Interchange represents a transfer of value between the financial institutions participating in an open-loop payments network such as ours. On purchase transactions, interchange fees are typically...

-

Page 25

..., products, programs and services. Through agreements with our customers, we authorize and monitor the use of our trademarks in connection with their participation in our payments network. In addition, we own a number of patents and patent applications relating to payments solutions, transaction...

-

Page 26

... payments networks. Among other things, these competitors provide Internet currencies, which can be used to buy and sell goods online, virtual checking programs, which permit the direct debit of consumer checking accounts for both online and point-of-sale transactions and services that support...

-

Page 27

... number of states have proposed bills that purport to limit interchange fees or merchant discount rates or to prohibit their application to portions of a transaction. In addition, the Merchants Payments Coalition, a coalition of trade associations representing businesses that accept credit and debit...

-

Page 28

... rules, security and marketing, which could impact our customers and us directly. Increases in fraud or other illegal activity involving our cards could also lead to regulatory intervention, such as mandatory card re-issuance. Certain of our operations in the United States are periodically reviewed...

-

Page 29

...-loop payments network such as ours. On purchase transactions, interchange fees are typically paid to issuers, which are the financial institutions that issue Visa cards to cardholders, by acquirers, which are the financial institutions that offer Visa network connectivity and payments acceptance...

-

Page 30

... to charge higher fees to consumers, thereby making our card programs less desirable and reducing our transaction volumes and profitability. Acquirers could elect to charge higher merchant discount rates to merchants, regardless of the level of Visa interchange, leading merchants not to accept cards...

-

Page 31

... Visa U.S.A.'s and Visa International's setting of default interchange rates violated federal and state antitrust laws. The lawsuits have been transferred to a multidistrict litigation in the U.S. District Court for the Eastern District of New York. The class action complaints have been consolidated...

-

Page 32

...institutions. The American Express lawsuit is part of the covered litigation, which our retrospective responsibility plan is intended to address. We, Visa U.S.A. and Visa International entered into a settlement agreement with American Express that became effective on November 9, 2007. The settlement...

-

Page 33

... standing to pursue his claims. After the trial court's decision, several putative class actions were filed in California state courts challenging Visa U.S.A.'s and Visa International's currency conversion practices for credit and debit cards. A number of putative class actions relating to Visa...

-

Page 34

... merchant class action lawsuit that Visa U.S.A. settled in 2003, alleging unlawful "tying" of credit and debit card services, attempted monopolization and other state law competition claims; a patent infringement claim against Visa U.S.A. and Visa International involving the Verified by Visa product...

-

Page 35

... Visa U.S.A.'s No Signature Required Program, and the other regarding Visa U.S.A.'s agreements with financial institutions that issue Visa debit cards, respectively.

Private plaintiffs often seek class action certification in cases against us, particularly in cases involving merchants and consumers...

-

Page 36

... agreement, provided that the issuer has entered into an agreement to issue MasterCard-branded debit cards and has repaid to Visa U.S.A. any unearned benefits or financial incentives under its Visa U.S.A. agreement. The settlement service fee bylaw was rescinded as of the effective date of the order...

-

Page 37

... the number of payment cards issued, our payments volume and revenues. We and our customers are subject to regulations related to privacy and data use and security in the jurisdictions in which we do business, and we could be adversely affected by these regulations. For example, in the United States...

-

Page 38

... processed and various other services we provide. In order to increase payments volume, enter new market segments and expand our card base, we offer incentives to customers, such as up-front cash payments, fee discounts, credits, performance-based growth incentives, marketing support payments...

-

Page 39

..., customers and other industry participants may develop products that compete with or replace value-added services we currently provide to support our transaction processing. For example, in recent years some of our competitors and members have begun to compete with our currency conversion services...

-

Page 40

... future growth and overall business. Merchants are pursuing litigation and supporting regulatory proceedings relating to the costs associated with payment card acceptance and are negotiating incentive arrangements, including pricing discounts, all of which may increase our costs and materially and...

-

Page 41

... with our customers and their relationships with cardholders and merchants to support our programs and services. We do not issue cards, extend credit to cardholders or determine the interest rates (if applicable) or other fees charged to cardholders using cards that carry our brands. Each issuer...

-

Page 42

...an interruption in service, increased costs or the compromise of data security. Additionally, we rely on service providers for the timely transmission of information across our global data network. If a service provider fails to provide the communications capacity or services we require, as a result...

-

Page 43

... to claims against us. For example, in January 2007, TJX Companies, Inc., a large retailer with stores in the United States, Canada and the United Kingdom, disclosed a significant security breach in connection with card and account information, which exposed tens of millions of payment cards issued...

-

Page 44

...our business relationships with our customers. Prior to our recent reorganization, a number of Visa's key members had officers who also served on the boards of directors of Visa U.S.A., Visa International, Visa Canada or the regional boards of directors of the unincorporated regions of Visa AP, Visa...

-

Page 45

... the same global operating rules as Visa U.S.A., Visa International and Visa Canada. These global operating rules regulate, among other things, interoperability of payment processing, brand maintenance and investment, standards for products and services, risk management, disputes between members and...

-

Page 46

.... See Item 13-"Certain Relationships and Related Transactions, and Director Independence-Relationship with Visa Europe-The Put-Call Option Agreement." The terms of our reorganization created financial incentives that reward net revenue growth in the four quarters ended December 31, 2007. One of the...

-

Page 47

... resulted in a more centralized corporate governance structure in which our board of directors exerts centralized management control. We face significant challenges integrating the operations of the different regions. We may also be unable to retain and attract key employees, and we may not realize...

-

Page 48

... the Internal Revenue Code of 1986, as amended, generally applies only to the extent that a taxpayer transfers property to a corporation in exchange for stock having the same fair market value. The IRS might therefore take the position that the difference (whether received on the date of closing of...

-

Page 49

... our board of directors will be divided into three classes, with approximately one-third of our directors elected each year; following the closing of an initial public offering until the third anniversary of such offering, six directors will be individuals elected or nominated by our regions; our...

-

Page 50

... In re Payment Card Interchange Fee and Merchant Discount Antitrust Litigation, 1:05-md-01720-JG-JO (E.D.N.Y.) or MDL 1720, including all cases currently included in MDL 1720, any other case that includes claims for damages relating to the period prior to proposed our initial public offering that is...

-

Page 51

... the released escrow amount and the market price of our class A common stock to be issued in our proposed initial public offering. The litigation committee has been established pursuant to a litigation management agreement among Visa Inc., Visa International, Visa U.S.A. and Robert R. Hackney, Bruce...

-

Page 52

... litigation, we have the right to join the judgment sharing agreement on the terms applicable to Visa International unless a claim relates to our conduct after the reorganization (other than the reorganization or our proposed initial public offering) or our conduct that is not the mere continuation...

-

Page 53

... Programs Policy, or CPP (which prohibited their respective members from issuing American Express or Discover cards), as well as Visa's "Honor All Cards" rule (which required merchants that accept Visa cards to accept for payment every validly presented Visa card) and a similar MasterCard rule...

-

Page 54

... Express filed a complaint against Visa U.S.A., Visa International, MasterCard and eight Visa U.S.A. and Visa International member financial institutions (JPMorgan Chase & Co., Bank of America Corporation, Capital One Financial Corp., U.S. Bancorp, Household International Inc., Wells Fargo & Company...

-

Page 55

... Class Action Complaint discussed below. On June 22, 2005, a purported class action lawsuit was filed by a group of merchants in the U.S. District Court of Connecticut against MasterCard, Visa U.S.A., Visa International and a number of Visa U.S.A. and Visa International member financial institutions...

-

Page 56

... the tens of billions of dollars), as well as attorneys' fees and injunctive relief. Visa U.S.A. and Visa International answered the First Consolidated Amended Class Action Complaint and the individual merchant complaints on June 9, 2006. On July 10, 2007, pursuant to a joint request by the parties...

-

Page 57

...Minnesota, alleging both the merchant opt-out claims at issue in GMRI's suit against Visa U.S.A. and a number of the claims set forth in the class complaint filed in Multidistrict Litigation 1720 relating to interchange and Visa rules. In December 2007, GMRI, Inc. and Visa U.S.A. agreed in principle...

-

Page 58

... its ruling on an antitrust standing issue. On April 27, 2007, Visa U.S.A. and the State of West Virginia reached an agreement in principle to settle all claims against Visa U.S.A. A provision was recorded in Visa U.S.A.'s consolidated statements of operations in connection with this settlement. On...

-

Page 59

... from issuing general purpose credit or debit cards in the United States on any other general purpose card network. The final judgment also provided that from the effective date of the final judgment (October 15, 2004) until October 15, 2006, Visa U.S.A. and Visa International were required to...

-

Page 60

... Related to Our Business-Legal and Regulatory Risks." United States. Approximately 50 class action and individual complaints have been filed on behalf of merchants against Visa U.S.A., Visa International and certain Visa U.S.A. member financial institutions alleging that their setting of interchange...

-

Page 61

... the Office of Fair Trading of the United Kingdom, or the OFT, issued a statement of objections against Visa International, Visa Europe, Visa UK and certain member financial institutions challenging the default interchange rates applicable to consumer credit card, charge card and deferred debit card...

-

Page 62

... Competition Law, California Business and Professions Code §§ 17200 et seq. The Schwartz Action claims that the alleged "fee" grossly exceeds any costs the defendants might incur in connection with currency conversions relating to credit card purchase transactions made in foreign countries and...

-

Page 63

...to as the Shrieve Action. Plaintiffs allege that defendants impose a "hidden transaction fee" of 1% on debit card transactions and ATM withdrawals in foreign countries, and that defendants therefore violated California's Unfair Competition Law. Visa U.S.A. and Visa International deny the allegations...

-

Page 64

... wholesale or government-mandated/managed rate, Visa U.S.A. and Visa International will require their issuing members in the United States to change their disclosures regarding base exchange rates to conform with the changed practices. As part of this settlement, plaintiffs in the Shrieve Action and...

-

Page 65

... merchant class action was filed in California state court against Visa U.S.A., Visa International, MasterCard, Merrick Bank and CardSystems Solutions, Inc. The complaint stems from a data-security breach at CardSystems, a payment card processor that handled Visa and other payment brand transactions...

-

Page 66

... on Visa U.S.A.'s agreements with banks that issue Visa debit cards. Visa U.S.A. is cooperating with the Division in connection with both CIDs. AAA Antiques Mall On November 13, 2007, a putative class action lawsuit was filed in Maryland state court against Visa U.S.A., MasterCard Worldwide, and...

-

Page 67

... by Visa" product, and that Verified by Visa infringed U.S. Patent 5,903,878, entitled Method and Apparatus for Electronic Commerce, or the 878 patent. The original Complaint alleged four causes of action: (1) infringement of the 878 patent; (2) breach of implied and written nondisclosure agreements...

-

Page 68

... the California Business & Professions Code §§ 17200 et seq. Visa International filed its answer to the Second Amended Complaint and related counterclaims on April 23, 2007. Discovery in this matter is currently ongoing and is scheduled to be completed on May 12, 2008. A patent claims construction...

-

Page 69

... leave to file an amended complaint adding J.P. Morgan Chase and Wells Fargo as defendants. Visa U.S.A. and Visa International opposed this motion on October 26, 2007 and asked the court, in the alternative, to stay all proceedings against Visa issuing financial institutions pending resolution...

-

Page 70

... of the members of Visa U.S.A., Visa International and Visa Canada was received to effectuate our reorganization and adopt the Visa Inc. 2007 Equity Incentive Compensation Plan. The voting results for the proposals related to the approval and adoption of the Global Restructuring Agreement and...

-

Page 71

..., on May 24, 2007, we issued 100 shares of our common stock to Visa International Service Association for an aggregate subscription price of $1.00, representing a price per share of $0.01. In connection with this issuance, we relied upon the exemption from registration provided by Section 4(2) of...

-

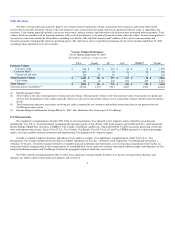

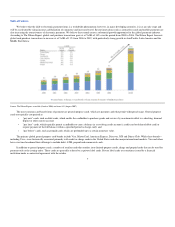

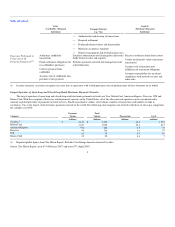

Page 72

... operating certificates from Visa's customers and are unaudited. Year-over-year change for fiscal 2003 represents change compared to fiscal 2002. Payments volume is the total monetary value of transactions for goods and services that are purchased with cards bearing our brands. Total transactions...

-

Page 73

... value of transactions for goods and services that are purchased with Visa products, including PIN-based debit volume, and excluding cash disbursements obtained with Visa-branded cards, balance transfers and convenience checks, which Visa U.S.A. refers to as cash volume. Operating revenues increased...

-

Page 74

...of activity on Visa-branded cards, which Visa U.S.A. refers to as service fees, and from the fees charged for providing transaction processing, which Visa U.S.A. refers to as data processing fees. Pricing varies and may be modified on a customer-by-customer basis through volume and support incentive...

-

Page 75

...services that facilitate transaction and information management among Visa U.S.A.'s customers. Volume and Support Incentives Volume and support incentives are contracts with financial institutions, merchants and other business partners for various programs designed to build payments volume, increase...

-

Page 76

... of Contents

and increase Visa-branded transactions. These contracts, which range in term from one to 13 years, provide incentives based on payments volume growth or card issuance, or provide marketing and program support based on specific performance requirements. Visa U.S.A. provides cash and...

-

Page 77

... and marketing promotion over the terms of the agreements. Visa International Fees Visa U.S.A. pays fees to Visa International based on payments volumes, exclusive of PIN-based debit volume, for services primarily related to global brand management, global product enhancements, management of global...

-

Page 78

... detection product and additional revenues from Visa U.S.A.'s debit processing services related to non-Visa network transactions offset the continued impact of higher volume-based discounts resulting from consolidation and transaction growth among customers. Of the total data processing fees, $122...

-

Page 79

... sales performance as new information becomes available. Amount represents adjustments resulting from amendments to existing contractual terms.

International Transaction Fees The increase in international transaction fees was primarily driven by multi-currency payments volume, which increased...

-

Page 80

... with Visa Extras, Visa U.S.A.'s point-based rewards program that enables enrolled cardholders to earn reward points on qualifying purchases.

The remaining increase is attributable to additional promotional activity related to Visa Signature, Visa Small Business, and Consumer Debit products. These...

-

Page 81

... charged the present value of the total payments to its consolidated statements of operations in fiscal 2006.

In addition, after a review of claims submitted, Visa U.S.A. reduced the accrual for reimbursement to customers for production costs related to the discontinued use of Visa-branded cards...

-

Page 82

... of equity earnings from Visa International as a result of an increase in net income for Visa International and an increase in interest income as the result of a shift in Visa U.S.A.'s investment portfolio from tax-exempt securities to higher yielding money market and auction rate securities. The...

-

Page 83

... favorably impact operating revenues, driven largely by Visa Signature, Visa U.S.A.'s premium credit platform, which generates higher fees. Operating revenues were also impacted by growth in debit volumes and transactions processed, reflecting the ongoing impact of certain member conversions to the...

-

Page 84

... fees from customers and the funds are intended to support various merchant programs designed to build payments volume and increase product acceptance. Beginning in fiscal 2006, the program was modified, requiring specific use of related revenues. Revenues related to the merchant incentive program...

-

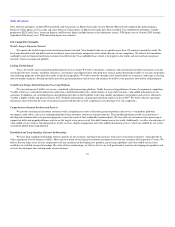

Page 85

... Visa U.S.A. fiscal 2007 consolidated financial statements.

Fiscal Year 2006 2005 $ Change 2006 vs. 2005 % Change (in millions, except percentages)

Personnel Network, EDP and communications Advertising, marketing and promotion Visa International fees Professional and consulting fees Administrative...

-

Page 86

... product development and innovation, call center operations and global processing and system development. Additional expenses for accounting and auditing services were incurred in conjunction with Visa U.S.A.'s review of its internal controls over financial reporting, and additional legal fees...

-

Page 87

... of a joint venture interest in Vital Processing Services LLC, a financial transaction processor for acquirers and merchants, which occurred in fiscal 2005 and lower equity in earnings related to Visa U.S.A.'s ownership in Visa International.

Fiscal Year 2006 2005 $ Change 2006 vs. 2005 % Change (in...

-

Page 88

... Committee oversees Visa U.S.A.'s treasury activity. Visa U.S.A. requires capital resources and liquidity to enable uninterrupted settlement of debit transactions; fund development of new technology, payment products and services; fund payment obligations under volume and support incentives; 87

-

Page 89

... acceptable risk criteria. Settlement of certain debit transactions due from customers participating in the Debit Processing Service and due to payment networks represents Visa U.S.A.'s most consistent liquidity requirement. These settlement receivables are generally collected on the business day...

-

Page 90

... borrow from the other company. There were no outstanding balances at September 30, 2007 or September 30, 2006 under this arrangement. In July 2006, Visa U.S.A.'s board of directors approved a plan to build a new data center on the east coast of the United States at an estimated cost of $397 million...

-

Page 91

... increases in the liability position of volume and support incentives and higher net income, adjusted for non-cash items. Investing Activities The increase in net cash used in investing activities in fiscal 2007 is primarily driven by facilities and equipment purchases related to the new data center...

-

Page 92

... with financial institutions and merchants for various programs designed to build payments volume and increase payment product acceptance. These agreements, which range in term from one to 13 years, provide card issuance, marketing and program support based on specific performance requirements. Visa...

-

Page 93

... these customers could adversely impact Visa U.S.A.'s operating revenues and operating income. Critical Accounting Estimates Visa U.S.A.'s consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation...

-

Page 94

... from Assumptions

Revenue Recognition Visa U.S.A. enters into incentive agreements with financial institution customers, merchants and other business partners to build payments volume and increase product acceptance. Certain volume and support incentives are based on performance targets and are...

-

Page 95

... on plan assets is based on current and expected asset allocation, as well as the long-term historical risks and returns associated with each asset class within the plan portfolio. A lower expected rate of return on plan assets increases pension cost. Legal Matters Visa U.S.A. is a party to legal...

-

Page 96

... issuing and acquiring members for settlement losses suffered by reason of the failure of any other member to honor credit and debit drafts, travelers cheques, or other instruments processed in accordance with Visa U.S.A.'s operating regulations. The fair value of the associated settlement risk...

-

Page 97

... accepted accounting principles, and expands disclosure requirements about fair value measurements. SFAS 157 is effective for fiscal years beginning after November 15, 2007. Visa U.S.A. is in the process of determining the effect, if any, of adopting SFAS 157 on its consolidated financial statements...

-

Page 98

... a fair value option. SFAS 159 is effective for fiscal years that begin after November 15, 2007. Visa U.S.A. is in the process of determining the effect, if any, of adopting SFAS 159 on its consolidated financial statements. Quantitative and Qualitative Disclosures about Market Risk Market risk is...

-

Page 99

... 39%

Visa U.S.A. manages its exposure to interest rate risk by investing primarily in rate-adjustable, or short-term securities, and a modest amount of fixed rate government agency securities to support longer term obligations. However, Visa U.S.A.'s efforts do not provide complete assurance that...

-

Page 100

...Notes to Balance Sheet VISA U.S.A. INC. At September 30, 2007 and September 30, 2006 and for the years ended September 30, 2007, 2006 and 2005. Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Operations Consolidated Statements of Changes...

-

Page 101

...of Contents

Report of Independent Registered Public Accounting Firm The Board of Directors Visa Inc. and Subsidiaries: We have audited the accompanying balance sheet of Visa Inc. as of September 30, 2007. This financial statement is the responsibility of the Company's management. Our responsibility...

-

Page 102

... subsidiary of Visa International Services Association) Balance Sheet At September 30, 2007 (in dollars)

September 30, 2007

Assets Total Assets Liabilities and Stockholder's Equity Total Liabilities Stockholder's Equity Common stock, $0.0001 par value, 100 shares authorized, issued, and outstanding...

-

Page 103

..., 2007, the boards of directors of Visa U.S.A., Visa International, Visa Canada and Visa Europe approved the GRA, an agreement that contemplates a series of transactions through which Visa U.S.A., Visa International, Visa Canada and Inovant will become direct or indirect subsidiaries of the Company...

-

Page 104

... will grant Visa Europe a put option under which the Company is obligated to purchase from the members of Visa Europe all of the share capital of Visa Europe at any time following the first anniversary of a successful completion of an initial public offering or 605 days after the closing date of the...

-

Page 105

...purchase price over this value attributed to goodwill. In the reorganization, the Company issued different classes and series of common stock reflecting the different rights and obligations of Visa financial institution members and Visa Europe based on the geographic region in which they are located...

-

Page 106

... Company applied discount rates and terminal values to the projected cash flows of the acquired regions. Visa Inc. Common Stock Issued to Visa Europe Visa Europe remained a separate entity owned and governed by its European member banks. Under the terms of the reorganization, Visa Europe exchanged...

-

Page 107

..., from November 9, 2007, the date the Company filed a registration statement with the United States Securities and Exchange Commission in connection with an initial public offering of the Company's class A common stock, the base license fee will be payable quarterly at an annual rate of $143 million...

-

Page 108

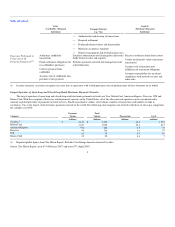

...consolidated statements of operations for fiscal 2007 and 2006 of Visa U.S.A., Visa International and Visa Canada.

Fiscal 2007 (in millions) 2006

Operating revenues Net (loss) income (ii) Settlement Agreement with American Express

$ $

5,193 (861)

$ $

3,902 453

The Company, Visa U.S.A. and Visa...

-

Page 109

... fiscal 2007 consolidated financial statements equal to $1.9 billion, the present value of the total payment it expects to make. The settlement will be funded through the Company's retrospective responsibility plan, which consists of several related mechanisms, including a series of agreements with...

-

Page 110

...

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors Visa Inc. and Subsidiaries: We have audited the accompanying consolidated balance sheets of Visa U.S.A. Inc. and subsidiaries as of September 30, 2007 and 2006, and the related consolidated statements of operations...

-

Page 111

... BALANCE SHEETS

September 30, 2007 (in thousands) September 30, 2006

Assets Cash and cash equivalents Investment securities, available-for-sale Accounts receivable Settlement receivable Current portion of volume and support incentives Current portion of deferred tax assets Prepaid and other current...

-

Page 112

... the Years Ended September 30, 2007 2006 (in thousands) 2005

Operating Revenues Service fees Data processing fees Volume and support incentives International transaction fees Other revenues Total operating revenues Operating Expenses Personnel Network, EDP and communications Advertising, marketing...

-

Page 113

.... AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

For the Years Ended September 30, 2007 2006 (in thousands) 2005

Net (loss) income Other comprehensive income (loss) , net of tax: Net unrealized gain (loss) on investment securities, available-for-sale Income tax (expense) benefit...

-

Page 114

... receivable Settlement receivable Volume and support incentives Other assets Accounts payable Settlement payable Accrued compensation and benefits Accrued and other liabilities Accrued litigation Member deposits Net cash provided by operating activities Investing Activities Investment securities...

-

Page 115

...of business. Visa U.S.A.'s products and services enable its members to participate in an international payment system that none could offer individually. Visa U.S.A. does not issue cards, set fees, or determine the interest rates consumers will be charged on Visa-branded cards. Visa U.S.A.'s issuing...

-

Page 116

... twelve months ended June 30, 2007. Visa U.S.A.'s members, which are comprised of domestic banks and other financial institutions, represent 100% of the Company's payments volume. The Company has one operating and reportable segment, "Payment Services," in the United States. The Company's activities...

-

Page 117

...-for-sale. These securities are recorded at cost at the time of purchase and are carried at fair value, based on current market or broker quotations. Unrealized gains and losses are reported in Other Comprehensive Income, net of tax. The Company does not engage in investment trading activities...

-

Page 118

...loss is reflected currently in the Company's consolidated statements of operations rather than when realized through dividends or distributions. Other non-marketable investments, resulting in ownership interests of less than these percentages, are accounted for using the cost method. The Company has...

-

Page 119

... volume and support incentives on the Company's consolidated balance sheets related to signing or renewing long-term contracts in instances where the Company receives a commitment from the member to generate a substantial portion of its credit and debit card payments volume on Visa-branded products...

-

Page 120

.... Data processing fees represent user fees for authorization, clearing, settlement, transaction processing services and other maintenance and support services that facilitate transaction and information processing among the Company's members globally, Visa International, Visa Canada and Visa Europe...

-

Page 121

... population of high-quality corporate bonds. The resulting discount rate reflects the matching of plan liability cash flows to the yield curves. To determine the expected long-term rate of return on pension plan assets, the Company considers the current and expected assets allocation, as well as...

-

Page 122

...'s Board of Directors, significant related party transactions and technological interdependence. Dividend and dissolution rights are based upon cumulative volume-based service fees paid by members to Visa International since inception, as a percentage of total volume based service fees received...

-

Page 123

... Europe. Visa U.S.A. has the rights to various designs and marks by virtue of its membership in Visa International. The Company paid fees to Visa International, based on payments volume, exclusive of PIN-based debit volume, for services primarily related to global brand management, global product...

-

Page 124

... rights to Visa International, Visa Canada and Visa Europe, in accordance with service agreements with these entities. A summary of data processing fees and other revenues received from Visa International, Visa Canada and Visa Europe is as follows:

For the Years Ended September 30, 2007 2006 (in...

-

Page 125

... on the Company's consolidated balance sheets at September 30, 2007.

Note 7-Investments Available-for-sale investment securities, which are recorded at fair value, consist of marketable debt securities issued by government-sponsored entities, tax-exempt municipal bonds, auction rate securities and...

-

Page 126

..., the Company does not consider these investments to be other-than-temporarily impaired at September 30, 2007. Equity securities primarily consist of mutual fund investments related to various employee compensation plans. For these plans, employees bear the risk of market fluctuations. Losses...

-

Page 127

... NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) The following represents Visa U.S.A.'s investments in the joint ventures and is included in other assets on the Company's consolidated balance sheets:

Ownership Percentage At September 30, 2007 (in thousands) 2006

Visa Resources Visa Land...

-

Page 128

... Services LLC (Vital) in exchange for capital contributions of $4.0 million and software with a book value of $3.5 million. In January 2005, Visa U.S.A. and MPH entered into an agreement with TSYS to sell the Company's 50% equity interest in Vital for a price of $95.0 million. The transaction closed...

-

Page 129

...its Visa Resolve OnLine platform, a web-based transaction dispute management program. This decision eliminated the need for a separate platform for debit exception processing. As a result, the Company recognized an impairment charge of $3.5 million in May 2006 for work completed to date. At the time...

-

Page 130

... cash flows from the Mini Card, given the Company's strategic focus on developing next-generation payment platforms and services and minimal Mini Card issuance by Visa members at that time. If the sum of expected future cash flows (undiscounted and without interest charges) is less than the carrying...

-

Page 131

... age and service requirements. Benefits are provided from retirement date until age sixty-five. Retirees must contribute on a monthly basis for the same coverage that is generally available to active employees and their dependents. The Company's contributions are funded on a current basis. Pension...

-

Page 132

... of tax effects, until they are amortized as a component of net periodic benefit cost. In addition, SFAS 158 requires that the measurement date, the date at which benefit obligations and plan assets are measured, be the company's fiscal year end. The Company adopted the measurement date provisions...

-

Page 133

... Service cost Interest cost Plan amendments Actuarial cost Settlements Benefit payments Effect of change in measurement date Benefit obligation-end of year Accumulated pension benefit obligation Change in Plan Assets: Fair value of plan assets-beginning of year Actual return on plan assets Company...

-

Page 134

...and the related amounts recognized on the consolidated balance sheets are as follows:

Pension Benefits September 30, 2006 Postretirement Benefits September 30, 2006 (in thousands)

Funded Status: Fair value of plan assets Benefit obligations Funded status Unrecognized prior service cost Unrecognized...

-

Page 135

...) 2007 2006 2005 Postretirement Benefits

Service cost Interest cost Expected return on assets Amortization of: Prior service (credit)/cost Actuarial loss Net periodic pension cost Settlement charge Total net benefit cost Visa U.S.A. share of net periodic pension cost Visa U.S.A. share of settlement...

-

Page 136

...population of high-quality corporate bonds. The resulting discount rate reflects the matching of plan liability cash flows to the yield curves. The expected long-term rate of return on plan assets is primarily based on the long-term historical risk and returns associated with each asset class within...

-

Page 137

... 2007 Actual Allocation 2006

Asset Class

Equity Securities Fixed Income Other Total

65% 30% 5% 100%

50% 25% 0%

80% 35% 7%

66% 29% 5% 100%

68% 30% 2% 100%

Plan assets are managed with a long-term perspective to ensure that there is an adequate level of assets to support benefit payments...

-

Page 138

...the United States. Personnel costs included $25.8 million, $24.1 million and $22.9 million in fiscal 2007, 2006 and 2005, respectively, for expenses attributable to the Company's employees under the plan. The Company's contributions to this plan are funded on a current basis and the related expenses...

-

Page 139

...is funded by debit issuers at the time of settlement, to support efforts on their behalf to secure utility merchant acceptance and promote debit products usage. Under program rules, unused funds, if any, would be returned to debit issuers at the conclusion of the program. In August 2006, the Company...

-

Page 140

... balance sheets and have net carrying values of $132.3 million and $147.7 million, respectively, at September 30, 2007 and 2006. In May 2004, the Company executed the First Amendment and Waiver to the Note Purchase Agreement (First Amendment) associated with these Senior Secured Notes. Under terms...

-

Page 141

... data processing and development support functions over the course of fiscal 2007. This action was intended to help Visa U.S.A. better align personnel and contract staffing levels with fluctuating project demand. As a result of this strategy, Visa U.S.A. reduced the total number of employees of Visa...

-

Page 142

... 2007 (in thousands) 2006

Deferred tax assets: Accrued compensation and benefits Investment securities, available-for-sale Adjustment to initially apply SFAS 158 (Note 12) Investments in joint ventures Accrued litigation Volume and support incentives-non-member Volume and support incentives-member...

-

Page 143

...and other matters. For tax purposes, the deduction related to these matters will be deferred until the payments are made and thus the Company established a deferred tax asset of $778 million related to these payments, which was net of a reserve to reflect the management's best estimate of the amount...

-

Page 144

... receives revenue from its members in the form of service fees, data processing fees and other fees, which is then used to create and support products and services that can be offered by the Company's members to cardholders and merchants. At September 30, 2007, the Company's Board of Directors...

-

Page 145

... customer accounted for 10% or more of the Company's net operating revenues in fiscal 2007, 2006 or 2005. Members of the Board of Directors who were not employees were compensated for their service to the Company. Directors who were also Visa employees did not receive any additional compensation...

-

Page 146

... are recorded in the Company's assets and liabilities. Amortization charges for related assets are included in network, EDP and communications in the consolidated statements of operations. Future minimum payments under capital leases are as follows:

For the Years Ending September 30, In Thousands...

-

Page 147

... term from approximately 1 to 13 years, provide card issuance, marketing and program support based on specific performance requirements. These agreements are designed to encourage more customer business and to increase overall Visa-branded payment volume, thereby reducing unit transaction processing...

-

Page 148

... payment products: the Visa Check card, Visa Buxx and the Interlink network. The Company also supports point-of-sale check service drivers at over 1,000 ATMs and provides gateway access to all major U.S. payment networks. The Company is subject to settlement risk for credit and debit transactions...

-

Page 149

... estimates of the probability of bank failure by member average daily volumes and estimated average number of days to settle. The Company's estimated settlement exposure amounted to $14.8 billion at September 30, 2007. The resulting probability-weighted value of the guarantee, after consideration...

-

Page 150

... in fiscal 2007, conversion issues arose which resulted in limited accessibility to the Visa Extras platform for participating members and cardholders for more than one month. During fiscal 2007, the Company recorded a charge of $5.7 million to remunerate impacted members for certain costs. These...

-

Page 151

... Financial Services, Inc. (Discover) filed an action against Visa U.S.A., Visa International and MasterCard International Incorporated (MasterCard) in United States District Court for the Southern District of New York. On November 15, 2004, American Express Travel Related Services Company, 150

-

Page 152

...denied Visa and MasterCard's motions to dismiss the plaintiffs' debit card claims, ruling that the plaintiffs had properly alleged a debit card market. Visa's motion to dismiss American Express's exclusive-dealing claim was also denied. Fact discovery is complete. At a hearing on April 25, 2007, the...

-

Page 153

... as purported class actions-were filed on behalf of merchants who accept payment cards against Visa U.S.A., Visa International, MasterCard and other defendants. Plaintiffs allege that defendants violated federal and state antitrust laws by setting interchange rates (among other claims, as described...

-

Page 154

...Act. The consolidated class action complaint further asserts that Visa ties "Payment Guarantee Services" and "Network Processing Services" to "Payment Card System Services" and engages in exclusive dealing, both in violation of Section 1 of the Sherman Act and that offline debit interchange violates...

-

Page 155

..., alleging both the merchant opt-out claims at issue in GMRI, Inc.'s suit against Visa U.S.A. and a number of the claims set forth in the class complaint filed in Multidistrict Litigation 1720 relating to interchange and Visa rules. In December 2007, GMRI, Inc. and Visa U.S.A. agreed in principle...

-

Page 156

...stay of discovery pending its ruling on an antitrust standing issue. On April 27, 2007, the parties reached an agreement in principle to settle all claims against Visa U.S.A. In connection with this agreement, the Company recorded a provision of $12.8 million for the settlement, which is included in...

-

Page 157

... state currency conversion class actions were filed against Visa U.S.A. and Visa International. Shrieve and Castro alleged that Visa had a duty to inform cardholders using debit cards overseas of the existence of the 1% currency conversion fee that Visa charges its members. Mattingly alleged Visa...

-

Page 158

... million to resolve the claims in the Schwartz matter; Visa's share is $18.6 million. The settlement agreement also includes provisions relating to disclosures on billing statements and other documents. The settlement agreement has been preliminarily approved by the United States District Court for...

-

Page 159

... Data filed amended counterclaims, adding a "concerted refusal to deal" claim under federal antitrust laws and expanding the market definition to include "debit card network processing services." On July 5, 2006, the parties signed a confidential settlement agreement, pursuant to which First Data...

-

Page 160

... In June 2003, a lawsuit was filed in California state court against Visa and MasterCard challenging certain corporate risk policies related to chargebacks. As to Visa, the plaintiff claims that fines and fees assessed pursuant to Visa's programs monitoring acquirers whose merchants have excessive...

-

Page 161

... are currently engaged in settlement negotiations. The potential settlement amount is not considered material to the Company's consolidated financial statements. AAA Antiques Mall On November 13, 2007, a putative class action lawsuit was filed in Maryland state court against Visa U.S.A., MasterCard...

-

Page 162

... filed a complaint against Visa U.S.A. and Target Corporation (Target) in United States District Court for the Northern District of Georgia. Softcard alleged that aspects of Visa and Target's smart card loyalty programs for cardholders infringed Softcard patents related to electronic coupon programs...

-

Page 163

... related litigation between American Express and U.S. Bancorp, Wells Fargo & Co., Washington Mutual, JP Morgan Chase & Co. and Capital One Financial Corp. Visa Inc.'s board of directors approved the settlement agreement on November 6, 2007 and Visa U.S.A.'s members approved the settlement agreement...

-

Page 164

... operations for the fiscal year ended September 30, 2007 and in current and long term accrued litigation on the consolidated balance sheets at September 30, 2007. The settlement will be funded by the members of Visa U.S.A. through Visa Inc.'s retrospective responsibility plan, a series of agreements...

-

Page 165

... Chief Financial Officer concluded that, at the end of such period, the disclosure controls and procedures of Visa Inc. were effective in alerting them, on a timely basis, to material information required to be disclosed by us in the reports that we file or furnish under the Securities Exchange Act...

-

Page 166

... from Europe)

Member of our compensation committee. Member of our nominating/corporate governance committee. Independent director. Member of our audit and risk committee. Mr. van der Velde will cease to be a director upon the closing of our proposed initial public offering pursuant to the terms of...

-

Page 167

... Chief Financial Officer of Citi Markets & Banking (CMB), the capital markets, banking and transaction services business of Citigroup Inc. In this capacity, he was responsible for finance, operations and technology for CMB. Prior to this role, he served in positions of increasing responsibility with...

-

Page 168

... as Chairman of the board of directors of our affiliate, Visa Jordan Services Company; a director of Salam International Investment Limited, a Middle East conglomerate with diversified operations in technology and communications, construction and development, luxury and consumer products, energy and...

-

Page 169

... of the Global Markets Institute from November 2004 to January 2007 and as a member of the management committee from February 2002 to January 2007. She currently serves on the audit committees of the boards of directors of Intuit Inc., a provider of business, financial management and tax solutions...

-

Page 170

... President and Chief Operating Officer of the Federal Reserve Bank of Boston from July 1991 to July 1994. Ms. Minehan has served as Managing Director of Arlington Advisory Partners, an advisory services firm, since July 2007. She also currently serves as a director and member of the audit committee...

-

Page 171

... directors and all employees in accordance with the listing requirements of such exchange. Material Changes to the Procedures by which Security Holders May Recommend Changes to the Company's Board of Directors Until the third anniversary of the closing our proposed initial public offering, our board...

-

Page 172

... as a class I director. The term of the class I directors will expire on the first anniversary of the closing of the reorganization, except that the term of the regional director for Visa Europe will expire on the day immediately prior to the closing date of our proposed initial public offering. The...

-

Page 173

...-based differentiation of compensation based on corporate and stockholder values. In order to be competitively positioned to attract and retain key executives, we target total compensation for executive officers, including salary, annual incentive target and long-term incentive value, at the 50th...

-

Page 174

...and a long-term equity incentive component to motivate our executive officers to achieve their business goals and reward them for achieving such goals. We have retained Towers Perrin, a global human resources consulting firm, to conduct an annual review of our total compensation program with respect...

-

Page 175

... market competitiveness to attract and retain talented employees with internal equity and provides a sufficient portion of total compensation tied to individual and corporate performance. Fiscal 2007 was a transition year for Visa. In addition to leading and managing our payments network business...

-

Page 176

...committee will consider market data provided by our outside consultants; internal review of the executive officer's compensation, both individually and relative to other executive officers; and individual performance of the executive officer.

Salary levels are typically considered annually as part...

-

Page 177

...U.S.A. board of directors retained discretion in determining any adjustments to these awards based on each executive officer's individual contribution to corporate results. The funding level of the incentive plan pool was determined by corporate results compared with the corporate targets, as stated...

-

Page 178

... and provide market-competitive compensation to employees on an individual employee basis. The annual incentive program will be funded based on global corporate performance metrics for the fiscal year. The compensation committee is currently in the process of determining the corporate performance...

-

Page 179

..., at the end of the first year, is adjusted by the human resources and compensation committee up or down, from 0% to 220%, based on the combined corporate performance of Visa U.S.A. and Inovant. For target awards granted at the beginning of fiscal 2007 under this long-term cash incentive plan, the...

-

Page 180

...Chief Operating Officer and other key employees or their spouses, as approved by the Chief Executive Officer, to use a corporate aircraft for limited personal use. Business priorities will always take precedence over personal usage. These employees will be responsible for all income taxes related to...

-

Page 181

... agreements, including severance provisions. See "-Employment Arrangements" and "-Potential Payments Upon Termination or Change-In-Control." Tax Implications Deductibility of Executive Compensation Section 162(m) of the Internal Revenue Code limits the ability of Visa to deduct for tax purposes...

-

Page 182

...broadbased 2007 special bonus program. The amounts in column (g) reflect performance-based cash awards earned under the Visa U.S.A. Annual Incentive Plan. Under the plan, Mr. Sheedy received $350,013, Mr. Floum received $695,653 and Mr. Partridge received $937,500. This column also reflects the year...

-

Page 183

... 2007 is included in the "-Non-Equity Incentive Plan Compensation" column of "-Summary Compensation Table." The amount shown in column (c) reflects the minimum payment level for the minimum performance level required under the Visa U.S.A. Long-Term Incentive Plan in order to receive any payment...

-

Page 184

... earlier termination of employment if vested. Retirement benefits are calculated as the product of 1.25% times the years of service multiplied by the monthly final average earnings for the last 60 consecutive months before retirement (or the product of 46.25% times the years of service divided by 25...

-

Page 185

.... Currently accrued benefits under the Visa Retirement Plan become 100% vested and nonforfeitable after three years of service. Visa Excess Retirement Plan To the extent that an employee's annual retirement income benefit under the plan exceeds the limitations imposed by the Internal Revenue Code...

-

Page 186

...

Rate of Return (%)

Name of Fund

Alger Capital Appreciation Institutional Fund-Institutional Class(1) Dodge & Cox Income(2) Dodge & Cox International Stock(3) Dreyfus Founders Discovery Fund-Class F(4) Fidelity Balanced Fund Fidelity Low-Priced Stock Fund Fidelity Retirement Money Market Portfolio...

-

Page 187

...or 13% for highly compensated employees, of salary and Internal Revenue Code limits. The maximum pre-tax amount an employee may contribute to the Visa Thrift Plan annually is restricted by the Internal Revenue Code. If an employee reaches this limit during the calendar year, an employee may continue...

-

Page 188

... approach; and (D) selecting the Visa group's top management. Mr. Saunders's annual bonus for fiscal 2007 is reported in "-Summary Compensation Table." Mr. Saunders's letter agreement also provides that he is eligible for a long-term performance bonus, with a target long-term bonus of 500%-600% of...

-

Page 189

... award may be payable in shares of Visa Inc. common stock as approved by the board of directors. In addition, to assist Mr. Morris with his relocation to the San Francisco area, we will provide Mr. Morris with: (i) payment of temporary living expenses for up to six months; and (ii) fifty round trip...

-

Page 190

... of all claims against Visa. In the event that payments made to Mr. Saunders upon his termination of employment are subject to the excise tax imposed on excess parachute payments under the Internal Revenue Code, he will receive an additional amount to place him in the same after-tax position as if...

-

Page 191

... reorganization nor our proposed initial public offering constitute a change of control for this purpose. In the event that payments made to Mr. Partridge upon his termination of employment are considered "parachute" payments and result in an excise tax, he will receive an additional amount equal to...

-

Page 192

... five-year period (2001 to 2006), Mr. Saunders received fees as a non-employee director but was not receiving compensation as the Chief Executive Officer or otherwise as an employee. Excise tax is generally triggered when payments contingent on a change in control exceed three times this historical...

-

Page 193

... Termination Event

Disability ($)

Death ($)

Long-Term Incentive Plan (unvested) Thrift Plan (unvested) Excess Thrift Plan (unvested) Health and Welfare Benefits Disability Income Excise Tax Gross-Up Cash Severance Outplacement Total Mr. Floum Termination Payments & Benefits

2,009,528 - - 30,019...

-

Page 194

...fees for service on the Visa International board of directors; and (ii) $181,241 retainer and meeting fees for service on the Visa AP board of directors. Represents meeting fees for service on the Visa International board of directors. Mr. McKay did not receive payment for his service on Visa Canada...

-

Page 195

...LAC affiliated members. In addition to Mr. Schulin-Zeuthen, all but two directors on the regional board of Visa LAC also serve on the board of InterAmerica Overseas Limited. InterAmerica Overseas Limited is in the process of winding-up its business.

Pursuant to our director compensation program, we...

-

Page 196

...

This plan became effective after the end of the most recently completed fiscal year, on October 3, 2007, the date it was approved by the affirmative vote of the members holding membership interests in Visa International, Visa U.S.A. and Visa Canada, which, upon the completion of the reorganization...

-

Page 197

...by each person who we believe was the beneficial owner of more than 5% of any voting class of our capital stock at that date. None of our directors or executive officers beneficially own any of our class AP, class Canada, class CEMEA, class EU, class LAC or class USA common stock. To the best of our...

-

Page 198

... Bank Limited Bank City 1 First Place 2001 Johannesburg South Africa ABSA Group Ltd. 170 Main Street 2000 Johannesburg South Africa Nedbank Ltd. 100 Main Street 2000 Johannesburg South Africa Class EU Visa Europe Limited 1 Sheldon Square London W26TT United Kingdom Visa Europe Services Inc. Class...

-

Page 199

...Barrio Actipan Mexico D.F., 03230 Mexico Class USA(9) JP Morgan Chase & Co. 270 Park Avenue New York, New York 10017-2070 Bank of America Corporation 100 N. Tryon St., Bank of America Corporate Center Charlotte, NC 28255 National City Corporation National City Center 1900 East Ninth Street Cleveland...

-

Page 200

..., to issue Visa-branded credit and debit cards in exchange for certain pricing terms, payments and other incentives. Visa U.S.A. and its affiliates provide, among other things, authorization, processing, settlement, account support, advertising and promotional services to Bank of America. Operating...

-

Page 201

... in the nine months ended June 30, 2007. In addition, in February 2007 the IOL board of directors authorized an additional payment of $2.28 million to Visa International during fiscal 2007 in order to help defray the costs borne by Visa International in connection with replacing computer equipment...

-

Page 202

... for servicing global merchants, ensure that their customers and members require acceptance of globally accepted cards, maintain adequate capital levels to support their ongoing business operations and establish and comply with rules relating to the operation of the Visa enterprise. For five years...

-

Page 203

...also provide clearing and settlement system services within Visa Europe's region. In addition, the parties share foreign exchange revenues related to currency conversion for transactions involving European cardholders as well as other cross-border transactions that take place in Visa Europe's region...

-

Page 204

... will grant Visa Europe a put option to require us to purchase from the Visa Europe members all of the issued shares of capital stock of Visa Europe. The put option may be exercised by Visa Europe at any time after the first anniversary of our proposed initial public offering. The price per share at...

-

Page 205

... and related audit services included employee benefit plan audits, review of internal control for selected information systems and business units (SAS 70 audits), and services related to web trust certifications. A portion of audit-related fees in fiscal 2007 in respect of assurance services related...

-

Page 206

... Visa Canada limited the services provided by KPMG LLP to audit services and tax compliance. The audit and risk committee pre-approved all audit and tax services provided by KPMG LLP. Following October 2007 Reorganization Following our October 2007 reorganization, our board of directors established...

-

Page 207

...of Contents

PART IV ITEM 15. (a) Exhibits, Financial Statement Schedules The following documents are filed as part of this Report. 1. 2. 3. Financial Statements See Index to Consolidated Financial Statements in Item 8 of this Report. Consolidated Financial Schedules None. The exhibits listed on the...

-

Page 208

... of Contents

SIGNATURES Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this Annual Report on Form 10-K to be signed on its behalf by the undersigned, thereunto duly authorized. VISA INC. By:

Name: Title: Date...

-

Page 209

... of Contents

Signature Title Date

/S/ /S/ /S/ /S/ /S/ /S/ /S/

FRANCISCO JAVIER FERNANDEZ-CARBAJAL

Francisco Javier Fernandez-Carbajal

Director Director

December 21, 2007 December 21, 2007 December 21, 2007 December 21, 2007 December 21, 2007 December 21, 2007 December 21, 2007

PETER HAWKINS...

-

Page 210

...-term debt securities of Visa Inc. and its subsidiaries have been omitted(1) Settlement Agreement, dated June 4, 2003, by and among Visa U.S.A. Inc. and Wal-Mart, Limited Brands, Sears, Safeway, Circuit City, National Retail Federation, Food Market Institute, International Mass Retail Association...

-

Page 211

...on Form S-4 (333-143966) filed on July 24, 2007)†Amended and Restated Global Restructuring Agreement, by and among Visa Inc., Visa International Service Association, Visa U.S.A. Inc., Visa Europe Limited, Visa Canada Association, Visa Asia Pacific, Visa Latin America (incorporated by reference to...

-

Page 212

... to Exhibit 21.1 of the Visa Inc. Registration Statement on Form S-1 (333-1472976) filed on November 9, 2007) Power of Attorney (included in signature page) Certification of Joseph W. Saunders, Chief Executive Officer and Chairman of the Board of Directors, pursuant to Rule 13a-14(a)/15d-14(a), as...

-

Page 213

... at such location is The Corporation Trust Company. Section 1.2 Other Offices. The Corporation may also have offices at such other places both within and without the State of Delaware as the Board of Directors of the Corporation (the "Board") may from time to time determine or the business of the...

-

Page 214

... or the Assistant Secretary of the Corporation, the transfer agent or other person responsible for giving notice. Section 2.3 Annual Meetings. (a) Annual meetings of stockholders shall be held at such date and time as shall be designated from time to time by the Board and stated in the notice...

-

Page 215

... of the Board or the Chief Executive Officer of the Corporation. Business transacted at any special meeting of stockholders shall be limited to the purposes stated in the notice. (b) Unless otherwise required by law, written notice of a special meeting stating the place, date and hour of the...

-

Page 216

... identity of such other person) concerning any take-over bid, tender offer, exchange offer, merger, consolidation, business combination, recapitalization, restructuring, liquidation, dissolution, distribution, stock purchase or other extraordinary transaction involving the Corporation or any of its...

-

Page 217

... or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended. (c) Notwithstanding anything in these By-Laws to the contrary, no business shall be conducted at any stockholders' meeting and no stockholder may nominate any person for election...

-

Page 218

...signed by the stockholder and filed with the Secretary of the Corporation, or (ii) transmitting or authorizing the transmission of a telegram, cablegram, or other means of electronic transmission to the person who will be the holder of the proxy or to a proxy solicitation firm, proxy support service...

-

Page 219

... days prior to the meeting in the manner provided by law (a) on a reasonably accessible electronic network; provided that the information required to gain access to such list is provided with the notice of meeting or (b) during regular business hours at the Corporation's principal place of business...

-

Page 220

...such information is accurate and reliable. (d) The date and time of the opening and the closing of the polls for each matter upon which the stockholders will vote at a meeting shall be announced at the meeting by the person presiding over the meeting. The Board may adopt by resolution such rules and...

-

Page 221

...the total number of directors then in office shall constitute a quorum for the transaction of business. Section 3.4 Vacancies. Subject to the Certificate of Incorporation and these By-Laws, unless otherwise required by law, any newly created directorship on the Board that results from an increase in...

-

Page 222

... in relying in good faith upon the records of the Corporation and upon such information, opinions, reports or statements presented to the Corporation by any of its officers or employees, or committees of the Board, or by any other person as to matters the director reasonably believes are within...

-

Page 223

...Special meetings of the Board for any purpose or purposes may be called by the Chairperson of the Board or the Chief Executive Officer or the President on twenty-four (24) hours' notice to each director either personally or by telephone, telegram, facsimile or electronic mail; special meetings shall...

-

Page 224

... or more Assistant Vice Presidents. Any number of offices may be held by the same person, unless the Certificate of Incorporation or these By-Laws otherwise provide. Such officers shall be elected or appointed from time to time as provided in Section 5.2 of these By-Laws, to hold office until their...

-

Page 225