Under Armour 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

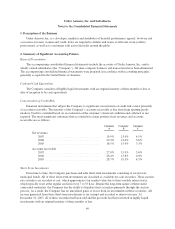

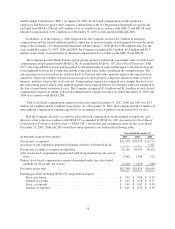

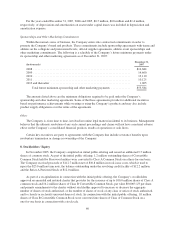

years beginning after November 15, 2007, however the FASB has delayed the effective date of SFAS 157 to

fiscal years beginning after November 15, 2008 for nonfinancial assets and nonfinancial liabilities, except those

items recognized or disclosed at fair value on an annual or more frequently occurring basis. The Company does

not believe that the adoption of SFAS 157 will have a material impact on its consolidated financial statements.

In June 2006, the FASB issued FIN No. 48, Accounting for Uncertainty in Income Taxes—an interpretation

of FASB Statement No. 109 (“FIN 48”), which provides additional guidance and clarifies the accounting for

uncertainty in income tax positions. FIN 48 defines the threshold for recognizing tax return positions in the

financial statements as “more likely than not” that the position is sustainable, based on its technical merits. FIN

48 also provides guidance on the measurement, classification and disclosure of tax return positions in the

financial statements. FIN 48 was effective for the first reporting period beginning after December 15, 2006, with

the cumulative effect of the change in accounting principle recorded as an adjustment to the beginning balance of

retained earnings in the period of adoption. Upon adoption of FIN 48 as of January 1, 2007, the Company

recorded a $1.2 million decrease to the beginning balance of retained earnings (see Note 11).

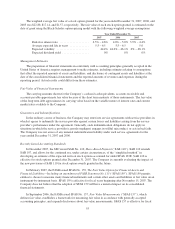

Reclassifications

Certain balances in 2006 and 2005 have been reclassified to conform to the current year presentation. These

changes had no impact on previously reported net income or stockholders’ equity.

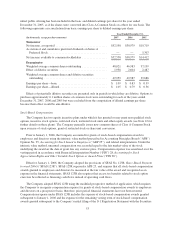

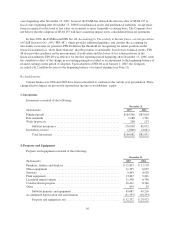

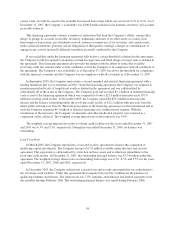

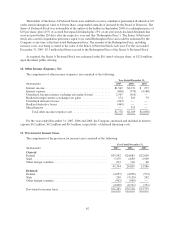

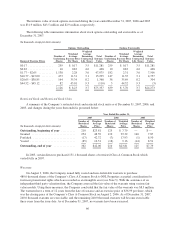

3. Inventories

Inventories consisted of the following:

December 31,

(In thousands) 2007 2006

Finished goods ................................................... $169,560 $83,618

Raw materials ................................................... 1,180 1,321

Work-in-process ................................................. 208 133

Subtotal inventories ........................................... 170,948 85,072

Inventories reserve ............................................... (4,866) (4,041)

Total inventories ............................................. $166,082 $81,031

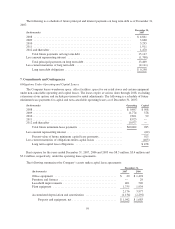

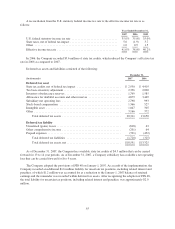

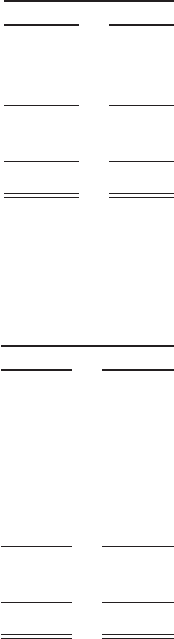

4. Property and Equipment

Property and equipment consisted of the following:

December 31,

(In thousands) 2007 2006

Furniture, fixtures and displays ..................................... $25,853 $ 17,178

Office equipment ................................................ 11,295 6,639

Software ....................................................... 9,849 4,928

Plant equipment ................................................. 13,867 5,401

Leasehold improvements .......................................... 11,598 6,700

Construction in progress ........................................... 10,411 8,346

Other .......................................................... 814 24

Subtotal property and equipment ................................ 83,687 49,216

Accumulated depreciation and amortization ........................... (31,355) (19,293)

Property and equipment, net .................................... $52,332 $ 29,923

56