Under Armour 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

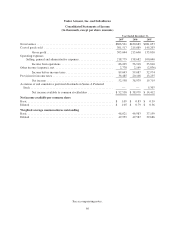

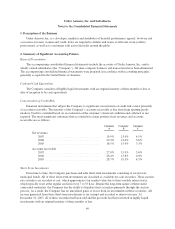

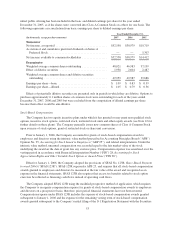

initial public offering has been included in the basic and diluted earnings per share for the year ended

December 31, 2005, as if the shares were converted into Class A Common Stock on a three for one basis. The

following represents a reconciliation from basic earnings per share to diluted earnings per share:

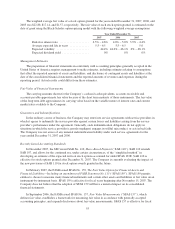

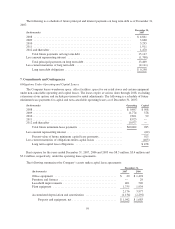

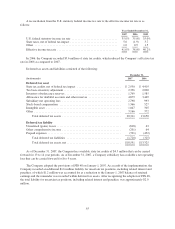

Year Ended December 31,

(In thousands, except per share amounts) 2007 2006 2005

Numerator

Net income, as reported ................................... $52,558 $38,979 $19,719

Accretion of and cumulative preferred dividends on Series A

Preferred Stock ........................................ — — 5,307

Net income available to common stockholders ................. $52,558 $38,979 $14,412

Denominator

Weighted average common shares outstanding ................. 48,021 46,983 37,199

Effect of dilutive securities ................................ 1,938 2,604 2,487

Weighted average common shares and dilutive securities

outstanding ........................................... 49,959 49,587 39,686

Earnings per share—basic ................................. $ 1.09 $ 0.83 $ 0.39

Earnings per share—diluted ................................ $ 1.05 $ 0.79 $ 0.36

Effects of potentially dilutive securities are presented only in periods in which they are dilutive. Options to

purchase approximately 0.1 million shares of common stock were outstanding for each of the years ended

December 31, 2007, 2006 and 2005 but were excluded from the computation of diluted earnings per share

because their effect would be anti-dilutive.

Stock-Based Compensation

The Company has two equity incentive plans under which it has granted or may grant non-qualified stock

options, incentive stock options, restricted stock, restricted stock units and other equity awards (see Note 12 for

further details on these plans). The Company generally issues new common shares of Class A Common Stock

upon exercise of stock options, grant of restricted stock or share unit conversion.

Prior to January 1, 2006, the Company accounted for grants of stock-based compensation awards to

employees and directors using the intrinsic value method prescribed in Accounting Principles Board (“APB”)

Opinion No. 25, Accounting for Stock Issued to Employees (“ABP 25”), and related interpretations. Under the

intrinsic value method, unearned compensation was recorded equal to the fair market value of the stock

underlying the award on the date of grant less any exercise price. Compensation expense was amortized over the

vesting period in accordance with Financial Interpretation Number (“FIN”) 28, Accounting for Stock

Appreciation Rights and Other Variable Stock Option or Award Plans (“FIN 28”).

Effective January 1, 2006, the Company adopted the provisions of SFAS No. 123R, Share-Based Payment

(revised 2004) (“SFAS 123R”). SFAS 123R supersedes APB 25, and requires that all stock-based compensation

awards granted to employees and directors be measured at the fair value of the award and recognized as an

expense in the financial statements. SFAS 123R also requires that excess tax benefits related to stock option

exercises be reflected as financing cash flows instead of operating cash flows.

The Company adopted SFAS 123R using the modified prospective method of application, which requires

the Company to recognize compensation expense for grants of stock-based compensation awards to employees

and directors on a prospective basis; therefore, prior period financial statements have not been restated.

Compensation expense under SFAS 123R includes the expense of stock-based compensation awards granted

subsequent to January 1, 2006 and the expense for the remaining vesting term of stock-based compensation

awards granted subsequent to the Company’s initial filing of the S-1 Registration Statement with the Securities

53