Under Armour 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

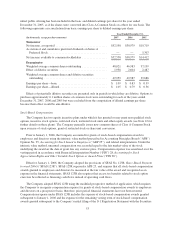

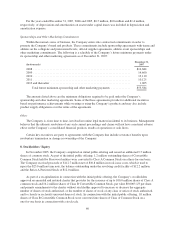

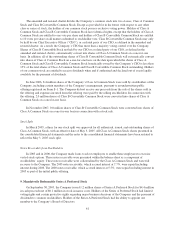

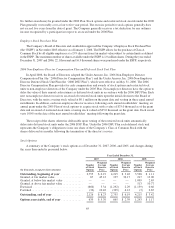

The weighted average fair value of a stock option granted for the years ended December 31, 2007, 2006, and

2005 was $22.88, $17.14, and $1.57, respectively. The fair value of each stock option granted is estimated on the

date of grant using the Black-Scholes option-pricing model with the following weighted average assumptions:

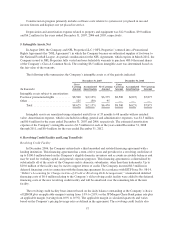

Year Ended December 31,

2007 2006 2005

Risk-free interest rate .................... 4.5% – 4.6% 4.6% – 5.0% 3.9% – 4.4%

Average expected life in years ............. 5.5–6.5 5.5–6.5 5.0

Expected volatility ...................... 44.4% 44.6% – 46.1% 0% – 48.1%

Expected dividend yield .................. 0% 0% 0%

Management Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates, including estimates relating to assumptions

that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the

date of the consolidated financial statements and the reported amounts of revenues and expenses during the

reporting period. Actual results could differ from these estimates.

Fair Value of Financial Instruments

The carrying amounts shown for the Company’s cash and cash equivalents, accounts receivable and

accounts payable approximate fair value because of the short term maturity of those instruments. The fair value

of the long term debt approximates its carrying value based on the variable nature of interest rates and current

market rates available to the Company.

Guarantees and Indemnifications

In the ordinary course of business, the Company may enter into service agreements with service providers in

which it agrees to indemnify the service provider against certain losses and liabilities arising from the service

provider’s performance under the agreement. Generally, such indemnification obligations do not apply in

situations in which the service provider is grossly negligent, engages in willful misconduct, or acts in bad faith.

The Company was not aware of any material indemnification liability under such service agreements for the

years ended December 31, 2007 and 2006.

Recently Issued Accounting Standards

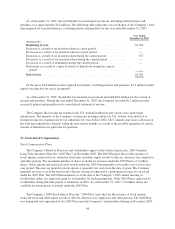

In December 2007, the SEC issued SAB No. 110, Share-Based Payment (“SAB 110”). SAB 110 amends

SAB 107, and allows for the continued use, under certain circumstances, of the “simplified method” in

developing an estimate of the expected term on stock options accounted for under SFAS 123R. SAB 110 is

effective for stock options granted after December 31, 2007. The Company is currently evaluating the impact of

the new provisions of SAB 110 for stock option awards granted in the future.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and

Financial Liabilities—Including an amendment of FASB Statement No. 115 (“SFAS 159”). SFAS 159 permits

entities to choose to measure many financial instruments and certain other assets and liabilities at fair value on an

instrument-by-instrument basis. SFAS 159 is effective for fiscal years beginning after November 15, 2007. The

Company does not believe that the adoption of SFAS 159 will have a material impact on its consolidated

financial statements.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (“SFAS 157”), which

defines fair value, establishes a framework for measuring fair value in accordance with generally accepted

accounting principles, and expands disclosures about fair value measurements. SFAS 157 is effective for fiscal

55