TD Bank 2009 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2009 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2009 TO OUR SHAREHOLDERS 3

THIS YEAR WE SAW THE INTEGRATION OF TD’S U.S. RETAIL

OPERATIONS. HOW DID THE INTEGRATION GO AND WHAT’S

NEXT FOR TD BANK, AMERICA’S MOST CONVENIENT BANK?

In November, after more than a year of incredibly hard work, we

completed a very complex integration, bringing together the best

of TD with the best of Commerce and TD Banknorth to create one

unified bank. From Maine to Florida, all our U.S. retail operations

are now united under one brand – TD Bank, America’s Most

Convenient Bank.

This integration was not a simple “rip and replace” merger, but

rather a build-out of the best of both legacy organizations, as well as

TD. We did experience delays with our overnight processing in the

first few days after our systems integration. This was disappointing

given the thousands of successful integration-related projects we

completed without a hitch. These delays did have an impact on

our customers – and for that, we’re sorry. In true TD style, our

organizational strengths were highlighted as employees worked

tirelessly to resolve the integration challenges – to make things

right for our customers and to recover with flair.

With the integration now complete, TD Bank, America’s Most

Convenient Bank, will continue to own the service and convenience

space while at the same time leveraging other TD products and

services to take market share and grow the business. As an integrated

North American bank, our considerable scale and breadth of product

offerings are giving us the opportunity to succeed in the most

competitive markets – that’s being demonstrated in New York City,

Boston and Washington, D.C. Look for us to continue building on

this momentum in 2010.

TD FOCUSES ON DELIVERING LEGENDARY CUSTOMER

EXPERIENCES. HOW DID YOU ADAPT YOUR STRATEGY

AMID THE ECONOMIC DOWNTURN?

We always listen very carefully to our customers so we can understand

what’s on their minds. Clearly many people were worried about

their financial future – and remain so. For TD to continue to be the

undisputed leader in customer service, we knew we had to define

what that meant in tough times. In short, we must continue to find

ways to deliver the same level of service to customers who are facing

hardships as we do to customers with opportunities.

And we’re working hard to do that. Earlier this year we launched

TD Helps, a program that provides our customers with practical

solutions to get through this downturn. By the end of the year, our

program had helped over 30,000 customers. This clearly makes

good business sense for us. But it means much more than that. For

the most part, these customers have done everything right, and

through no fault of their own, they’ve come across some serious

financial adversity. We’re proud to use our strength as a bank to

do something for them. And we’ll remain proud to stand by our

customers and clients and help them build a better future.

WHAT’S YOUR OUTLOOK FOR 2010 AND WHAT SPECIFIC

OPPORTUNITIES DO YOU SEE?

There are some positive signs that we are in a recovery. But we can’t

kid ourselves. We expect that underlying economic conditions will

remain lacklustre for the foreseeable future. Large structural shifts

are taking place in the global economy. A rebalancing is underway.

Nevertheless, there’ll no doubt be opportunities to take advantage

of our position of strength through this market dislocation to continue

to grow market share. We’ll aim to continue growing our under-

represented businesses in Canada, such as small business banking

and insurance. At the same time, our goal is to leverage our wealth

management and wholesale banking capabilities across our U.S.

footprint, as we take advantage of our newly consolidated U.S. retail

platform. An enormous amount of hard work went into completing

the U.S. integration, and in 2010 we’ll see more opportunities to

cross-sell our products and services.

It’s also very important to think about TD’s unique and inclusive

employee culture. And I can tell you that TD’s employment brand

has never been stronger. We’re able to attract the best people on both

sides of the border, whether at the executive level or at the entry level.

We relentlessly measure employee engagement, and we’re very

committed to increasing that on a constant basis. And we’re receiving

accolades that recognize us as a best employer. I think our extraordinary

workplace is a true source of strength for us and a competitive

advantage as we move forward.

Overall, while we remain cautious, I’m confident that our business

model will survive the downturn and that we’ll continue to drive

forward our vision of being the better bank and emerge from these

challenging times with momentum on our side.

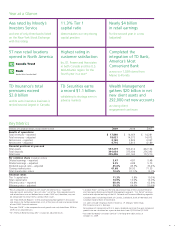

Our Retail Strategy

Continues to Deliver

Our retail businesses continue to

provide a strong, consistent earnings

anchor for our shareholders. We’ve

hit almost $4 billion in adjusted retail

earnings for two years in a row –

quite an achievement considering the

economic conditions during this time.

And over the past five years, our

adjusted retail net income has more

than doubled.

We Live and Breathe

Risk Management

At TD, we only take on risks that we

understand and that can be managed

within an acceptable level – that’s

consistent across all of our businesses.

And we work hard to make sure all

of our employees understand this too.

During the financial crisis, our approach

to risk management has been put to the

test. We were one of the few global

institutions that did not require support

from the government.

Ed Clark

President and Chief Executive Officer

05 06 07 08 09

0

$4,000

3,000

2,000

1,000

RETAIL NET INCOME

(millions of Canadian dollars)

Adjusted Reported

Please see “How the Bank Reports” in the accompanying MD&A for information

on how adjusted results are calculated.