TD Bank 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

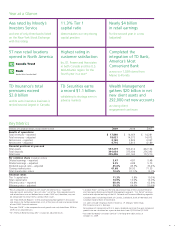

Year at a Glance

11.3% Tier 1

capital ratio

demonstrates our very strong

capital position

Nearly $4 billion

in retail earnings

for the second year in a row

(adjusted)

Highest rating in

customer satisfaction

by J.D. Power and Associates

in both Canada and the U.S.

Mid-Atlantic region for the

fourth year in a row*

57 new retail locations

opened in North America Completed the

integration of TD Bank,

America’s Most

Convenient Bank

across our 1,028 stores from

Maine to Florida

Aaa rated by Moody’s

Investors Service

and one of only three banks listed

on the New York Stock Exchange

with this rating

TD Securities earns

a record $1.1 billion

validating its strategy even in

adverse markets

TD Insurance’s total

premiums exceed

$2.8 billion

and its auto insurance business is

ranked second largest in Canada

Wealth Management

gathers $20 billion in net

new client assets and

292,000 net new accounts

as strong client

engagement continues

Key Metrics

(millions of Canadian dollars, except where noted) 2009 2008 2007

Results of operations

Total revenues – reported $ 17,860 $ 14,669 $ 14,281

Total revenues – adjusted 18,621 14,372 14,072

Net income – reported 3,120 3,833 3,997

Net income – adjusted 4,716 3,813 4,189

Financial positions at year-end

Total assets 557,219 563,214 422,124

Total deposits 391,034 375,694 276,393

Total loans 255,496 221,160 177,210

Per common share (Canadian dollars)

Diluted earnings – reported 3.47 4.87 5.48

Diluted earnings – adjusted 5.35 4.88 5.75

Dividend payout ratio – adjusted 45.6% 49.3% 36.4%

Closing market price 61.68 56.92 71.35

Total shareholder return 13.6% (17.1)% 13.0%

Financial ratios

Tier 1 capital ratio 11.3% 9.8% 10.3%

Total capital ratio 14.9% 12.0% 13.0%

Efficiency ratio – reported 68.4% 64.8% 62.8%

Efficiency ratio – adjusted 59.2% 64.6% 59.6%

1Results prepared in accordance with GAAP are referred to as “reported.”

Adjusted results (excluding “items of note,” net of tax, from reported results)

and related terms are not defined terms under GAAP and, therefore, may not

be comparable to similar terms used by other issuers.

See “How the Bank Reports” in the accompanying Management’s Discussion

and Analysis for further explanation, a list of the items of note and reconciliation

of non-GAAP financial measures.

“Five-year CAGR” is the compound annual growth rate calculated from 2004 to

2009, on an adjusted basis.

“TD's Premium Retail Earnings Mix” is based on adjusted results.

“C

anadian Retail” earnings are the total adjusted earnings of the Canadian Personal

and Commercial Banking and Wealth Management segments. “U.S. Retail” earnings

are the total adjusted earnings of the U.S. Personal and Commercial Banking segments.

Canadian peers include Royal Bank of Canada, Scotiabank, Bank of Montreal and

Canadian Imperial Bank of Commerce.

U.S. peers include Citigroup, Bank of America, J.P. Morgan, Wells Fargo,

PNC Financial and U.S. Bancorp.

For purposes of comparison with U.S. peers, dividends per share five-year compound

growth rate are calculated on a year-to-date basis from Q3 2004 to Q3 2009.

“Aaa rated by Moody's Investors Service” is for long-term debt and as at

October 31, 2009.