TD Bank 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2009 TO OUR SHAREHOLDERS

2

Momentum =The Right Strategy

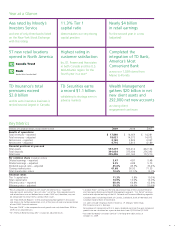

It was a landmark year. Despite the downturn we delivered a record $4.7 billion in adjusted profit – and

for the second year in a row we had almost $4 billion in retail earnings. TD Securities earned a record

$1.1 billion, all while reducing risk. And we successfully completed the integration of TD Bank, America's

Most Convenient Bank.

THE PAST YEAR HAS BEEN DESCRIBED AS THE WORST DOWNTURN SINCE THE 1930S.

HOW HAS TD MANAGED THROUGH IT?

For years we’ve cultivated a conservative risk management philosophy – we only take on risks that we

understand and that can be managed within an acceptable level. It’s that simple. This philosophy helped us

outperform many of our competitors through the downturn. At a time when many banks were retrenching

or retreating, TD maintained a position of strength and has continued to grow. And even as we grew our

lending to our customers and clients, we actually continued to grow our already strong capital base,

in part because we are prudent managers of risk-weighted assets.

As a result, by almost every measure, we’ve emerged as a top-10 financial institution in North America.

Look at our 2009 earnings – despite some exceptionally tough market conditions at the start of the year, TD

earned a record $4.7 billion on an adjusted basis. We did all this through old-fashioned banking, by delivering

for our customers and clients. We hit almost $4 billion in adjusted retail earnings for the second year in a row.

That’s $4 billion of consistent, high-quality earnings – a fantastic foundation for our bank to keep growing in

the future. In fact, in 2009 we earned more in retail earnings than any of our North American peers.

At TD Securities, we had a record year with more than $1.1 billion in earnings. We’re building the dealer

of the future – a wholesale bank focused on franchise businesses and designed to be profitable even in adverse

market conditions. And we’re solidifying our position as a top-ranked dealer while continuing to reduce risk.

I think it’s also important to give credit to governments, regulators and central banks around the world.

As a group they’ve responded both quickly and appropriately to the financial crisis. In Canada’s case, we

benefited from the fiscal action of the government, prudent oversight of the regulators and the proactive

monetary policies of the Bank of Canada.

All of our success is underpinned by people. You can have the best strategy in the world, but it means

nothing

without a talented team that can execute that strategy. That’s why our core advantage comes down to the people

we employ. We work hard to create a workplace that attracts people who are passionate about the customer

experience, and I’m extremely proud of our 74,000 employees for all their hard work over the past year.

HOW DO YOU PLAN TO BUILD ON THIS MOMENTUM?

It begins by remaining true to our strategy, which we like to keep simple: to produce long-term profitable

growth by building great franchises and delivering value to our customers, shareholders and communities.

The core of TD’s strategy didn’t change in 2009 and it won’t change in 2010.

That means we’re going to continue to invest in our capabilities. It also means being disciplined

acquirers, being highly selective and patient and deploying our capital for prudent medium-term growth.

We’ll continue to build our branch network in both the U.S. and Canada. And as the year begins, we still

lead the pack on banking hours; we’re open more than 50 per cent longer on average than our competitors

both north and south of the border. I expect these competitive advantages to continue delivering strong

results, and we’ll aim to keep taking market share in small business, commercial and personal banking –

outgrowing the competition in revenues and profits.

“I’m confident that our

business model will

survive the downturn

and that we’ll continue

to drive forward our

vision of being the

better bank and emerge

from these challenging

times with momentum

on our side.”

TO OUR SHAREHOLDERS