TD Bank 2009 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2009 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158

|

|

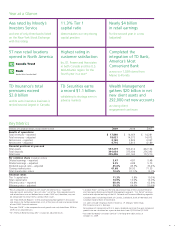

12.4% TD’s 5-year CAGR

TD Bank Financial Group 2009 Snapshot1

In 2009, TD Bank Financial Group (TD) demonstrated that with the right strategy and dedicated employees,

strong businesses can perform even in a tough economy. By almost every measure, our performance

surpassed our own expectations. And we’ve ended the year with solid earnings and an exceptionally

strong balance sheet and capital position, which is allowing us to emerge from the financial crisis with

our business model intact and momentum on our side.

12.9% TD’s 5-year CAGR

(adjusted)

7.3% TD’s 5-year CAGR

(adjusted)

12.4% TD’s 5-year CAGR

12.4% Canadian peers

5-year CAGR

(25.6)% U.S. peers

5-year CAGR

2.27% TD’s 2009 return on

risk-weighted assets

(adjusted)

6.2% Canadian peers

(7.2)% U.S. peers

78% Retail

22% Wholesale

8.5% TD’s premium earnings

mix is built on a North

American retail focus –

a lower-risk business

with consistent earnings.

55%

CANADIAN

RETAIL

23%

U.S.

RETAIL

22%

WHOLESALE

05 06 07 0809

0

$5,000

4,000

3,000

2,000

1,000

NET INCOME

available to common shareholders

(millions of Canadian dollars)

Adjusted Reported

05 06 07 0809

5

6

$7

4

3

2

1

0

EARNINGS PER SHARE

(Canadian dollars)

Adjusted Reported

05 06 07 0809

3.5%

1.0

0.5

3.0

2.5

2.0

1.5

0

RETURN ON RISK-

WEIGHTED ASSETS

(per cent)

Adjusted Reported

05 06 07 0809

100

300

400

$600

500

200

0

TOTAL ASSETS

(billions of Canadian dollars)

05 06 07 0809

0.5

1.5

2.0

$2.5

1.0

0

DIVIDENDS PER SHARE

(Canadian dollars)

TOTAL SHAREHOLDER

RETURN

(5-year CAGR)

TD’S PREMIUM RETAIL

EARNINGS MIX IN 2009